Bitcoin (BTC) bounces into a brand new week as volatility catalysts multiply worldwide.

-

Bitcoin sees a visit above $92,000 after the weekly open, however merchants are making ready for brief alternatives.

-

Liquidity hunts are the secret on the subject of short-term BTC value motion.

-

Geopolitics, the Fed and inflation knowledge converge to provide a possible macro volatility shock.

-

Bitfinex whales are signalling {that a} new BTC value uptrend is due subsequent.

-

2026 could find yourself a yr of consolidation with a battle at $65,000, evaluation predicts.

Merchants fade one other weekend BTC value pump

Bitcoin started the weekly candle on a excessive due to some volatility into the Asia market open.

Knowledge from TradingView confirmed BTC/USD hitting native highs of $92,392 on Bitstamp.

The timing of the headline-driven transfer instantly made merchants suspicious. Bitcoin, they famous, tends to cancel out features made earlier than the beginning of a brand new TradFi buying and selling week.

Over the previous 6 Asian session pumps, 4 out of 6 had been absolutely retraced.

The final two occasions value pumped right into a Monday, it marked an area high and absolutely reversed the transfer, giving again much more.

We’re as soon as once more pumping into Monday. Maintain the Jan thirteenth pivot in thoughts. pic.twitter.com/XLM9oDLSe8

— LP (@LP_NXT) January 12, 2026

“Hopefully, like we have seen many weeks, we’ll get a scam-pump on Sunday so we will search for shorts early within the week. With the weak ~$87,600 month-to-month open as closing goal,” dealer Lennaert Snyder instructed X followers prematurely of the weekend.

“For sure with present headlines immediately goes to be tremendous fascinating,” dealer Skew predicted Monday.

“Commodities as a complete are getting bid right here together with BTC with some spot shopping for lifting value right here.”

On increased time frames, dealer CrypNuevo centered on the 50-week exponential transferring common (EMA) at $97,400 as a possible upside goal earlier than new lows.

“My essential state of affairs over the previous month is that value will revisit the vary lows earlier than it may possibly go increased – I anticipate Bitcoin to return to low $80’s,” he mentioned.

CrypNuevo remained bullish on 2026 as a complete, contemplating optimum market entries and $73,000 as a “worst case state of affairs.”

“Sudden squeezes” grow to be commonplace

A number of traditional BTC value metrics are aligning to foretell a recent spherical of market volatility.

New findings from onchain analytics platform CryptoQuant put alternate order-book liquidity within the firing line.

“Liquidation spikes on each the lengthy and quick facet align intently with sharp wicks and quick reversals. This conduct is typical of liquidity hunts, the place overleveraged positions are compelled out during times of compressed value motion,” contributor The Alchemist 9 wrote in a Quicktake weblog publish Sunday.

The publish described BTC value motion as “more and more formed by liquidation occasions fairly than natural spot demand.”

Open curiosity, funding charges and the Bollinger Bands volatility indicator all level to “sudden squeezes” happening on decrease timeframes.

“Volatility right here seems to be manufactured by leverage resets fairly than sustained spot shopping for or promoting,” The Alchemist 9 mentioned.

CryptoQuant acknowledged that liquidity hunts don’t indicate a powerful upward or downward pattern.

The newest liquidity knowledge from monitoring useful resource CoinGlass exhibits a key space of curiosity at $90,000.

Macro volatility cocktail arrives

An enormous week for US inflation knowledge might grow to be much more unstable as geopolitics meets a showdown between the federal government and the Federal Reserve.

The newest releases of the Shopper Value Index (CPI) and Producer Value Index (PPI) come as markets assess the fallout from the US quasi-takeover of Venezuela and threats to intervene in Iran.

On the identical time, the US Supreme Courtroom is because of rule on the legality of the worldwide commerce tariffs imposed by President Donald Trump final yr.

As Cointelegraph reported, crypto markets stay extremely delicate to any information occasions associated to tariffs and their implications for liquidity developments.

