XRP’s technical and onchain signals mean a bullish breakout, with bulls considering a considerable rally towards $2.80 by the month’s end.

XRP’s (XRP) price may reach $2.80 by month’s end, according to several bullish technical setups on multiple time frames.

Key takeaways:

-

XRP technical chart setups converge on the $2.80 target.

-

Spot taker CVD remains positive, suggesting confidence among buyers.

XRP falling wedge breakout targets $2.70

The XRP/USD pair broke out of a falling wedge pattern on Jan. 1, as shown on the two-day chart below.

Related: XRP reclaims $2 as fund inflows diverge from broader crypto outflows

In technical analysis, a falling wedge is a classic bullish setup characterized by two downward-sloping, converging trendlines, showing decreasing selling momentum and volume. It often leads to an upside breakout as sellers get exhausted and buyers take control.

The altcoin is required to hold above the support at $2 to increase its chances of a return toward $2.40. Overcoming this resistance would open the way for a run toward the bullish target of the prevailing chart pattern at $2.70.

“$XRP is breaking out of a Falling Wedge after trading sideways for a month”, Trader CryptoWIZRD said in a recent post on X, adding that the last time this happened was in Q4/2025 when the price “exploded” 486%.

XRP bull flag targets $2.80

The eight-hour chart shows XRP price trading with a bull flag, with the price facing resistance from the pattern’s upper trendline at $2.15.

An eight-hour candlestick close above this area will clear that path for XRP’s rise toward the top of the flag’s post at $2.41 and later to the measured target of the prevailing chart pattern at $2.80.

Such a move would represent a 32.5% increase from the current price.

The relative strength index has increased to 51 from 42 on Monday, suggesting growing bullish momentum.

As Cointelegraph reported, a break above the downtrend line on a descending channel at $2.30 on the daily chart could signal a potential trend change. The XRP/USDT pair may then rally to $2.70.

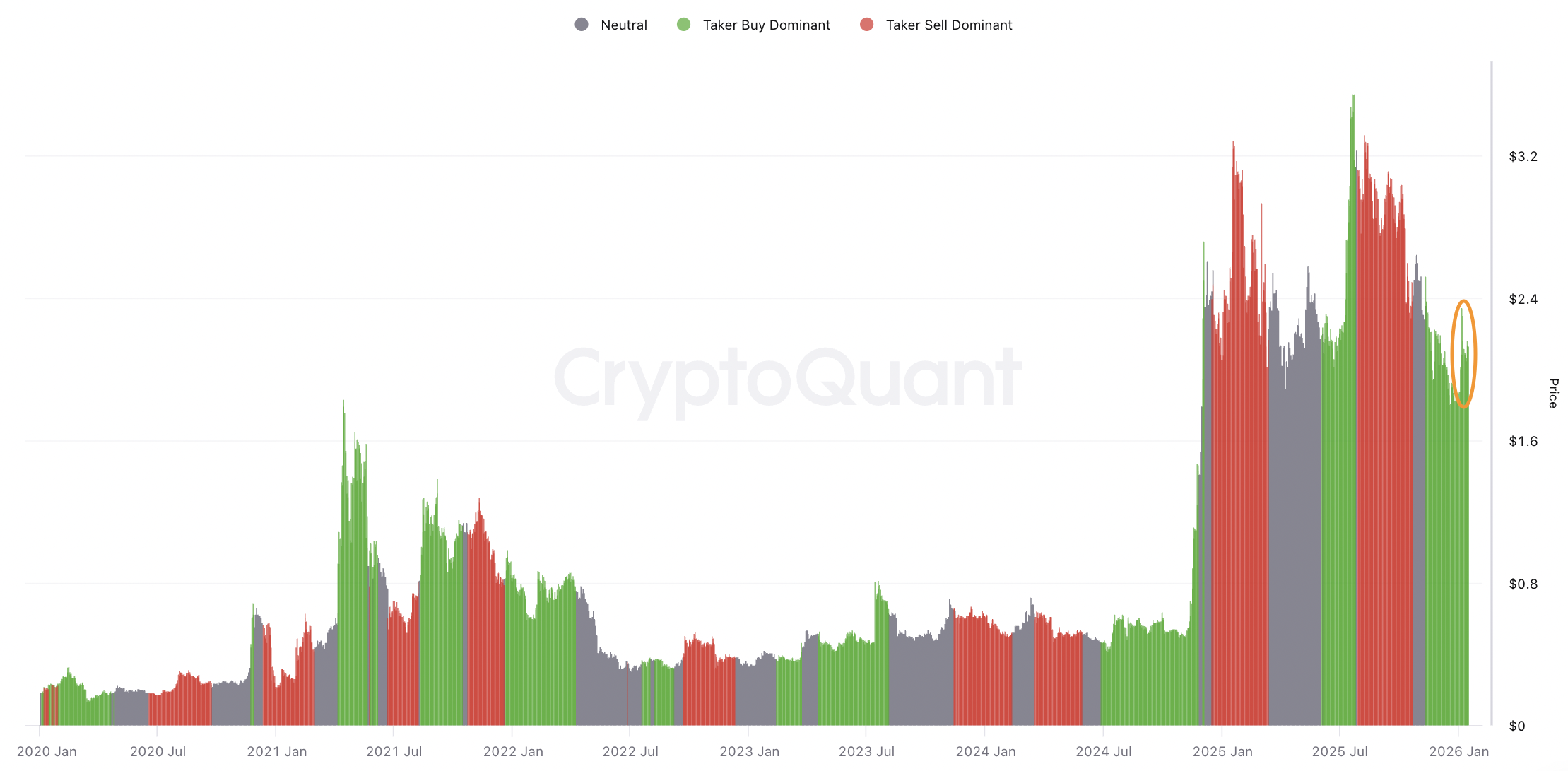

XRP spot taker CVD signals high buyer volumes

The 90-day Spot Taker Cumulative Volume Delta (CVD), a metric showing the balance of buyers and sellers, reveals that buy-orders (taker buy) have become dominant again.

CryptoQuant data shows that the demand-side pressure has dominated the order book since November 2025, with the XRP/USD pair rising 16% in 2026 so far.

This indicates that more traders are buying XRP at the market price, rather than waiting for cheaper bids, demonstrating growing confidence in higher prices ahead.

The last time XRP saw a similar surge in spot CVD was in July 2025, preceding a 65% price rally within weeks. This echoes the technical setup with a $2.80 target from the yearly open.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we aim to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might consist of positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage developing from your dependence on this info.