Mantra’s OM (OM) token staged a sharp rebound after plunging 90% over the weekend, following an active reaction from the job’s group attending to accusations of a carpet pull rip-off.

OM bounces 200% as co-founder addresses issues

Since April 14, OM was trading for as high as $1.10, practically 200% greater when compared to its post-crash low of $0.37 a day prior.

OM/USDT day-to-day rate chart. Source: TradingView

The rebound followed Mantra resolved installing rug-pull accusations.

Co-founder JP Mullin assured the neighborhood that the job stays active, indicating the main Telegram group being “still online.”

” We are here and not going anywhere,” Mullin composed, likewise sharing a confirmation address to show the group’s OM token holdings. He associated the OM’s crash to “negligent forced closures started by central exchanges.”

Source: JP Mullin

The guarantee relaxed the OM token sell-off that had actually eliminated over $5 billion in market capitalization and liquidated $75.88 million worth of futures positions in a day.

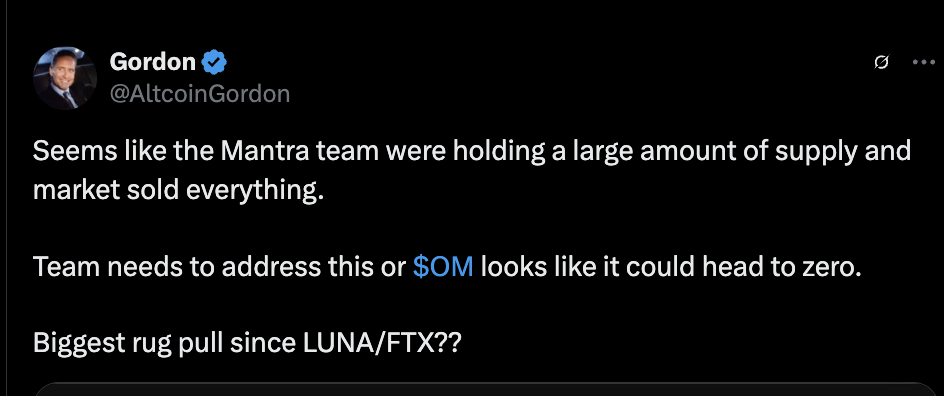

Many online analysts declared the Mantra group, apparently managing 90% of the token supply, managed the sell-off due to suspicious OM transfers to central exchanges right before the crash.

