Bitcoin’s (BTC) cost stopped working in another effort to break above resistance at $94,000 on Tuesday as volatility struck the marketplace ahead of the Fed rate cut choice on Wednesday.

Secret takeaways:

-

The chances of a 25 bps cut on Wednesday now stand at 96%, according to Polymarket

-

BTC cost might drop as low as $84,000 if crucial assistance levels are broken.

96% possibilities of a 25 basis points cut

The year’s last United States Federal Free market Committee (FOMC) two-day conference started on Tuesday, with the policy choice on rates of interest anticipated on Wednesday at 2:00 pm pm ET.

Market individuals anticipate the Federal Reserve to reduce rates of interest by 0.25%, marking its 3rd cut of the year.

Related: Bitcoin FOMO drips back at $94K, however Fed might ruin the celebration

Polymarket reveals a 96.8% opportunity that rates of interest will be cut to in between 3.50% and 3.75%, with a 3% possibility that the rates will stay the same.

Nevertheless, any bullish cost action from lowered rates of interest is most likely currently priced in.

Bitcoin was pulling back towards $92,000 on Wednesday as worries installed that Fed Chair Jerome Powell’s speech after the conference might put the marketplace back on unsteady ground.

” The other day’s weak tasks information knocked rate-cut hopes somewhat and rattled TradFi markets; all eyes now on the Fed and wage information,” Bitcoin expert AlphaBTC stated in a Wednesday post on X, including:

” If the Fed surprises hawkishly or earnings remain company, anticipate another sell-off.”

For that reason, the marketplace will acutely enjoy Powell’s language at the FOMC press conference to see if there is any shift in tone.

Today, the marketplace is pricing a “25bps rate cut, however the genuine drama will originate from Jerome Powell’s speech,” market analyst Wess stated on Tuesday.

Secret Bitcoin cost levels to enjoy

Bitcoin should turn $93,300 into assistance to target greater highs above $100,000.

For this to take place, BTC/USD should initially restore its position above the 50-day easy moving average (yellow line) at $98,000.

The $100,000 mental level is essential for BTC cost since duplicated rejections from this point might result in another sell-off, as seen in February.

Above that, a significant supply zone extends all the method to $108,000, where the 200-day SMA lies. This trendline was lost on Nov. 3 for the very first time because April 22.

Bulls will likewise need to conquer this barrier in order to increase the possibilities of BTC’s go to $110,000.

Alternatively, the bears will try to preserve the $94,000-yearly open resistance level, therefore increasing the probability of brand-new lows listed below $90,000.

A crucial location of interest lies in between $90,000 and the previous variety lows at $87,500, reached on Sunday. Listed below that, the next relocation would be a retest of the Nov. 21 lows of $84,000, removing all the gains made over the last 3 weeks.

Bitcoin expert AlphaBTC considered BTC’s rally towards $98,000, cautioning a drop listed below $91,000 would be devastating for the marketplace.

” However Bitcoin should hold 91.5 K now IMO, otherwise we will see blood in the streets.”

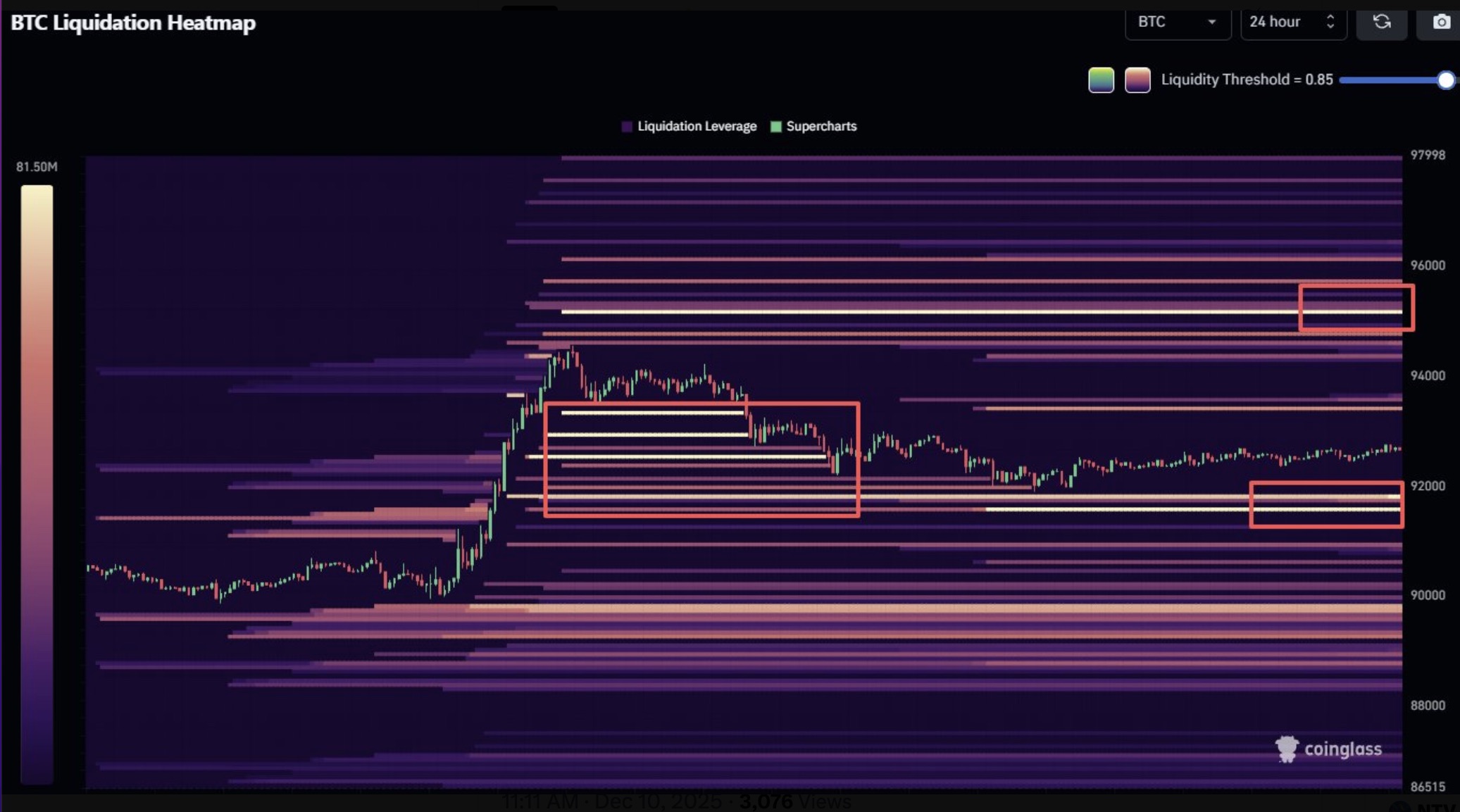

The Bitcoin liquidation heatmap exposes a big liquidity cluster in between $93,000 and $96,000. Listed below the area cost, the location to enjoy is $91,500.

This highlights locations where the cost may swing to, depending upon the result these days’s FOMC conference.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding. While we make every effort to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this details.