Secret takeaways:

-

Solana’s strong onchain metrics and DApps earnings supremacy mean long-lasting strength in spite of current selling pressure from significant holders.

-

Solana ETF inflows and varied onchain activity assistance SOL, yet macro dangers in AI and trade stay essential challenges to a $250 healing.

Solana’s native token, SOL (SOL), fell 6% after flirting with $172 on Monday. The drop mostly mirrored a pullback in the Nasdaq Index, which came under pressure after CoreWeave (CRVW United States) cut its cloud services earnings projection and reports appeared that China prepares to prohibit the United States military from accessing its rare-earth minerals. Exists any opportunity for SOL to recover the $250 level in the near term?

SOL has actually underperformed the altcoin market by 7% over the previous 2 weeks, without any clear driver for the decrease. In truth, the background has actually been rather motivating, marked by the launching of a Solana area exchange-traded fund (ETF) in the United States and a noteworthy uptick in Solana’s onchain activity.

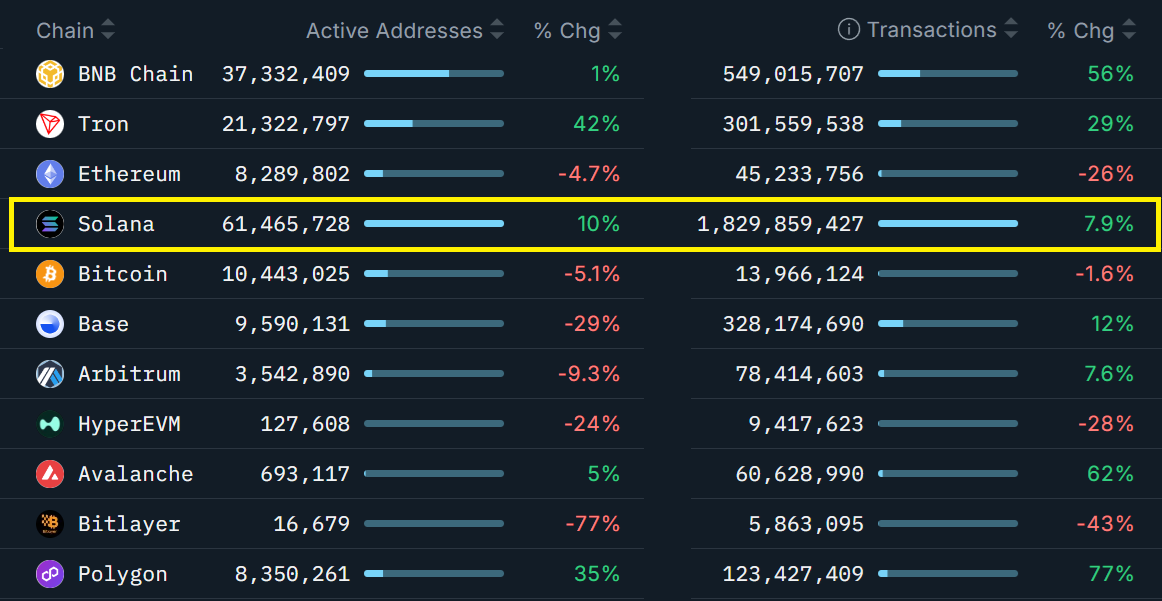

Network activity on Solana has actually risen over the previous one month, with active addresses increasing by 10% and deals increasing by 8%. By contrast, Ethereum saw 5% less active addresses and a 26% drop in deals throughout the very same duration. Hyperliquid, an increasing rival in the decentralized exchange (DEX) area, likewise experienced a 28% decrease in onchain activity.