Source: AltcoinGordon

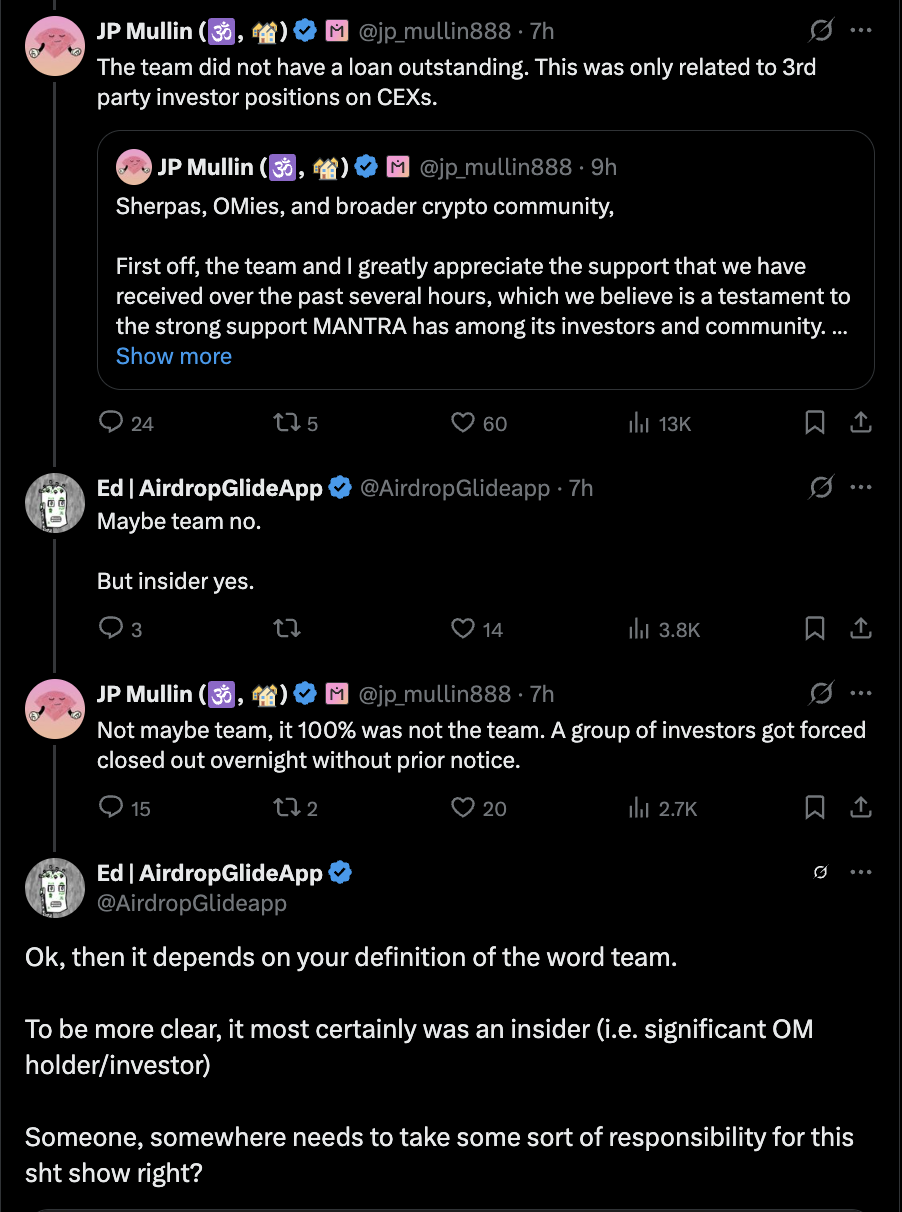

Expert Ed even more declared that the Mantra group utilized their OM holdings as security to protect high-risk loans on a central exchange.

He kept in mind that an abrupt modification in the platform’s loan danger specifications set off a margin call, adding to the token’s sharp decrease.

Source: Ed

Exchanges change loan danger specifications to handle market volatility and secure themselves from prospective insolvency due to falling security worths. Central exchanges like OKX have actually altered their specifications after Mantra’s tokenomics upgrade in October 2024.

Significantly, Mantra doubled the overall supply of OM tokens from 888,888,888 to 1,777,777,777 in the stated month. It even more transitioned from a topped to an uncapped, inflationary design with a preliminary 8% yearly inflation rate.

Source: Wu Blockchain

OKX CEO Star Xu called Mantra a “huge scandal,” including that it would launch appropriate reports concerning its crash in the coming days.

OM bounce may look like LUNA’s bull trap

OM’s 200% rebound from its $0.37 low might look remarkable, however its structure carefully looks like the traditional bull trap pattern seen in Terra’s LUNA ordeal in Might 2022.

OM’s rate has actually crashed listed below the 50-week rapid moving average (50-week EMA; the red wave) assistance near $3.25 and is now checking resistance at the 200-week EMA (the blue wave) at around $1.08.

OM/USDT weekly rate chart. Source: TradingView

On the other hand, OM’s weekly relative strength index (RSI) has actually dropped to 33.31, signifying weakening momentum and increasing the danger of another breakdown.

Related: What is a carpet pull in crypto and 6 methods to find it?

This setup highly mirrors LUNA’s post-crash habits. After its sharp decrease in Might 2022, the rate staged a quick healing however stopped working to recover its 50-week and 200-week moving averages, setting off a much deeper and more extended sag.

LUNA/USD weekly rate chart. Source: TradingView

Much Like LUNA, OM now deals with installing suspicion in spite of the short-term bounce, with chartist AmiCatCrypto stating that the Mantra token can plunge 90% within a day after rallying for 100 days.

” If you ask me if booming market is over. Brief response. YES,” she composed, including:

” Any gains from this point is thought about bounces.”

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.