Secret takeaways:

-

Long-lasting financiers have actually been offering 45,000 ETH daily, increasing sell-side pressure.

-

Ether’s 50-week EMA and bear flag breakdown target $2,500.

Ether’s (ETH) drop towards $3,000 on Friday was preceded by a substantial quantity of offloads from long-lasting holders, which some experts stated might result in a much deeper rate correction.

Long-lasting holders are unloading

Ether long-lasting holders, entities holding ETH (ETH) for more than 155 days, have actually magnified their sell-side activity as the rate dropped listed below essential assistance levels.

Examining ETH invested volume by age, utilizing a 90-day moving average, Glassnode experts stated that 45,000 ETH, worth about $140 million, is leaving 3– ten years holder wallets daily.

Related: Ether’s possibility of turning bullish before 2025 ends depends upon 4 vital elements

Glassnode included:

” This marks the greatest costs level by skilled financiers because February 2021.”

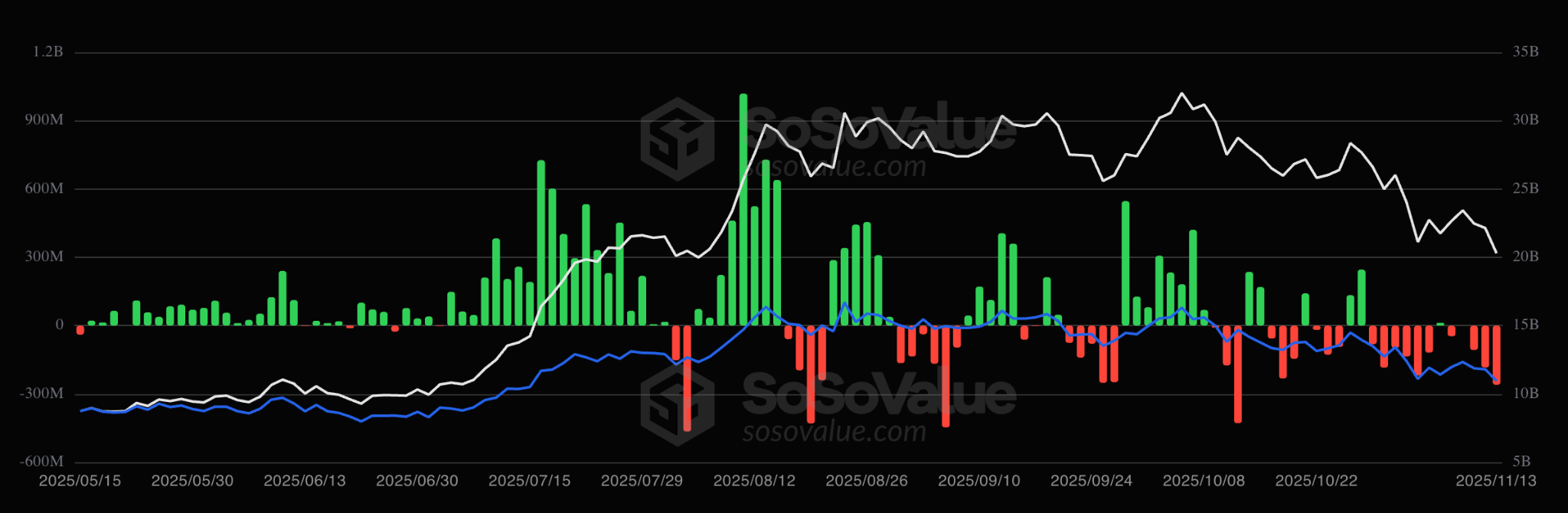

This lines up with a rise in area Ethereum exchange-traded funds (ETF) outflows, which even more reduces ETH rate. These financial investment items tape-recorded $259 million in net outflows on Thursday, marking their worst day because Oct. 10, according to information from SoSoValue.

This marked the 4th successive day of outflows for the Ethereum ETFs, as completion of the 43-day United States federal government shutdown stopped working to reignite financier hunger.

A cumulative web outflow of $1.42 billion from Ethereum ETFs because early November signals strong institutional selling pressure, sustaining worries of a much deeper correction.

