Secret takeaways:

-

XRP acquired 30% in the previous week, enhanced by increasing institutional interest and deep trading liquidity, now the third-largest crypto by market cap.

-

Ripple’s positioning with ISO 20022, a brand-new monetary messaging requirement, and its stablecoin (RLUSD) support a pivot towards real-world monetary combination.

-

Public business are starting to deal with XRP as a treasury possession, signifying a shift from speculation to tactical allowance.

Ripple’s XRP (XRP) token may be the most interesting cryptocurrency on the marketplace. Typically dismissed for doing not have clear usage cases, it has actually silently reached end up being the third-largest cryptocurrency by market cap, now at $168 billion. In the previous week alone, XRP acquired over 30%, exceeding both Bitcoin (BTC) (+10%) and Ether (ETH) (+21%).

What’s driving this rise? A mix of strong liquidity, a devoted neighborhood, and most notably, positioning with the growing institutional story. As this booming market is significantly driven by standard financing, XRP discovers itself in the ideal location at the correct time.

XRP discovers a specific niche

There’s an extensive belief in the crypto neighborhood that XRP has actually never ever “made” its top-tier status. XRP Journal is a permissioned blockchain created for interbank settlements, now utilized by a variety of popular banks. Nevertheless, most popular XRPL items do not need holding XRP itself, that makes its tokenomics doubtful.

There are some Web3 tasks presently being developed on XRPL. Still, their scale is insignificant compared to leading wise agreement platforms like Ethereum or Solana, in part since of XRPL’s absence of programmability.

That stated, the 2025 cycle isn’t about Web3 buzz. It has to do with institutional adoption, regulative clearness, and capital circulations. Which’s where Ripple, and by extension XRP, are distinctively placed.

Ripple’s institutional aspirations

On July 1, the United States Federal Reserve embraced ISO 20022, a brand-new worldwide requirement for monetary messaging. This follows comparable relocations by other significant worldwide payment networks like SWIFT. Ripple has actually been lined up with this requirement considering that 2020, when it ended up being the very first DLT business to sign up with the ISO 20022 body. That placing might now settle.

Volante Technologies, a Fedwire tech supplier, just recently verified that organizations utilizing its Fedwire-as-a-Service item can pick XRP for settlement. This connection– RippleNet plus ISO 20022 plus Fedwire– produces an on-ramp for real-world XRP use in managed monetary facilities.

Additionally, Ripple is well-positioned to gain from the stablecoin market development. In December 2024, the business introduced RLUSD, a dollar-pegged stablecoin that has actually considering that surpassed a $517 million market cap. To seal its compliance, on July 2, Ripple Labs CEO Brad Garlinghouse verified that the business requested a nationwide bank charter from the OCC. Previously, Ripple Labs likewise requested a Fed Master account together with Basic Custody, a company it got in February 2024. If authorized, this would enable Ripple to hold RLUSD straight with the Fed.

XRP’s an “simple trade” with growing tactical interest

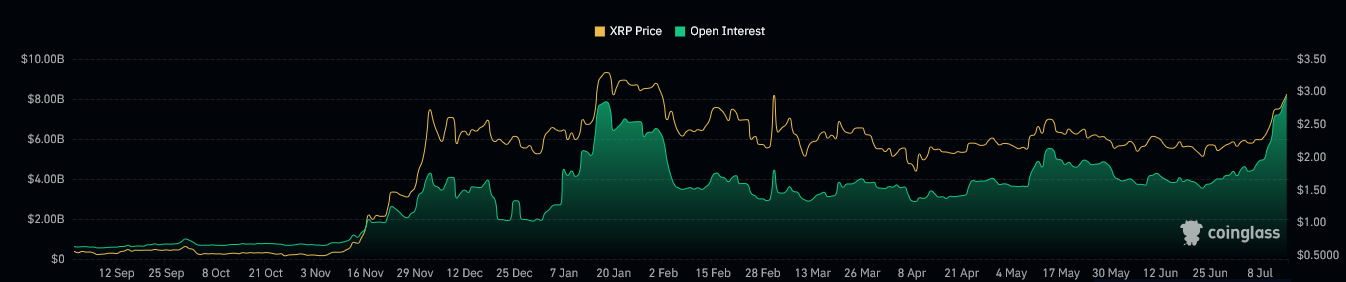

There may not be a clear roadmap for XRP (yet?), however the marketplace plainly values Ripple’s aspirations. XRP’s present everyday trading volume goes beyond $11 billion, more than double Bitcoin’s when changed for market cap. Its futures open interest now stands at a record $8.1 billion, recommending continual speculative momentum.

High liquidity and volume depth, together with XRP’s habits– dragging BTC, then capturing up quickly– make XRP a reasonably “simple trade” in crypto.

Nevertheless, what’s brand-new is the shift from pure speculation to tactical financial investment. Numerous public business are developing XRP treasuries. Nasdaq-listed Spear and Webus revealed strategies to assign $500 million and $300 million, respectively, to XRP reserves. Smaller sized companies like VivoPower and Wellgistics Health, likewise noted on Nasdaq, have actually likewise participated in, preparing to purchase $121 million and $50 countless XRP, respectively.

While these allowances are still small compared to Bitcoin’s $102 billion in business holdings, they mark an essential pattern: the framing of XRP as a treasury and settlement possession. If these business surpass holding and start utilizing XRP for cross-border payments– as Webus means– a genuine synergy might emerge.

XRP’s institutional push continues through ETFs. On July 14, the NYSE authorized the listing of the ProShares Ultra XRP ETF, based upon XRP futures. While less impactful on rate than an area fund, it signifies a growing institutional interest. The United States SEC is still pondering on the approval of area XRP ETFs.

On The Other Hand, Canada is an action ahead. On June 18, 3iQ’s area XRP ETFs (XRPQ and XRPQ.U) started trading on the Toronto Stock market, rapidly accumulating over $50 million in AUM, the business revealed on X.

Related: clearness Act isn’t best, however it’s the expense United States Congress need to pass this summer season

Whether XRP’s energy validates its assessment, Ripple’s placing plainly resonates with the marketplace. Ripple has actually taken a regulatory-compliant, institutionally tasty story– something most crypto tasks have a hard time to accomplish.

As Cosmo Jiang, basic partner of Pantera Capital, stated in an interview:

” I believe the factor XRP may prosper is because, beyond the understanding of a great deal of individuals in crypto, including myself, XRP has an actually, actually strong following. There’s a great deal of social networks influencers that are actually into XRP, there’s a great deal of broad awareness amongst organizations and standard financing.”

In a market significantly specified by understanding, placing, and gain access to– not simply code– XRP’s increase might state more about the future of crypto than its critics care to confess.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.