Secret takeaways:

-

Newer Bitcoin financiers offered over 148,000 BTC at a loss on Nov. 14.

-

Experts concur that pressing Bitcoin’s cost listed below the Jan. 1 open at $93,000 might activate a fresh drop to locations listed below $90,000.

Bitcoin (BTC) cost dropped to $92,000 on Sunday, eliminating almost all of this year’s gains as completion of the United States federal government shutdown stopped working to enhance financier belief. This has actually led financiers and traders to reassess their threats and remain mindful, with the most current purchasers offering their BTC at a loss.

Bitcoin “weak hands” understand losses

Bitcoin has actually backtracked 25% from its all-time high of $126,000 set on Oct. 16. The drop listed below the 50-week moving typical and the weekly close listed below $100,000 for the very first time in 6 months have actually sealed a more risk-off position amongst Bitcoin financiers.

Onchain information from CryptoQuant revealed that over 148,000 BTC held by retail or more recent entrants– those with less than 1 million BTC and having actually held for less than one month– were cost a loss on Nov. 11.

Related: BTC cost booming market lost? 5 things to understand in Bitcoin today

” This fire sale accompanied Bitcoin at approximately $96,853, a level far underneath their typical purchase cost of in between $102,000 and $107,000,” stated CryptoQuant expert Crazzyblockk in a Quicktake analysis on Sunday, including:

” This was not profit-taking; this was a substantial loss recognized on a significant scale.”

