Ethereum’s native token, Ether (ETH), continues to combine under $2,000, which some traders consider as a mental level. Ether rate slipped listed below this variety on March 10, and the altcoin continues to trade at its most affordable worth considering that October 2023.

Ethereum 4-hour chart. Source: Cointelegraph/TradingView

Ether rate has actually likewise lost market price with regard to other significant altcoins, with XRP rate reaching its greatest level versus ETH in 5 years on March 15.

The genuine concern amongst financiers is whether ETH can regaining a part of its current losses or whether traders will capitulate if the rate falls listed below $1,900.

Ethereum traders might leap ship if rate falls listed below $1,900

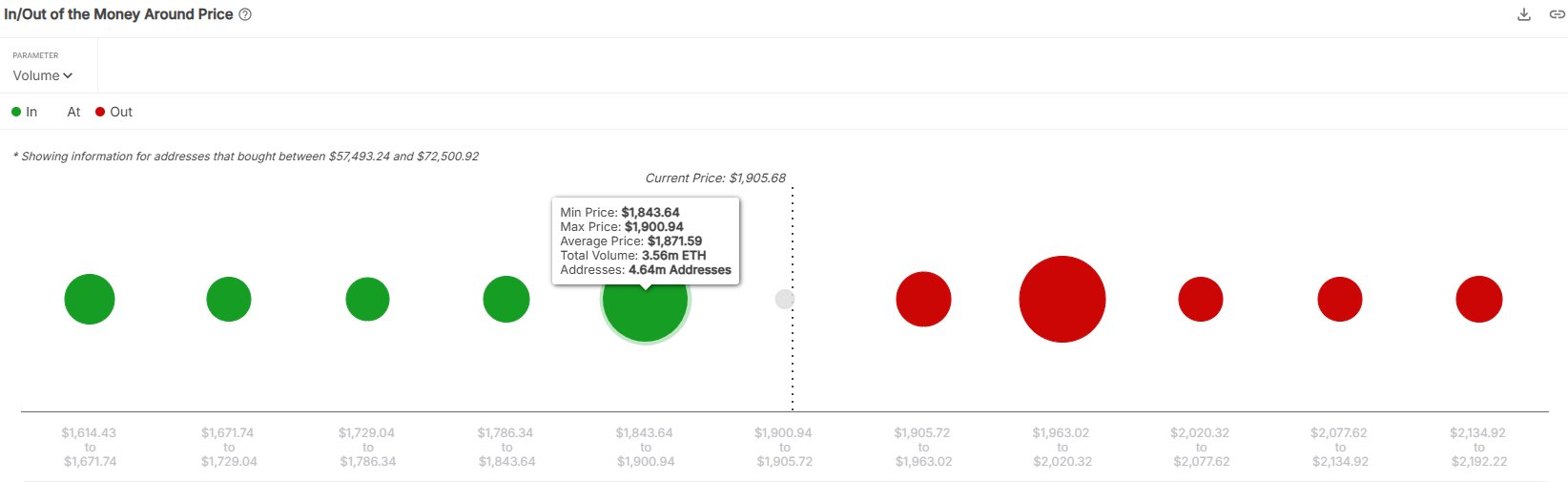

According to information from IntoTheBlock, an information analytics platform, Ethereum holders collected 3.56 million ETH in between $1,900 and $1,843, with a typical rate of $1,871. For that reason, the existing build-up worth presently stands at $6.65 billion. This shows that ETH’s rate has a strong assistance level in between $1,900 and $1,843, which can possibly function as the bullish turnaround zone.

Ethereum In/Out of the cash chart. Source: X.com

Nevertheless, if Ether drops listed below $1,843, information indicate the possibility of increasing capitulation worries. Capitulation is a market belief where financiers tend to stress, offering their positions at a loss throughout a sharp market correction. If ETH combines for an extended duration under $1,843, the probability of a much deeper correction increases tremendously.

