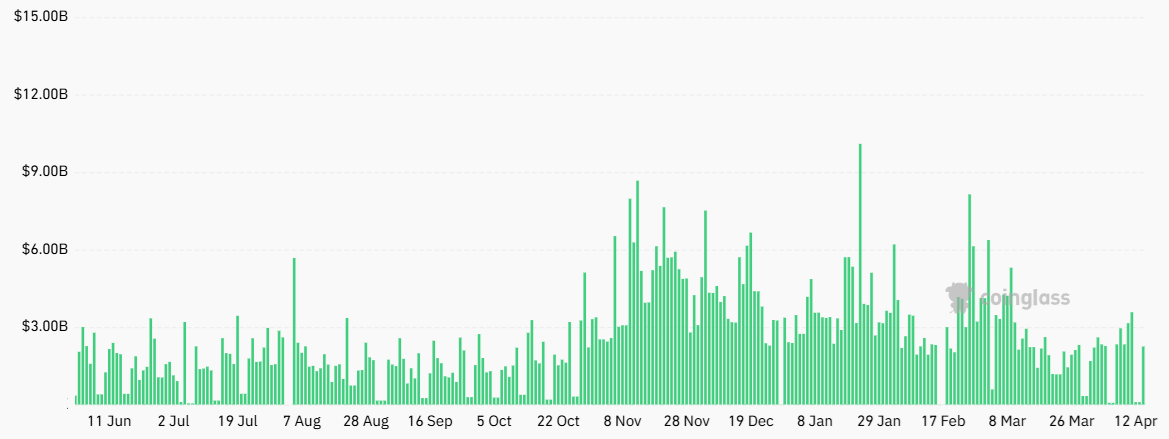

Area Bitcoin (BTC) exchange-traded funds saw an overall of $872 million in net outflows in between April 3 and April 10, triggering traders to question if total interest in Bitcoin is fading. The strong selling pressure started on April 3, as international trade stress increased and worries of a financial recession grew. This pattern is particularly worrying after 2 days of area Bitcoin ETF net circulations listed below $2 million on April 11 and April 14.

Area Bitcoin ETFs aggregate net circulations, USD. Source: CoinGlass

Bitcoin’s cost has actually stayed reasonably steady near $83,000 for the previous 5 weeks, which even more recommends weak interest from both purchasers and sellers. On one hand, this absence of volatility might reveal that Bitcoin is ending up being a more fully grown property class. For instance, a number of S&P 500 business have actually dropped 40% or more from their all-time highs, while Bitcoin’s biggest drawdown in 2025 was a much healthier 32%.

Nevertheless, Bitcoin’s efficiency has actually dissatisfied those who thought in the “digital gold” story. Gold has actually acquired 23% up until now in 2025, reaching an all-time high of $3,245 on April 11. Despite the fact that Bitcoin surpassed the S&P 500 by 4% over the previous one month, some financiers fret that its appeal is fading, as it is presently uncorrelated with other properties and not serving as a reputable shop of worth.

Typical Bitcoin ETF volume goes beyond $2 billion daily

When taking a look at the area Bitcoin ETF market– particularly compared to gold– Bitcoin has some benefits. On April 14, area Bitcoin ETFs had a combined trading volume of $2.24 billion, which is 18% listed below the 30-day average of $2.75 billion. So, it would not be precise to state that financier interest in these items has actually vanished.

Area Bitcoin ETFs everyday volumes, USD. Source: CoinGlass

While Bitcoin ETF volumes are lower than the $54 billion daily traded by the SPDR S&P 500 ETF (SPY), they are not far behind gold ETFs at $5.3 billion and lead United States Treasurys ETFs at $2.1 billion. This is remarkable, thinking about that area Bitcoin ETFs in the United States just introduced in January 2024, while gold ETFs have actually been trading for over twenty years and have $137 billion in properties under management.

