Secret takeaways:

-

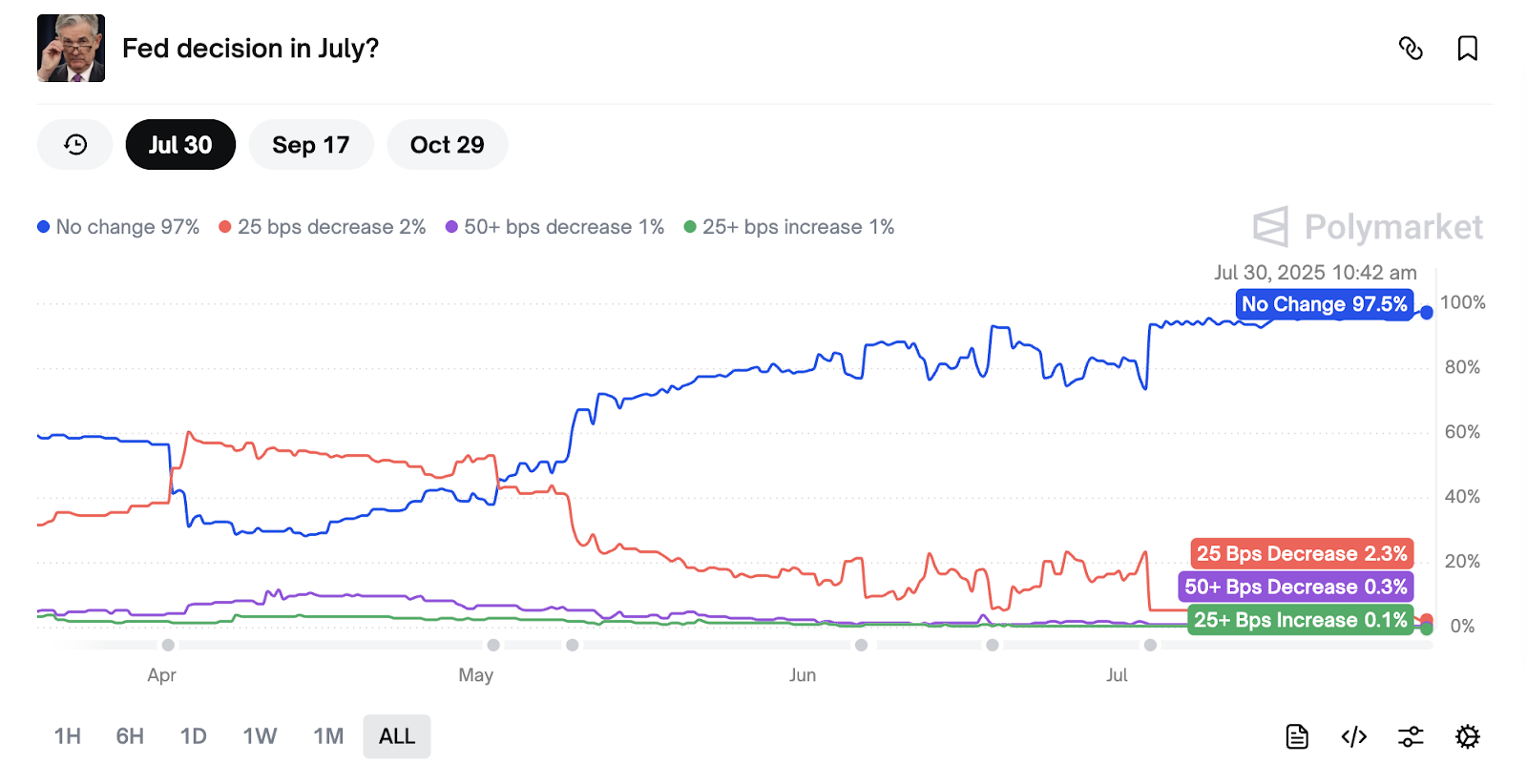

Fed interest-rate cut chances today are now less than 3%, according to Polymarket.

-

BTC rate might drop as low as $112,000 if crucial assistance levels are broken.

Bitcoin (BTC) rate stayed flat on Wednesday at $118,200, as traders embraced a wait-and-see technique amidst growing macro unpredictability.

97% possibility rate of interest the same

The United States Federal Free Market Committee (FOMC) two-day conference began on Tuesday with the policy choice on the rates of interest anticipated on Wednesday at 2:00 pm ET.

Market individuals anticipate the Federal Reserve to leave rates the same, in spite of pressure from President Donald Trump to decrease rates.

Related: Bitcoin momentum loss is pre-FOMC derisking, not a pattern modification

Polymarket sees a 97.5% possibility that the present rate of interest will stay in between 4.25% and 4.50%, and simply a 2.3% possibility of a 0.25% rate cut.

A typical market belief is that any bearish rate action from the same rate of interest is currently priced in.

Traders appeared to “worry offer” on Tuesday as unpredictability grew around Fed Chair Jerome Powell’s speech after the conference, stated crypto financier TedPillows.

” Individuals most likely discarded their bags in worry. However they’ll most likely wind up FOMO redeeming in at greater rates after the Fed speaks,” the expert included, discussing that it is a familiar pattern that has actually traditionally preceded strong relocations in August.

” Then August strikes, whatever goes parabolic. And the sidelined traders? They wind up chasing, once again.”

For that reason, the marketplace will acutely enjoy Powell’s language at the FOMC press conference to see if there is any shift in tone.

” Financiers will be listening really thoroughly to the Fed chair, and a dovish posture can affect the marketplace,” stated markets analyst James DePorre in an X post on Wednesday.

” The cut matters, however Powell’s words at journalism conference are more vital,” OptionsTrading101 informed their X fans on Tuesday.