Listed Below $1,843, the size and volume of ETH build-up are substantially lower, which even more shows the value of the $1,900 to $1,843 assistance variety.

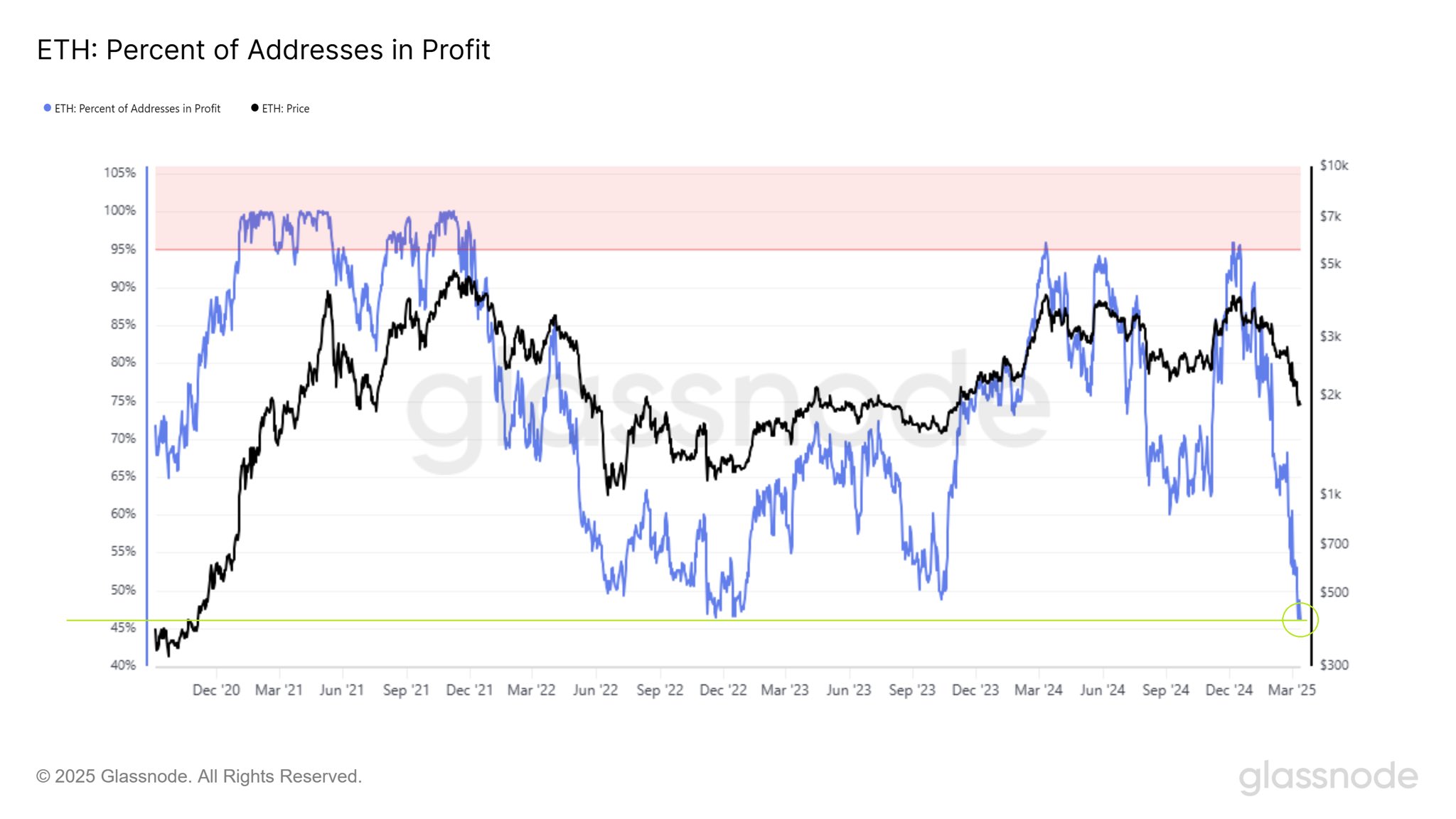

Likewise, the portion of Ethereum addresses under earnings dropped to its most affordable level considering that the start of the years. It is the most affordable worth considering that December 2022 at simply under 46%.

