Secret takeaways:

SOL (SOL), the native cryptocurrency of Solana, dealt with a strong rejection at the $158 level on Monday. The subsequent drop to $143 by Wednesday marked a 14% loss over 7 days. Traders now stress that the opportunities of recovering the $200 level have actually reduced, as need for leveraged SOL positions rose in the middle of the current cost weak point.

Since Wednesday, open interest on SOL futures reached 45.7 million SOL, a 19% boost from the previous month. While every long (purchaser) is matched with a brief (seller), the strength of take advantage of on each side can vary. Those exceptional positions are now valued at $6.7 billion, making it vital to examine which side has actually been more aggressive.

Will SOL ETF approval chances cause price advantages?

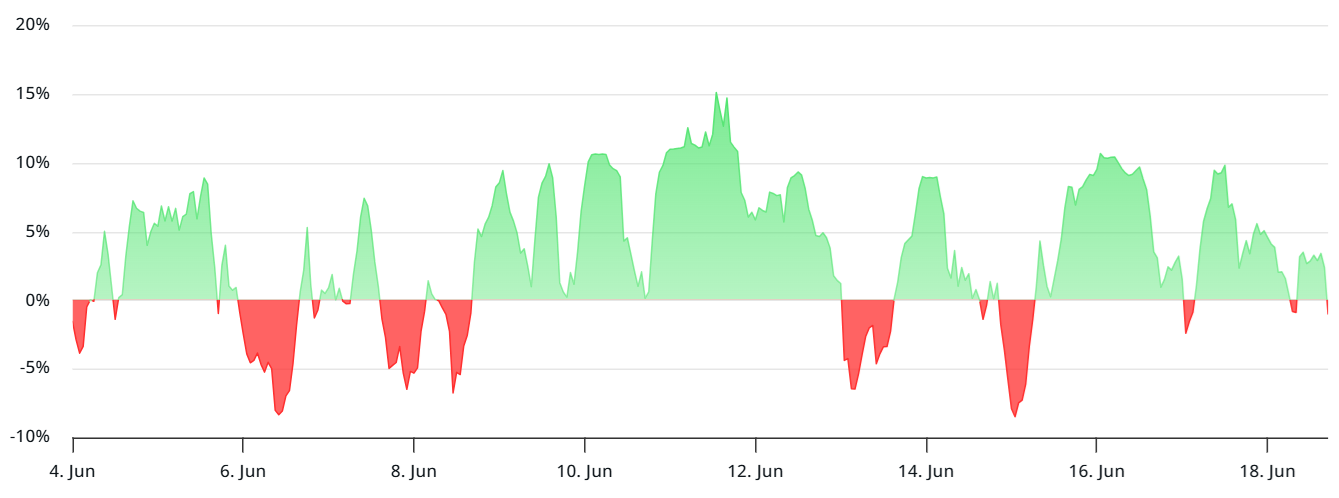

Financing rates on continuous futures function as a crucial metric for comprehending market belief. In neutral conditions, the annualized financing rate must fall in between 5% and 15%, suggesting that long positions are paying a premium to keep trades open. When markets turn bearish, this rate tends to drop listed below that variety.

On Wednesday, SOL’s financing rate was up to 0%, recommending a growing cravings for bearish positions. More significantly, this indication has actually stopped working to remain above the 15% annualized limit over the previous 3 months, showing a more comprehensive uncertainty amongst bulls. Even the rally to $185 in mid-May stopped working to set off renewed interest in leveraged longs.

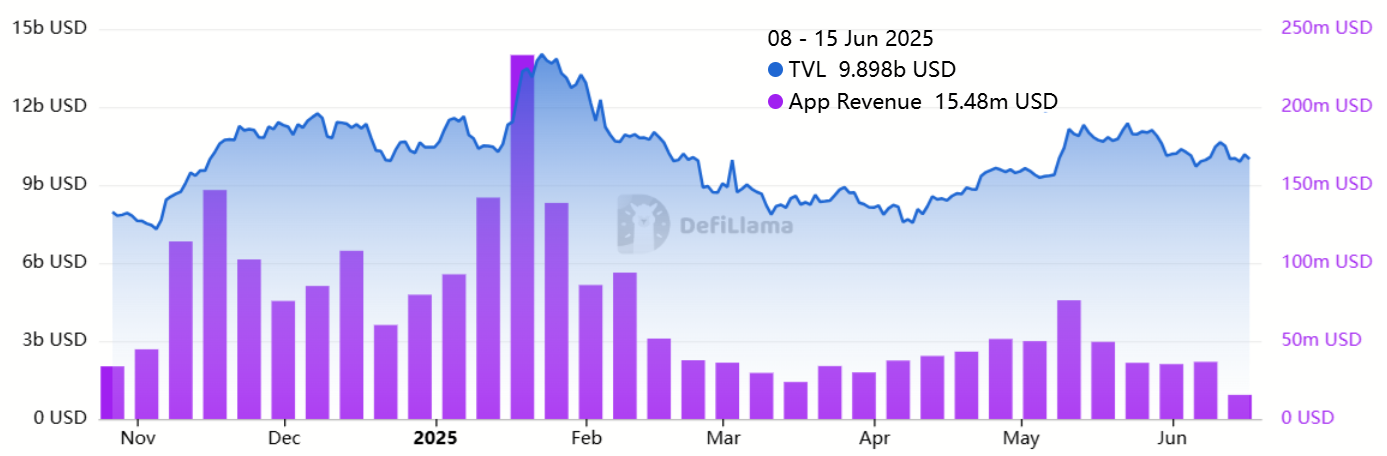

While leveraged longs are not strictly needed for SOL to recover the $200 mark, a considerable modification in financier understanding is crucial. In the lack of restored self-confidence, the marketplace might continue to deal with selling pressure. SOL’s efficiency stays carefully connected to network activity on Solana, which has actually stagnated over the previous 3 months following a record high in January.

The overall worth locked (TVL) on the Solana network has actually stayed constant at almost $10 billion, while weekly profits from decentralized applications (DApps) has actually dropped listed below $40 million. For contrast, these DApps created more than $100 million each week in between mid-November and mid-February.

SOL’s current decrease likewise shows the overhyped enjoyment sustained by memecoin activity, especially following the launch of the Authorities Trump (TRUMP) token on Solana. This captured traders off guard, as previous efforts by business lined up with United States President Donald Trump had mostly preferred Ethereum.

Related: Altcoin ETF applications rise as SEC softens crypto position

The prospective approval of a SOL area exchange-traded fund (ETF) by the United States Securities and Exchange Commission is viewed as the most substantial short-term driver for the token. Still, experts argue that SOL stands to benefit much more from the long-lasting development of tokenized securities on the Solana blockchain, according to a Cantor Fitzgerald equities research study report.

The experts supposedly assert that Solana is “meaningfully much better than Ethereum throughout every metric,” and anticipate an increasing variety of business to embrace SOL as a treasury property. They indicate strong designer development and higher functional effectiveness compared to Ethereum’s more complicated layer-2 community.

While the $200 SOL cost target might appear out of reach based upon derivatives information, growing institutional interest and blockchain adoption might quickly reverse existing market belief.

This short article is for basic info functions and is not planned to be and must not be taken as legal or financial investment guidance. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.