“Early-January volatility has created some distinctive buying and selling situations for traders,” buying and selling useful resource The Kobeissi Letter summarized on X.

A weekend curveball got here within the type of Fed Chair Jerome Powell, who turned the topic of a legal investigation — allegedly over the dealing with of a renovation challenge.

In an announcement, Powell brazenly advised that the motives for the transfer by the Division of Justice (DOJ) lay elsewhere, particularly rates of interest not falling as rapidly as Trump needed.

“This new menace just isn’t about my testimony final June or concerning the renovation of the Federal Reserve buildings. It’s not about Congress’s oversight function; the Fed by means of testimony and different public disclosures made each effort to maintain Congress knowledgeable concerning the renovation challenge. These are pretexts,” he mentioned.

“The specter of legal prices is a consequence of the Federal Reserve setting rates of interest based mostly on our greatest evaluation of what’s going to serve the general public, fairly than following the preferences of the President.”

Inventory market futures fell instantly after the assertion went public, whereas gold hit new all-time highs of $4,601 per ounce.

The timing of the debacle is notable, coming simply weeks earlier than the Fed is because of keep away from one other charge minimize at its Jan. 28 assembly.

“Trump vs Powell will end in much more volatility,” Kobeissi added.

A number of senior Fed officers are set to take to the stage for public talking engagements this week.

Bitfinex whales’ Bitcoin longs roll over

Bitfinex whales proceed to level the way in which ahead on the subject of BTC value developments — if historical past is a information.

Whales’ BTC lengthy positions proceed to shrink this week after reaching an area excessive close to 73,000 BTC.

All through a lot of the bull cycle, whales pivoting on this approach preceded intervals of value upside, and market individuals are hoping that this time will likely be no totally different.

“From a long-term perspective, a bull market is already underway,” pseudonymous crypto investor and knowledge analyst CW, a contributor to onchain analytics platform CryptoQuant, commented on the subject Monday.

“Whereas the short-term could also be complicated, the present state of affairs is a bit noise in the long term.”

The final reversal from native highs got here in April final yr, across the time that BTC/USD noticed long-term lows close to $75,000. Within the coming weeks, the pair gained 50%.

In his personal evaluation on the weekend, commentator MartyParty employed the Wyckoff technique to foretell historical past repeating, calling for a swing low, referred to as the “spring,” to emerge subsequent.

“This precedes the Wyckoff Spring,” he instructed X followers.

Bitfinex longs at the moment whole round 71,800 BTC, marking their lowest ranges since Dec. 15.

Bear market nonetheless a 2026 actuality

Bitcoin maturing as an asset has not made it immune from bear markets — and 2026 might simply show that, new evaluation says.

Associated: Trump guidelines out SBF pardon, Bitcoin in ‘boring sideways’: Hodler’s Digest, Jan. 4 – 10

