Secret takeaways:

-

Solana was up to $192 on Thursday, removing its whole rally to $253 in under a week.

-

An area ETF judgment on Oct. 10 might open much deeper institutional circulations.

-

SOL’s RSI setup indicates a possible short-term bottom in spite of the altcoin’s more comprehensive correction.

Solana (SOL) slipped listed below the $200 mark on Thursday, removing its current rally to an eight-month high of $253. The 19% dip that unfolded in a week has actually rattled market momentum and raised concerns about near-term strength.

Yet, a looming driver might alter the story. Grayscale’s area SOL exchange-traded fund (ETF) faces its very first approval due date on Oct. 10, a choice that might figure out whether institutional capital streams start to support SOL in a manner comparable to BTC and ETH over the previous year.

While the REX Osprey Staking SOL ETF, released in July, provides area direct exposure, its structure is less substantial than a pure area item. A Grayscale area ETF would permit more direct institutional involvement, possibly opening much deeper liquidity and more comprehensive adoption.

That choice is just the very first in a series of judgments. The United States Securities and Exchange Commission (SEC) is set to examine 5 other applications, with a last due date on Oct. 16, 2025, consisting of propositions from Bitwise, 21Shares, VanEck, Grayscale, and Canary. Jointly, the lineup highlighted the growing institutional interest in bringing SOL into traditional financial investment cars.

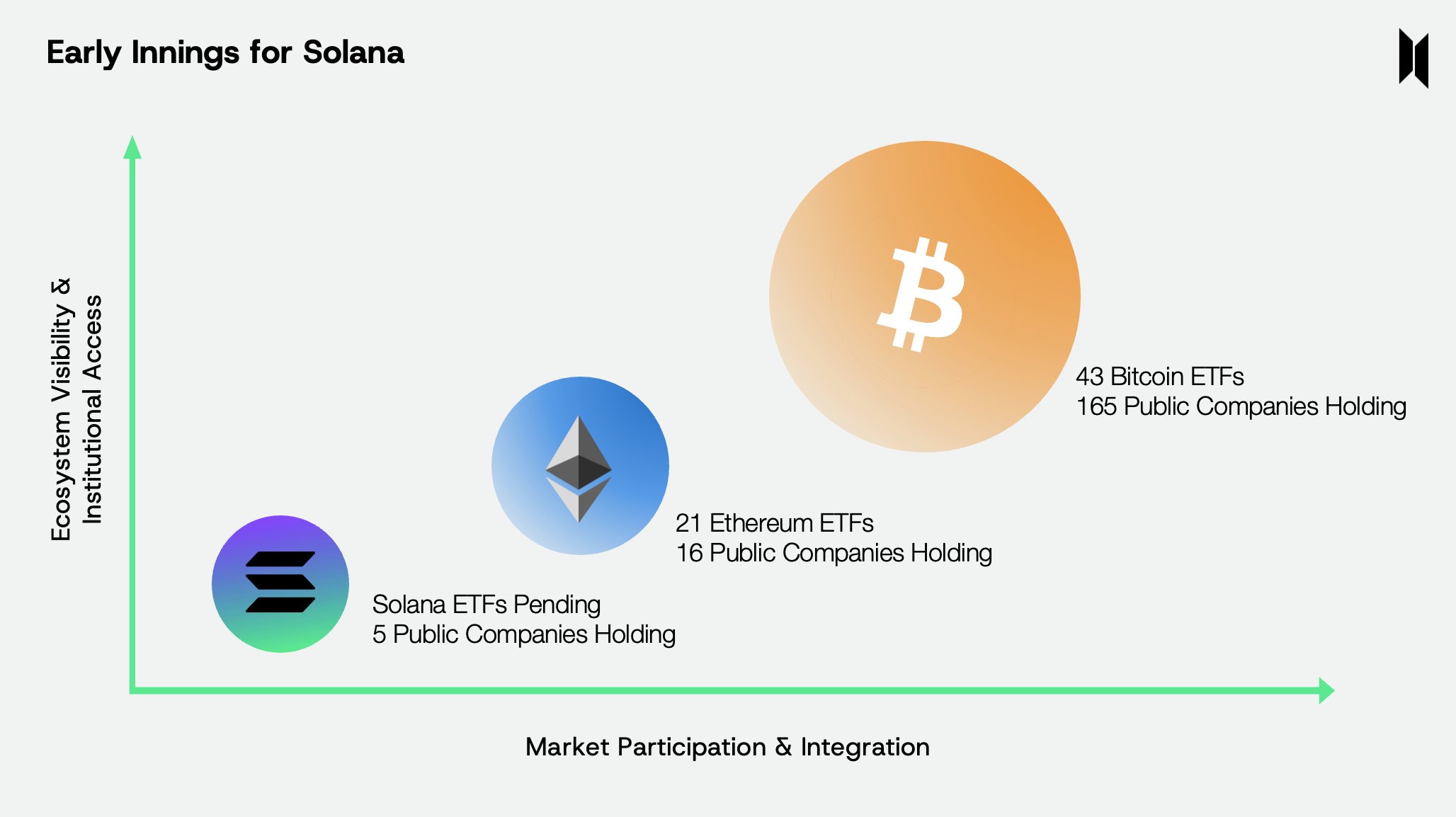

Advocates argue the timing might be critical. Property supervisors at Pantera Capital just recently called SOL “next in line for its institutional minute,” mentioning under-allocation relative to BTC and ETH. While organizations hold around 16% of Bitcoin and 7% of Ether, less than 1% of SOL’s supply is institutionally owned. Pantera Capital recommended that an area ETF might speed up adoption, particularly as business like Stripe and PayPal broaden their combinations with Solana.

