Secret takeaways:

-

XRP forms a double leading and increasing wedge, signifying short-term disadvantage danger towards $1.94.

-

NUPL suggests traders remain in rejection, looking like previous pre-crash stages.

-

Long-lasting charts still indicate bullish targets in between $3.69 and $17.

XRP (XRP) has actually rebounded by more than 50% in a month after forming a regional low at $1.80. Improving danger cravings and potential customers of an “altseason” have actually improved its rate.

Could XRP rally even more from present levels or run the risk of a pullback in the coming days? Let’s analyze.

XRP “double leading” pattern mean sell-off

XRP formed a double leading near $2.65, signifying a possible pattern turnaround. The pattern consists of 2 clear peaks and a neck line around $2.47. After the 2nd peak, XRP dropped listed below the neck line, validating the bearish setup.

A verified breakdown listed below this level indicate a disadvantage target near $2.30. The double leading recommends compromising momentum after a strong rally. If purchasers stop working to break above $2.65, the pattern stays in play and bearish.

Increasing wedge mean possible 20% XRP rate crash

XRP likewise broke down from an increasing wedge pattern, signifying a shift from bullish to bearish momentum. Current stopped working efforts to break above the pattern’s upper trendline from the pattern restate the exact same.

A wedge breakdown is validated when the rate falls listed below its lower trendline, which XRP seems trying since Might 15. The cryptocurrency is in addition evaluating assistance from the 50-4H rapid moving average (50-4H EMA; the red wave).

Breaking listed below the assistance zone increases the opportunity of XRP falling another 20% to around $1.94. This level originates from determining the height of the increasing wedge pattern and deducting it from the breakdown point.

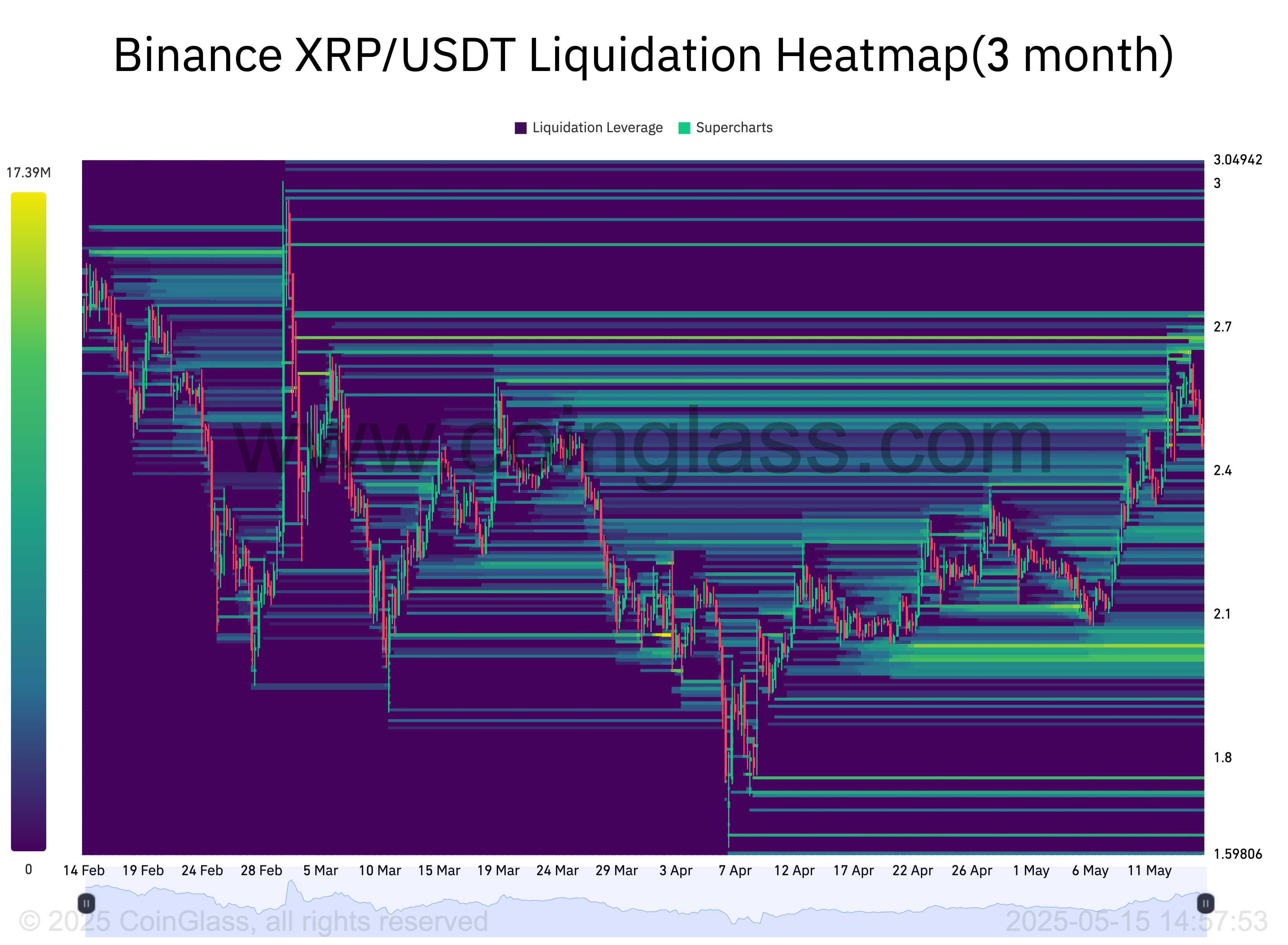

The $2.00–$ 2.04 variety is likewise crucial since it holds a a great deal of leveraged long positions worth around $50 million, according to information resource CoinGlass.

If XRP drops listed below this variety, a lot of these positions might be required to close, triggering a long capture. That would include selling pressure and press the rate better to the $1.94 target.

XRP traders remain in “rejection”– onchain metric

XRP’s Net Latent Profit/Loss (NUPL) has actually moved into the Belief– Denial zone, displayed in green on the Glassnode chart below. When in rejection, lots of still anticipate costs to increase, even as momentum fades.

This NUPL level has actually traditionally marked the early phases of significant corrections. For instance, XRP entered this stage before sharp decreases in 2018 and 2021.

If history repeats, XRP might deal with more disadvantage in the short-term, leading the way towards the rate targets highlighted by the double leading and increasing wedge technical setups.

XRP long-lasting charts remain bullish

A counter analysis suggests a prospective 45% rally towards $3.69 by June if a breakout from a multimonth falling wedge pattern plays out as meant.

Nevertheless, if XRP falls back listed below the wedge’s upper trendline and loses assistance at the 20-day (purple) and 50-day (red) rapid moving averages (EMA), the bullish setup might be revoked, running the risk of a decrease towards $1.75.

A number of long-lasting XRP rate forecasts have targets of $5.24 and even $17, based upon balanced triangle patterns and Fibonacci extensions revealed listed below.

Related: History rhymes? XRP rate acquired 400% the last time whale streams turned

XRP’s long-lasting charts reveal a consistent bullish predisposition in spite of short-term pullback threats, suggesting that the rally is most likely not over.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.