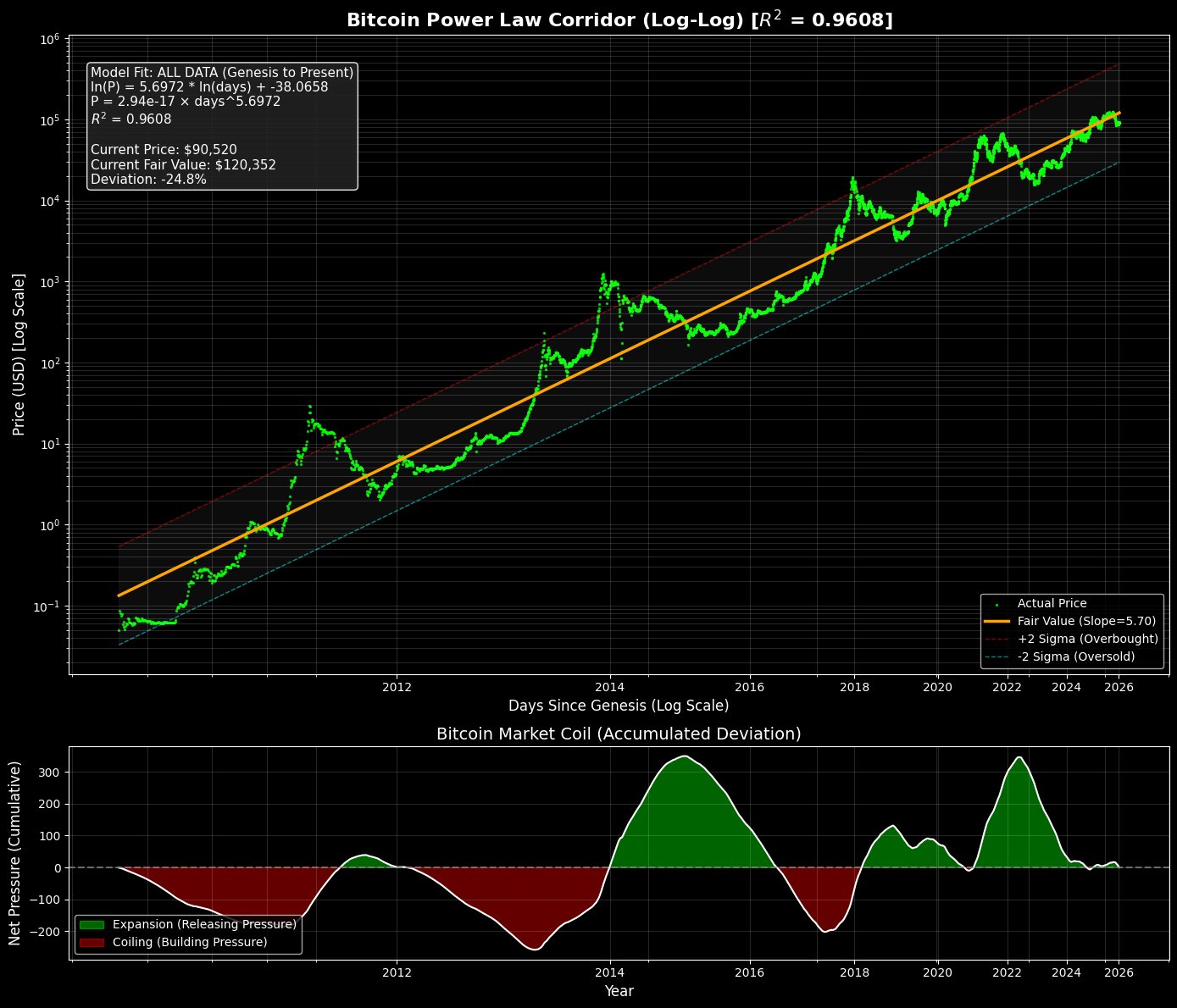

Updating followers on Bitcoin’s energy legislation value mannequin, Jurrien Timmer, director of worldwide macro at Constancy Investments, mentioned that this yr might find yourself as an enormous consolidation interval for BTC/USD, adopted by a brand new bear market low.

“It’s fascinating that a variety of Bitcoin of us are proclaiming that the 4 yr cycle is useless and a brand new structural up wave is at hand,” he wrote.

“I’m skeptical, not concerning the waning energy of the halving cycle (with which I agree), however the concept bear markets are now not going to occur.”

Energy legislation pattern traces at the moment envisage a battle happening at $65,000 if the value consolidates.

As Cointelegraph reported late final yr, BTC value hugging its energy legislation pattern line for a lot of the bull market was already giving rise to requires main upside.

Now, govt David Eng describes value as “coiling beneath” its long-term development trajectory, with just one viable consequence.

“Bitcoin is Compressed Beneath Its Development Legislation, and Compression All the time Resolves Upward,” he summarized on X.

Eng added that “historical past says decision comes by value catching up, not the legislation giving approach.”

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice. Whereas we try to offer correct and well timed data, Cointelegraph doesn’t assure the accuracy, completeness, or reliability of any data on this article. This text could comprise forward-looking statements which might be topic to dangers and uncertainties. Cointelegraph is not going to be responsible for any loss or injury arising out of your reliance on this data.