Secret takeaways:

-

XRP rate dropped 8.75% on Friday regardless of Ripple’s $1 billion acquisition strategies.

-

A drop towards the $2 assistance level is possible in the coming days, as bulls pin their hopes on a rebound.

Ripple is supposedly preparing to raise $1 billion to buy XRP (XRP) for its own digital possession treasury. This relocation might make it the world’s biggest business holder of this top-five cryptocurrency.

Nevertheless, XRP bulls mainly neglected the news on Friday, with the rate falling 8.75% after the Oct. 17 statement, while continuing its dominating drop, as revealed listed below.

Can XRP break out of its dominating drop in October?

XRP rate eyes healing after evaluating $2 assistance

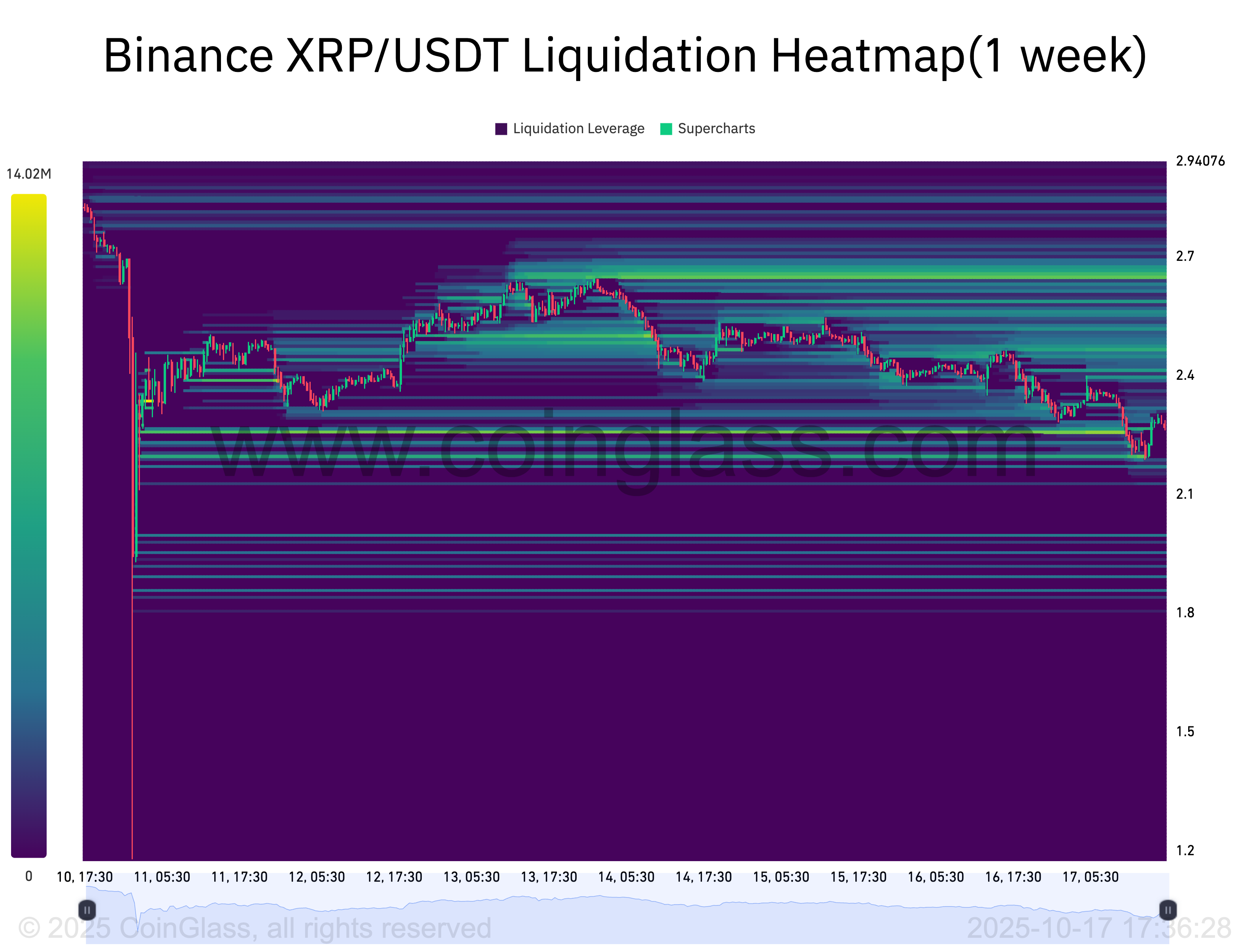

Looking broadly, XRP has actually been varying within a falling wedge pattern after recently’s crypto market thrashing, which liquidated a record $20 billion or more in positions.

The rate might still dip towards the $2 assistance level, accompanying the wedge’s lower border and acting as a prospective turnaround zone.

A breakout above the wedge’s upper trendline might activate a benefit towards the $2.36–$ 2.75 variety, up 5-20% from existing rate levels, in October.

Related: Ripple purchases business treasury management business GTreasury for $1B

That variety includes levels with as much as $118.76 million in cumulative brief utilizes, according to CoinGlass information.

Possible brief liquidations at these levels might include momentum towards $3, a mental resistance target even more lining up with the upper border of XRP’s coming down triangle pattern.

Alternatively, a close listed below $2 would revoke the wedge setup, welcoming additional drawback pressure towards $1.65, the 0.618 Fibonacci retracement level, by month’s end.

Longer term: XRP still on track for a breakout

On longer-term charts, XRP is keeping its rising triangle breakout situation regardless of plunging 60% throughout recently’s “black Friday.”

Since Friday, the cryptocurrency was holding above the triangle’s lower trendline near $2.25 while considering a rebound towards the upper trendline near $3.55.

A breakout above $3.55 with considerable volumes might send out the rate to as high as $7.75, representing a 250% boost from existing levels, by early 2026.

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.