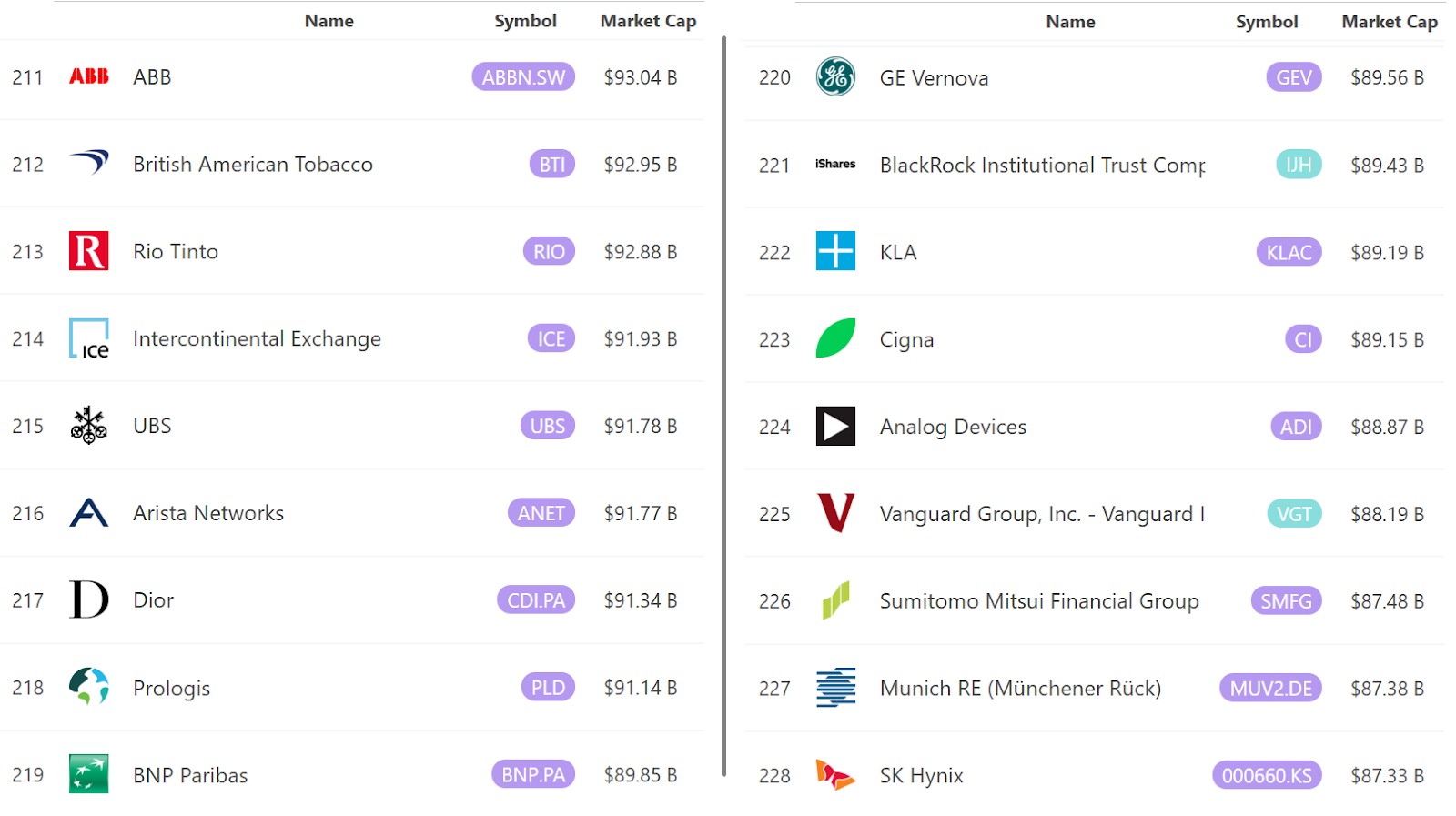

Even when consisting of the Grayscale GBTC Trust, which went beyond 200,000 shares traded daily in 2017 before it was transformed to an ETF, Bitcoin financial investment items are still less than 8 years of ages. Presently, area Bitcoin ETFs hold about $94.6 billion in properties under management, which is more than the marketplace capitalization of popular business such as British American Tobacco, UBS, ICE, BNP Paribas, Cigna, Sumitomo Mitsui and a number of others.

Related: Bitcoin reveals growing strength throughout market decline– Wintermute

Ranking of tradable properties by market capitalization, USD: Source: 8marketcap

To see how area Bitcoin ETFs have actually ended up being developed in the market, one can take a look at the leading holders of these items. These consist of popular names like Brevan Howard, D.E. Shaw, Apollo Management, Mubadala Financial Investment, and the State of Wisconsin Financial Investment. From pension funds to a few of the world’s biggest independent property supervisors, Bitcoin ETFs offer an option to conventional properties, despite short-term cost motions.

As the property class grows and more items like futures and choices are noted, Bitcoin might become consisted of in international indexes, whether in the products or currencies classification. This might lead passive funds to invest, increasing both cost capacity and trading volume. For that reason, the existing absence of strong net inflows or outflows is not uncommon and ought to not be viewed as an indication of weak point.

This short article is for basic info functions and is not planned to be and ought to not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.