Ethereum onchain information signals subsiding need

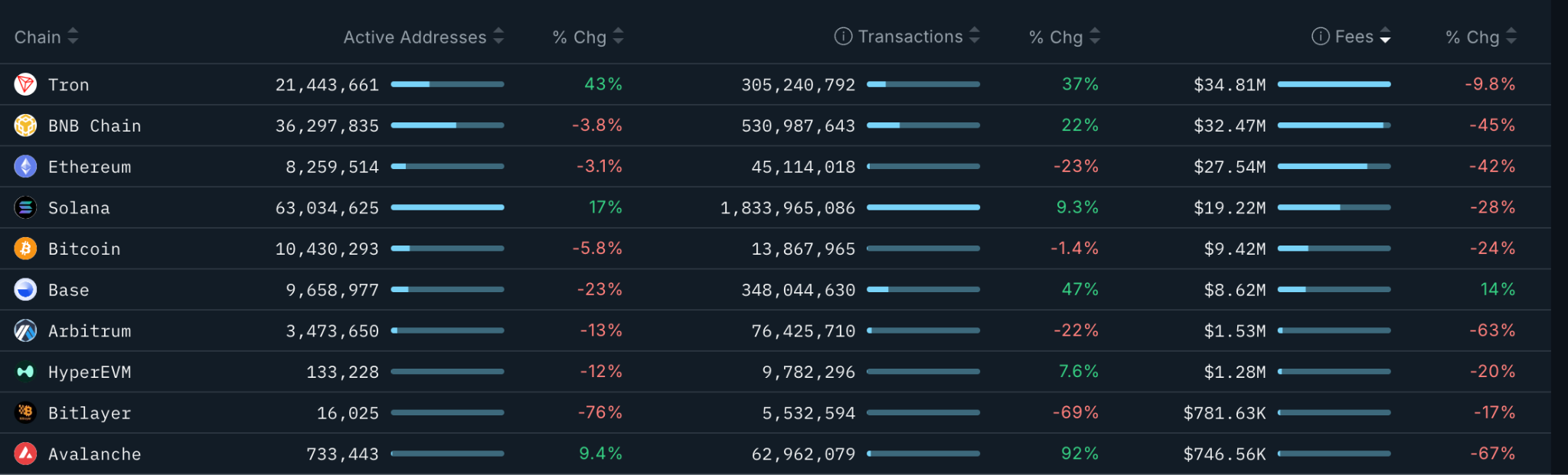

Onchain activity over the last 7 days paints a stressing image. While Ethereum continues to lead its rivals, protecting approximately 56% of the marketplace’s overall worth locked (TVL), this metric has actually come by 21% over the last thirty days, according to DefiLlama.

Much more worrying is the decrease in network costs, showing subsiding need for blockspace, which strengthens Ether’s rate weak point around $3,000.

Ethereum’s costs over the previous thirty days dropped to $27.54 million on Friday, representing a 42% reduction. Likewise, Solana’s costs decreased simply 9.8% while BNB Chain profits come by 45%, strengthening the bearishness in the market.

This might continue to press Ether’s rate in the coming weeks, especially when paired with increasing market worry, which has actually gone back to levels last seen throughout the sell-off led by President Donald Trump’s tariff statements in April.

ETH rate bear flag targets $2,500

Lots of experts alert that the existing drop might speed up unless a clear bullish shift takes place, potentially including pressure on day traders and little holders.

” Ethereum loses the 50-week EMA, a crucial macro assistance,” stated expert Bitcoinsensus in a Friday X post, describing the $3,350 level.

Previous breakdowns activated significant disadvantage relocations, with the last one leading to a 60% drop to $1,380 from $3,400 in between late January and early April.

Bitcoinsensus included:

” Pattern stays bearish unless rate recovers this level quick.”

Ether’s rate action in the day-to-day amount of time has actually verified a bear flag once it broke listed below $3,450, accompanying the 200-day SMA and the lower border of a bear flag.

The next significant assistance sits at the $3,000 mental level, which bulls need to protect strongly.

Losing this level would clear the method for a fresh down leg towards the determined target of the pattern at $2,280, or a 23% drop from the existing level.

As Cointelegraph reported, $3,000 stays a crucial assistance zone for the ETH/USD set, and holding it is essential to preventing more losses.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.