ETH: Portion of addresses in Revenue. Source: X

A low portion of lucrative addresses has actually traditionally shown a rate bottom for Ethereum. Provided the high ETH build-up and less lucrative addresses, these elements might function as bullish signals. As an outcome, the probability of Ethereum combining listed below $1,843 in the long term is reducing.

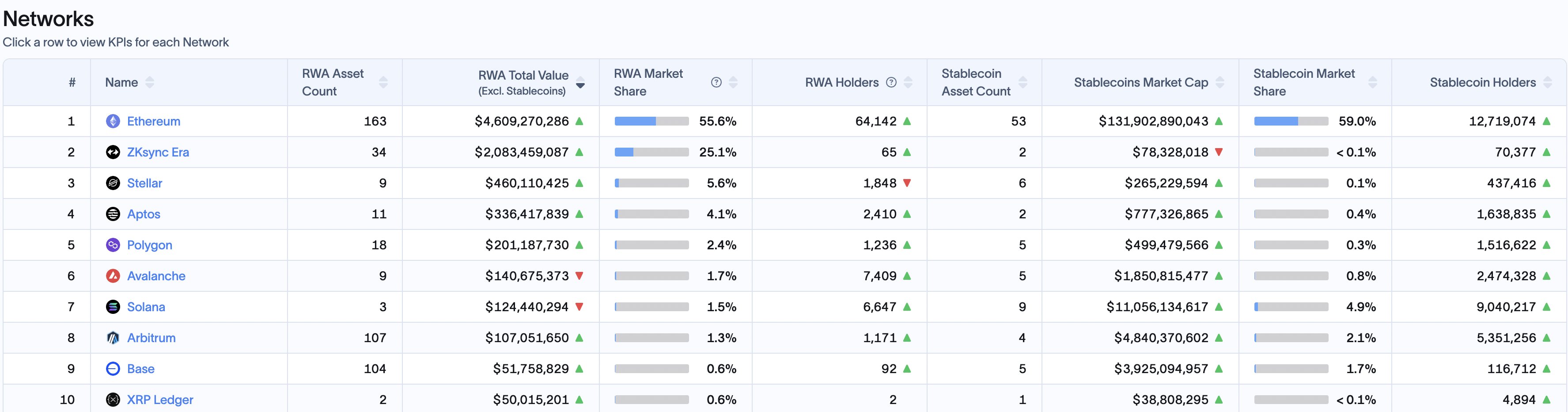

Hitesh Malviya, the creator of DYOR crypto, stated it is not a “good time to bearish on ETH.” In an X post, Malviya highlighted the current increase of real-world possessions (RWAs) in the market, with a 50.9% boost in development over the previous one month and an 850% annual boost, with Ethereum and ZKsync catching more than 80% of the overall market share.

RWA’s market share on L1s. Source: X

Related: Bitcoin ‘bullish cross’ with 50%- plus typical returns flashes once again