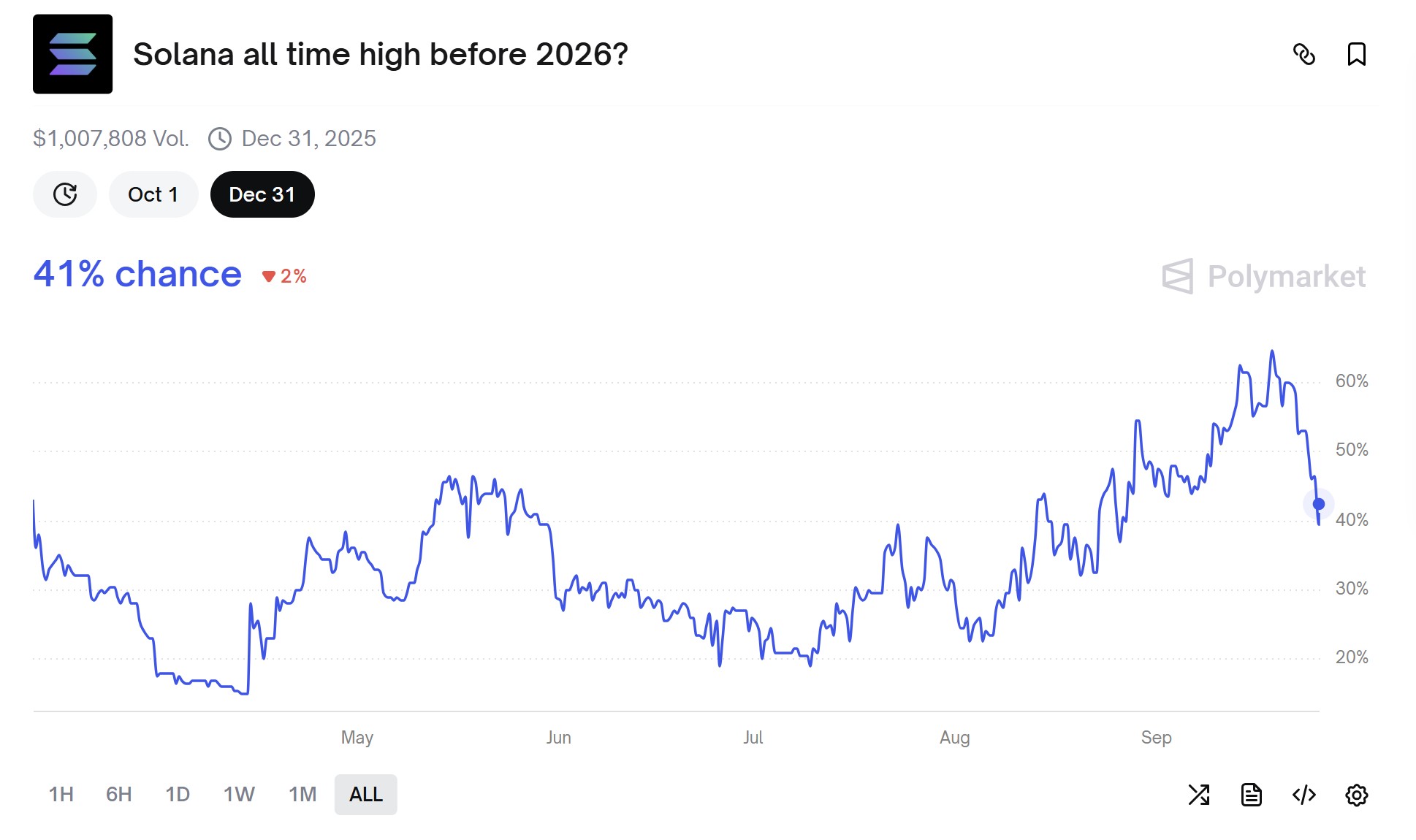

Still, not all signs indicate an impending breakout. Forecast markets platform Polymarket presently appoints simply a 41% possibility of SOL reaching a brand-new all-time high in 2025. That indicated sticking around care even as ETF speculation heightens.

Related: Australian physical fitness company tanks 21% on Solana treasury gamble

Rate sign with an 80% hit rate signals SOL bottom

SOL’s cost action has actually shown impressive volatility over the previous 3 weeks. The token rallied to $253 from $200 in simply 12 days, however a fast turnaround highlighted damaging short-term momentum, with sellers recovering ground quicker than purchasers had actually developed it.

Nevertheless, on greater timeframes, the more comprehensive pattern stays useful. SOL continues to form a pattern of greater highs and greater lows, keeping the day-to-day structure bullish. The present correction is unfolding within the very first significant need zone or order block in between $200 and $185, which likewise overlaps with the 0.50– 0.618 Fibonacci retracement band, an area typically expected technical bounces. Holding this zone would strengthen the uptrend and possibly reset momentum.

Losing the $185 level would move attention to the next order block in between $170 and $156. While such a relocation would not right away turn the day-to-day chart bearish, it would considerably damage pattern strength and most likely welcome much deeper selling pressure.

On the intraday side, the four-hour chart is revealing indications of sellers’ fatigue. The Relative Strength Index (RSI) has actually once again dipped listed below 30, a level that traditionally signified bottoms or greater lows for SOL.

Given That April 2025, this setup has actually taken place 5 times, and on 4 of those celebrations, SOL published quick healings. If the pattern repeats, short-term relief might follow, as the greater timeframe correction plays out.

Related: Solana open interest strikes record 72M SOL, however why is cost falling?

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.