Secret takeaways:

-

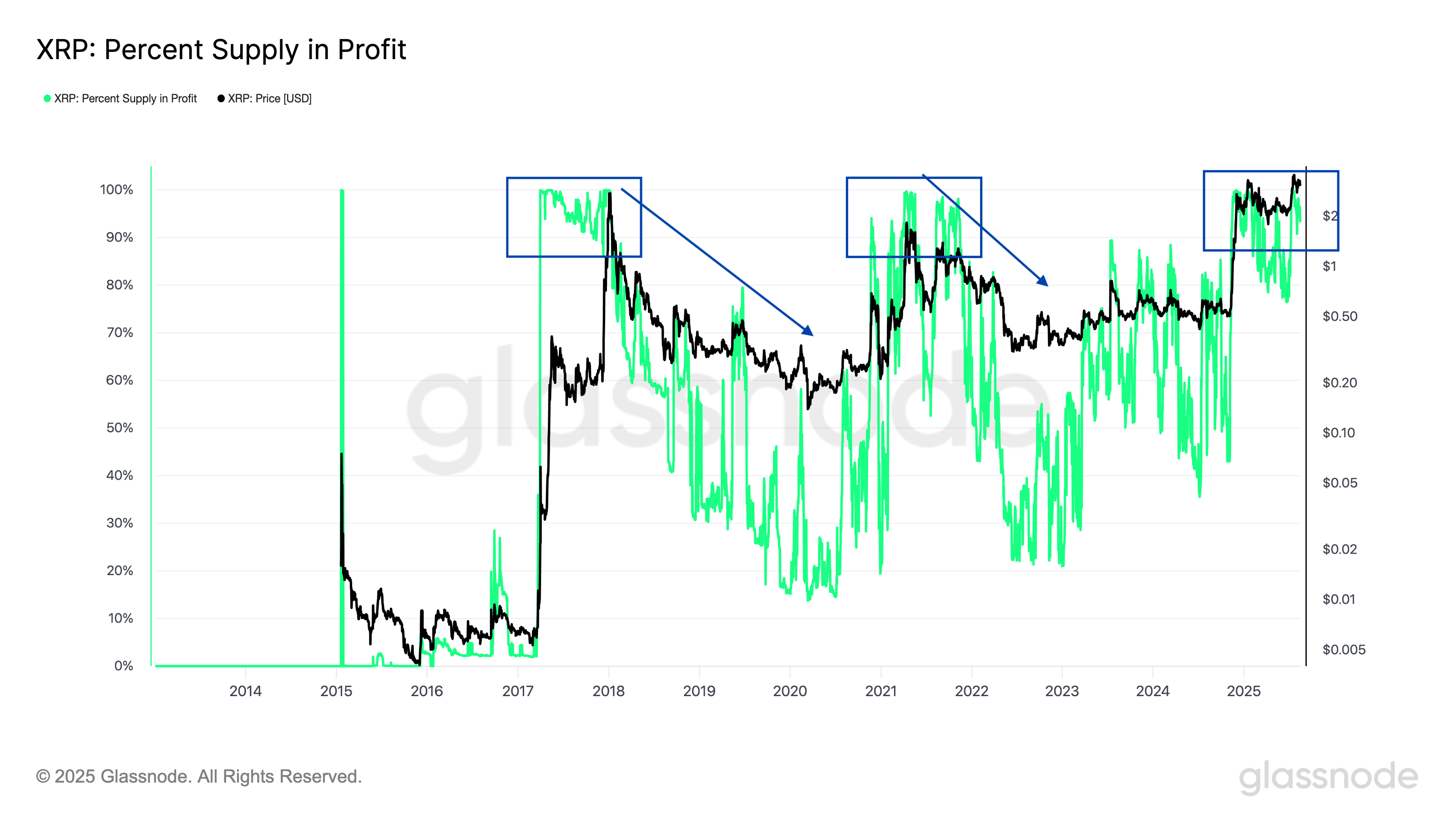

XRP’s rally to $3 has actually pressed 94% of supply into revenue, a level that traditionally marked macro tops.

-

XRP remains in the “belief– rejection” zone, onchain metrics reveal, echoing peaks in 2017 and 2021.

XRP’s (XRP) rally to over $3 has actually pressed almost 94% of its flowing supply into revenue, Glassnode information programs.

Since Sunday, XRP’s percent supply in revenue was 93.92%, highlighting strong financier gains as the cryptocurrency rallied by more than 500% in the previous 9 months to $3.11 from under $0.40.

90%> > supply in revenue is generally an XRP macro top

Such high success has actually traditionally indicated overheated conditions.

In early 2018, over 90% of holders remained in revenue simply as XRP peaked near $3.30 before a 95% rate turnaround. A comparable setup appeared in April 2021, when success levels above 90% preceded an 85% crash from the leading near $1.95.

The broad success highlights strong financier gains, which normally increases the danger of circulation as traders might look for to understand earnings. A comparable situation might be unfolding now.