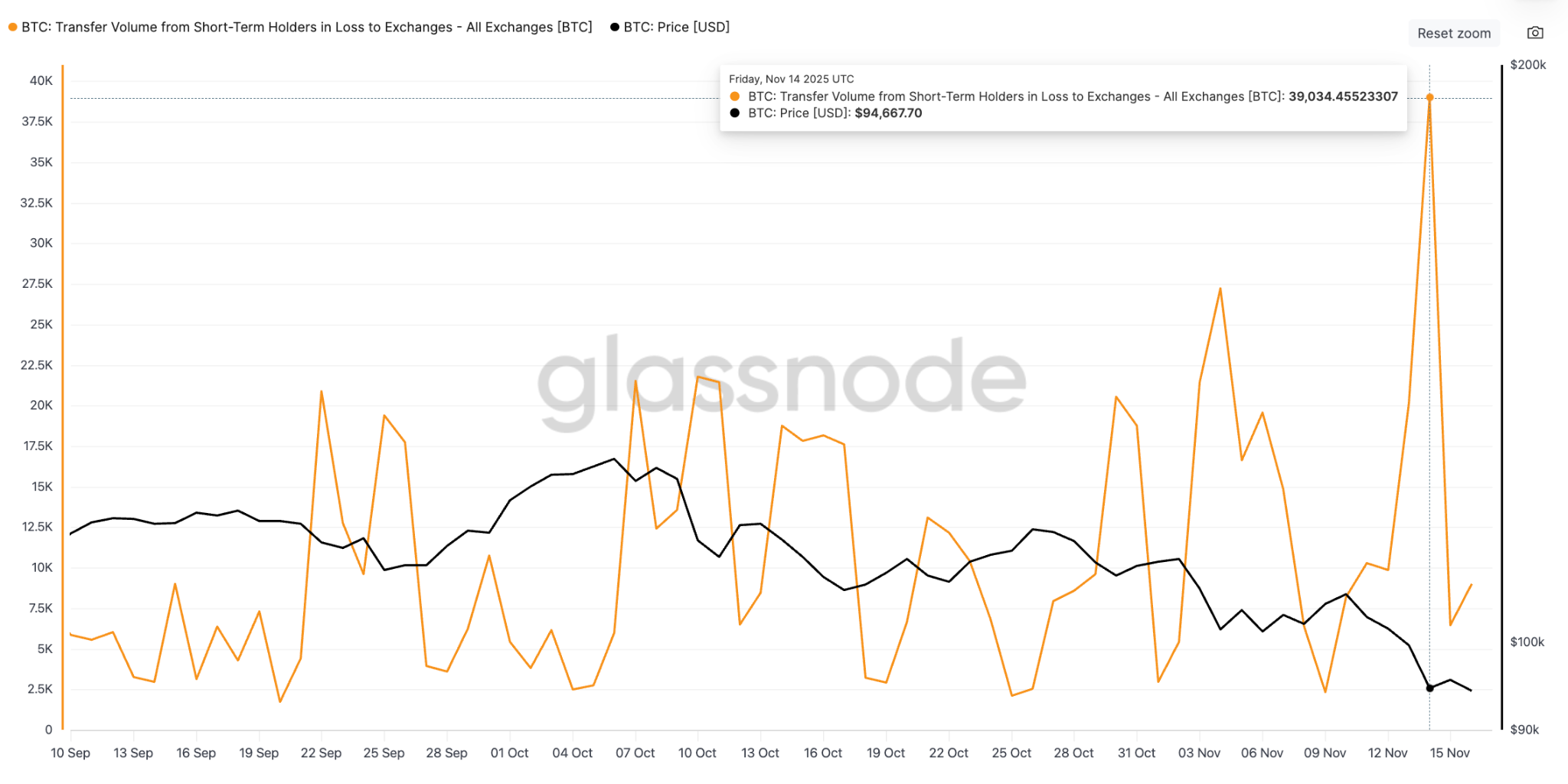

Extra information from Glassnode exposed that more than 20,175 BTC were moved by short-term holders– financiers who have actually held the possession for less than 155 days– to exchanges at a loss on Thursday. This rose to 39,034 BTC on Nov. 14, accompanying a 13.5% drop in BTC’s cost to $92,900 from $107,500.

This activity highlights a familiar behavioral pattern where short-term speculators panic-sell throughout market dips, regularly recognizing losses.

These financiers are most likely facing their very first significant recession and “selected to secure a loss instead of run the risk of steeper decreases, changing their paper losses into genuine ones,” the expert stated, including:

” The large volume of 148,000 BTC being discarded at a loss represents an eliminating of restless capital. While it represents extreme short-term discomfort, this transfer of coins from worried sellers to unfaltering purchasers at a reduced cost can strengthen a more powerful long-lasting base.”

Bitcoin cost might drop listed below $90,000 before rebounding

Bitcoin’s newest drop listed below the 50-week moving average has a number of traders and experts requiring much deeper cost corrections to sub-$ 90,000 levels.

Crypto expert Jelle stated the cost was “in a yet another restorative duration, inside a bigger #Bitcoin uptrend.”

Jelle included that Bitcoin is “most likely slice till completion of the year or maybe dip 5% lower, and after that begin rising once again towards brand-new highs.”

A 5% drop from the existing levels would see the BTC/USD set extend the drop to $89,300.

Bitcoin expert AlphaBTC stated, “Bitcoin is due for a bounce, however … there is still another dip listed below $90K to come.”

According to AlphaBTC, a close listed below the annual open at $93,300 might see the cost drop lower, potentially bottoming around April lows of $74,000.

#Bitcoin End of Year strategy

Bitcoin is due a bounce, however I have a sly sensation there is still another dip listed below 90K to come, before it occurs. Then we wait on more Rates and Jobs information, which might still be a while in coming, BUT when it does i believe the last huge … pic.twitter.com/CXJ6FVanLf

— AlphaBTC (@mark_cullen) November 17, 2025

On the other hand, forecast market platform Polymarket jobs various cost results for the remainder of the week. The most likely result for BTC is now $98,000 at 70%, while a close listed below $92,000 is at 55% possibility, and 35% chances of a drop towards $90,000. The opportunities of the cost recovering $100,000 are at 50%.

As Cointelegraph reported, Bitcoin might extend its drop to fill orders at the quote within the $88,500 to $92,000 zone.

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.