Ethereum long/short ratio shows a neutral market

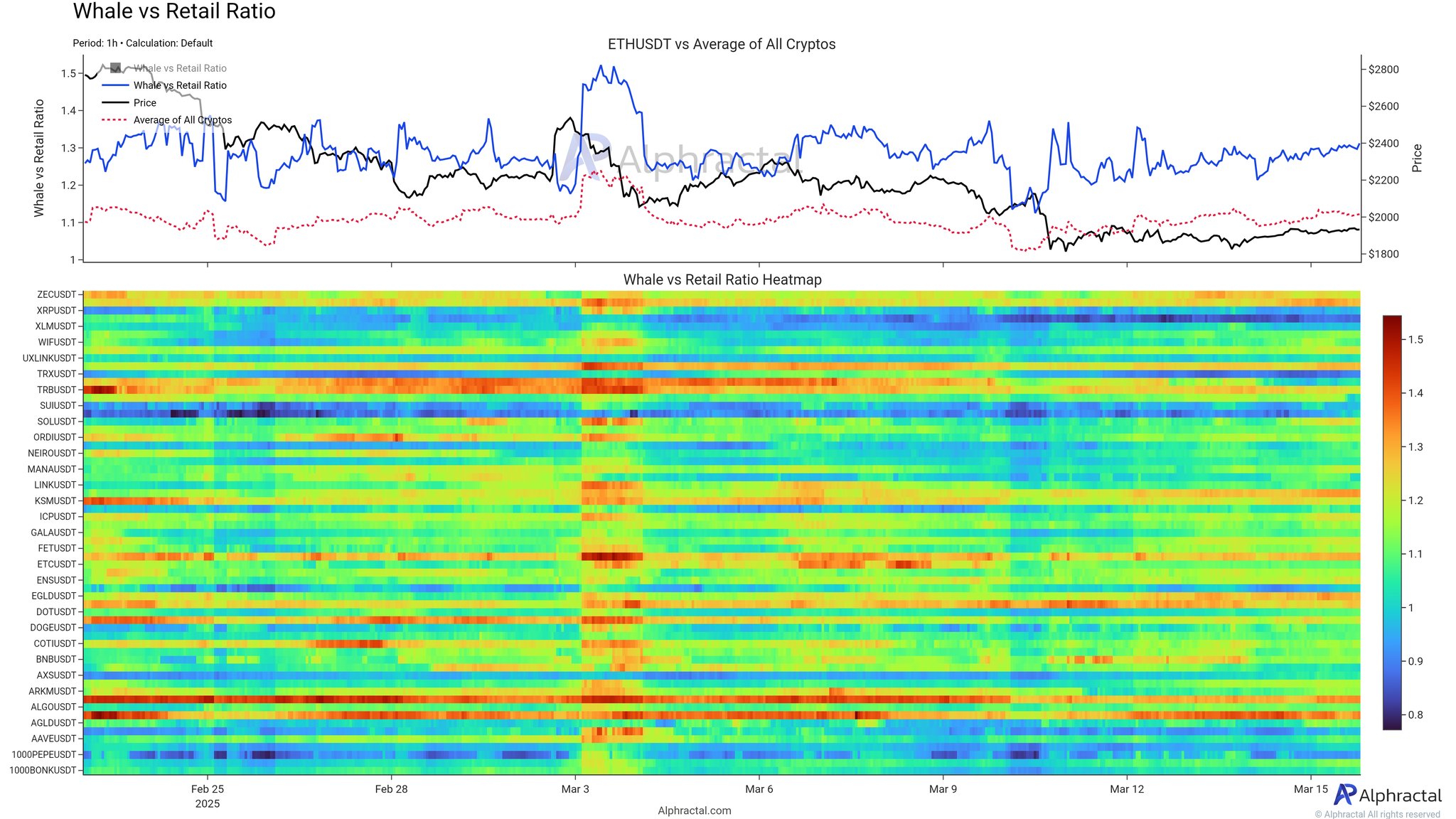

Alphractal, a crypto information analysis site, evaluated Ether’s existing market belief based upon the long/short ratio, a metric to assess the percentage of futures traders wagering for rate boosts (long) versus reduces (shorts).

Whales vs. Retail ratio heatmap. Source: X

According to the chart above, the biggest financiers are more likely towards taking long positions, whereas smaller sized financiers remain in the procedure of deleveraging. Deleveraging ways relaxing dangerous, obtained positions, which decreases market volatility and interest in leveraged trading.

With the existing ratio at 1.3, the long/short ratio shows a well balanced however mindful market. Alphractal included,

” This shows that, in the short-term, Ethereum is experiencing low volatility and low interest in take advantage of, which might leave lots of traders tired and impatient.”

Related: Ethereum onchain information recommends $2K ETH rate runs out grab now

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.