Traders are likewise aiming to Friday’s United States nonfarm payrolls report, in addition to a variety of Trump tariff due dates and how they will affect the crypto market.

What’s next for Bitcoin rate?

Presently, $120,000 is the crucial level traders are looking for Bitcoin. Numerous experts stated that a high volume push through above this resistance unlocks for a speedy transfer to fresh all-time highs.

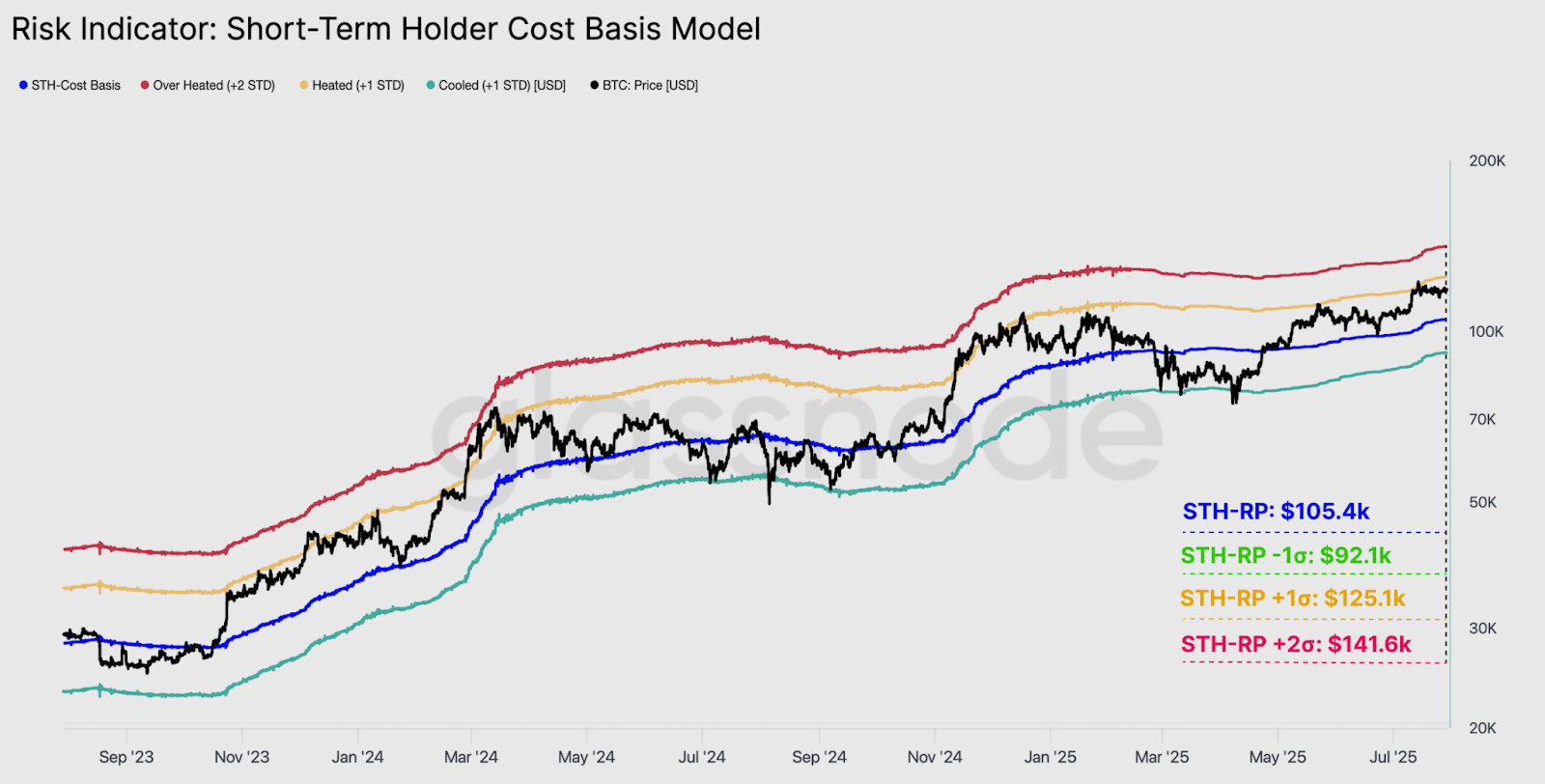

” A verified breakout beyond this zone might move market characteristics, bringing the $141K area into focus,” Glassnode stated in its most current “Week Onchain” report.

The $141,000 level matches 2 basic variances above the STH understood rate. As displayed in the chart below.

Glassnode included:

” This is a location where crucial onchain metrics recommend profit-taking might greatly magnify.”

Another level to enjoy is $125,000, which represents the STH expense basis pressed one basic discrepancy greater.

On the disadvantage, traders ought to watch on Bitcoin’s STH expense basis at $105,400 and the annual open around $93,000, which appears to accompany the STH expense basis pressed one basic discrepancy lower.

A chart shared by popular expert Killa recommends $114,000-$ 116,000 as a crucial location of interest, as the BTC rate might drop listed below it to fill the reasonable space worth to $112,000 before recuperating.

A huge “What if” for $BTC.

Very same mechanic as last variety or … just 2 lows. Time to fuck around a discover. pic.twitter.com/2OVbueMO8F

— Killa (@KillaXBT) July 30, 2025

Likewise, SuperBitcoinBro, a confidential BTC expert, highlighted that Bitcoin might sweep to as low as $112,000 initially before a “capture greater” with the next significant liquidity cluster in between $119,800 and $121,000.

Nebraskangooner, another Bitcoin expert, stated that the BTC rate will stay in variety “up until Powell speaks with make a huge relocation.”

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.