Secret takeaways:

-

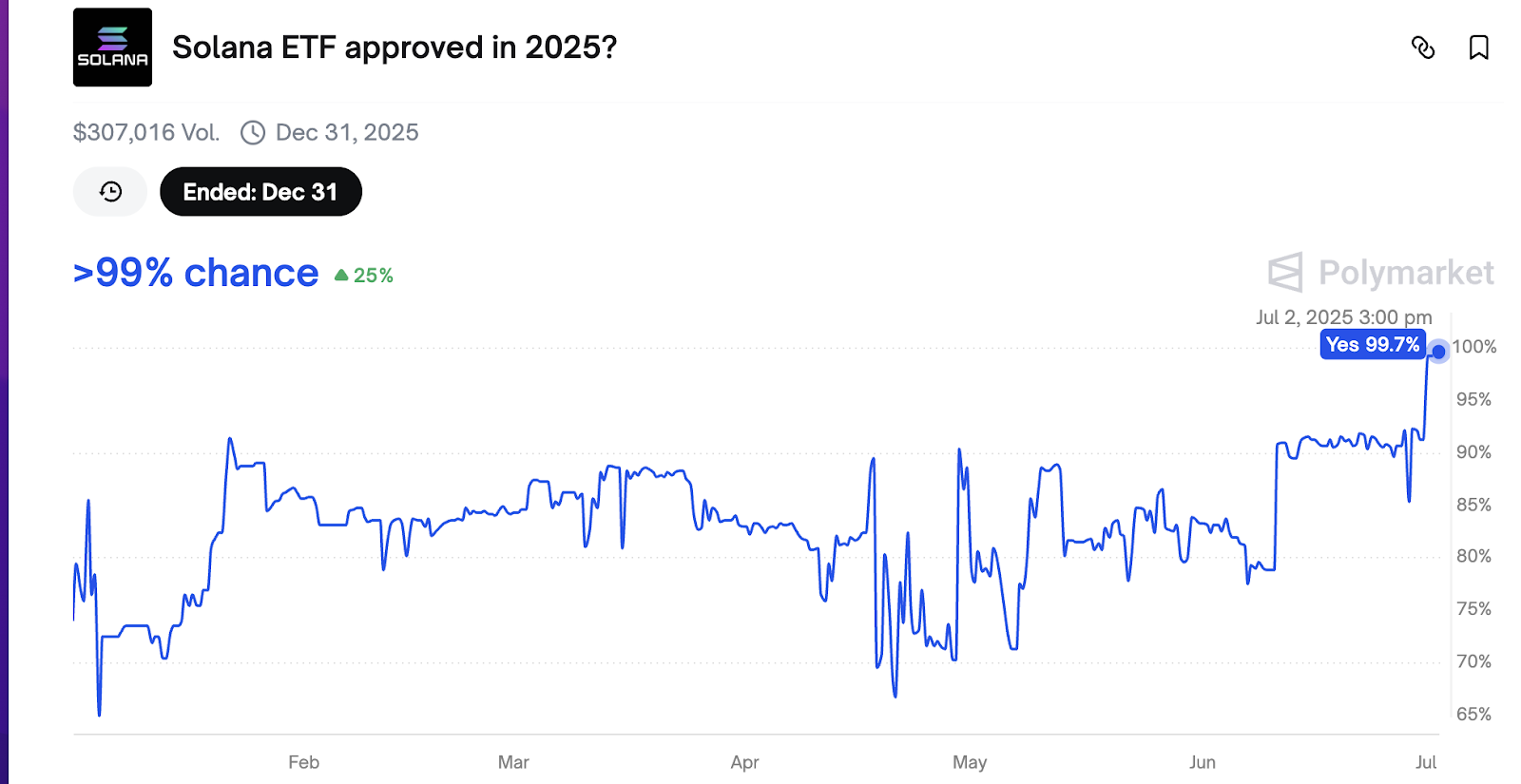

Area Solana ETF approval chances leap to 99.7% on Polymarket.

-

A SOL cost bull flag remains in play on the everyday chart, targeting $300.

Solana’s (SOL) cost printed a bull flag pattern on the everyday chart, a technical chart development connected with strong bullish momentum following an upward breakout.

Could this technical setup, paired with the most likely approval of an area Solana ETF in 2025, signal the start of a rally to brand-new all-time highs?

SOL cost bull flag targets $300

SOL cost technicals reveal it might get momentum if it breaks out of a bull flag pattern on the everyday candle light chart.

A bull flag pattern is a bullish setup that forms after the cost combines inside a down-sloping variety following a sharp cost increase.

Bull flags normally fix after the cost breaks above the upper trendline and increases by as much as the previous uptrend’s height. This puts the upper target for SOL cost at $303, or a 100% boost from present costs.

The everyday RSI is moving above the midline, increasing to 53 on Wednesday from near-oversold conditions at 31 on June 22, suggesting increasing bullish momentum.

Related: SOL futures financing rate turns unfavorable: Is $180 the next stop?

To make sure a continual healing, the SOL/USD set should initially conquer the resistance in between $155 and $165, which are likewise the 50-day and 200-day easy moving averages.

Numerous experts argue that SOL’s development to $300 is inescapable, pointing out increasing network circulations, increasing area Solana ETF approval chances, and bullish onchain metrics.

” Solana’s inevitability continues to grow as fund inflows from other chains are growing each week and month,” stated crypto expert CryptoBits in a Wednesday post on X, including:

” My targets are sitting at $200, $300 and after that uncharted area at $500.”

A current X analysis by market expert Alek Carter recommends that strong basics and SOL snapping its multimonth sag put it on a course to $300.

$SOL looking finest chart i have actually ever seen.

SOL striking tough basically too and this is simply broke the sag and the factor is tremendous energy.

And every action is pointing us towards just one thing.

SOL pump is coming and targets is 280$ -300$.

What’s your strategies purchasing … pic.twitter.com/VyZUqZJeb4

— Alek (@Alek_Carter) June 30, 2025

Solana ETF approval chances leap to 99.7%

The possibility of the United States Securities and Exchange Commission authorizing an area Solana exchange-traded fund (ETF) in 2025 leapt to 99.7% on July 2, according to Polymarket information.

The chances presently stand at 99% at the time of composing on Wednesday, indicating financier self-confidence in Solana’s future in conventional monetary markets.

Several area Solana ETF applications from property management giants like VanEck, Grayscale, 21Shares, Bitwise and Canary Capital signal robust need for controlled SOL financial investment cars.

Bloomberg senior ETF expert James Seyffart stated he anticipates a “wave of brand-new ETFs in the 2nd half of 2025,” positioning the Solana ETF approval chances at 95%.

Here are mine and @EricBalchunas‘ latest chances on area crypto ETF approvals by the end of 2025. We anticipate a wave of brand-new ETFs in this 2nd half of 2025. pic.twitter.com/H3pxJhqMy3

— James Seyffart (@JSeyff) June 30, 2025

Although the SEC postponed its choice on Fidelity Investments’ area Solana application, Seyffart stated that the hold-up was anticipated which “interactions in between the SEC and providers must be seen favorably.”

Approval of area Solana ETFs might open institutional capital, enhancing need for SOL and possibly driving costs higher, with some experts anticipating targets as high as $1,300.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.