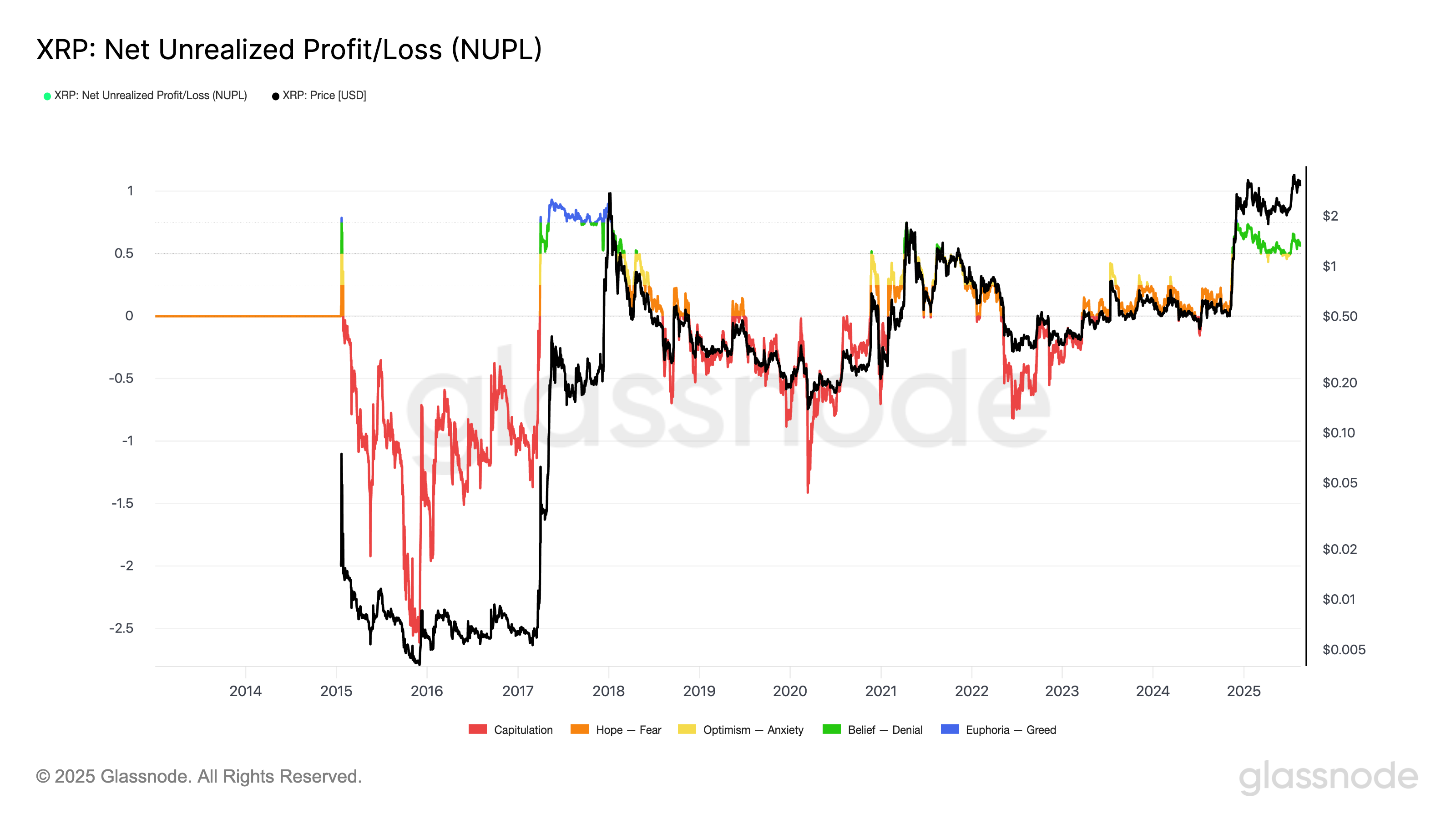

XRP’s NUPL mirros 2017 and 2021 rate peaks

XRP’s Net Latent Profit/Loss (NUPL) is additional signaling leading threats.

The indication, which tracks the distinction in between latent gains and losses throughout the network, has actually gone into the “belief– rejection” zone, a stage traditionally observed before or throughout market tops.

For instance, in late 2017, XRP’s NUPL increased to comparable levels simply as XRP rate peaked above $3.30. A similar pattern unfolded in April 2021, when NUPL readings above 0.5 accompanied XRP’s leading near $1.95 before another sharp decline.

The existing trajectory recommends financiers are greatly in revenue however not yet completely “ecstasy.” However the danger of profit-taking and circulation will magnify if NUPL increases towards greed levels for the very first time considering that 2018.

XRP may soak up possible selling pressure and prevent a much deeper correction listed below $3 if it can bring in fresh inflows, driven by institutional need and more comprehensive altcoin momentum.

XRP’s timeless bearish setup threats 20% drop

XRP rate is combining inside a coming down triangle after increasing above $3.

The pattern, normally bearish, is specified by lower highs versus horizontal assistance near $3.05. Previously this month, XRP briefly broke listed below the assistance in a fakeout, just to rebound back inside the structure.

The pressure from duplicated retests of the lower trendline raises the danger of a definitive breakdown. A verified relocation listed below $3.05 might activate a sell-off towards $2.39 by September, down about 23.50% from existing rate levels.

Related: Is $30 XRP rate a genuine possibility for this bull cycle?

On the other hand, the bulls should break above the coming down resistance line to restore upside momentum and revoke the bearish setup. Lots of think that the XRP rate might increase to $6 in this situation.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.