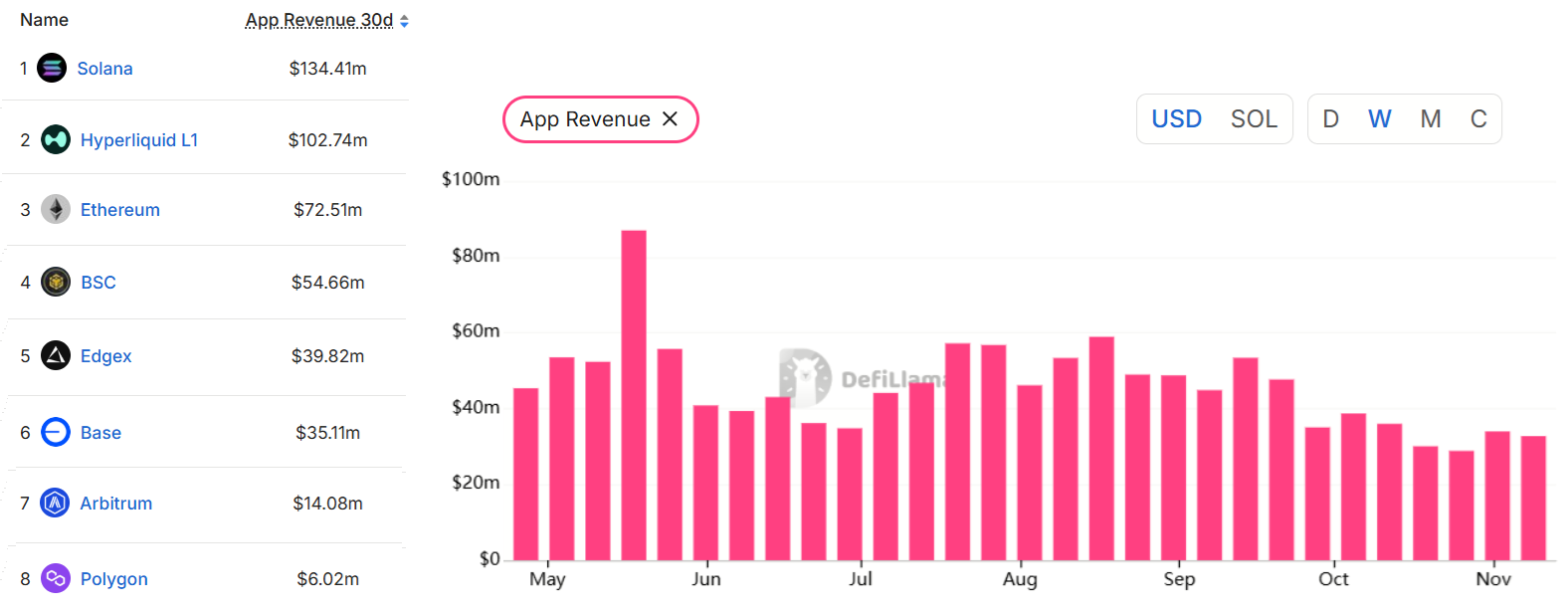

Solana continues to control in decentralized applications (DApps) earnings. No other network comes close, providing Solana a sustainable one-upmanship. These DApps reward users by sharing part of their incomes as yield, a system that assists the network bring in more deposits and enhance its position.

Solana’s development reveals more powerful diversity throughout several sectors

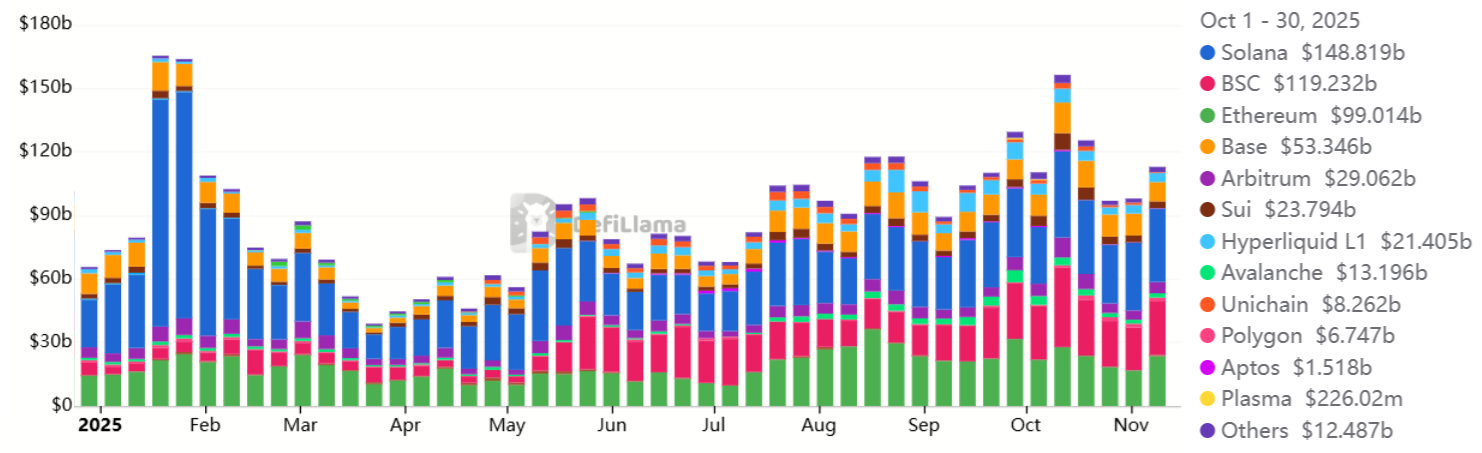

The overall worth locked (TVL) on Solana presently stands at $12 billion, broadening the space with BNB Chain, which holds $8 billion. Over the previous one month, numerous tasks have actually published strong gains, consisting of a 35% boost in Securitize (Real Life Assets), a 31% increase in Solstice USX (Basis Trading), and a 10% uptick in deposits on Meteora (Liquidity Swimming Pools). This information recommends that Solana’s development is ending up being more varied and less dependent on a single sector.

Memecoin launches and trading activity were when the primary forces driving Solana’s user development and network costs, however that momentum faded by March. While the token has actually given that recuperated from its 2025 low of $95, traders stay careful about its near-term benefit.

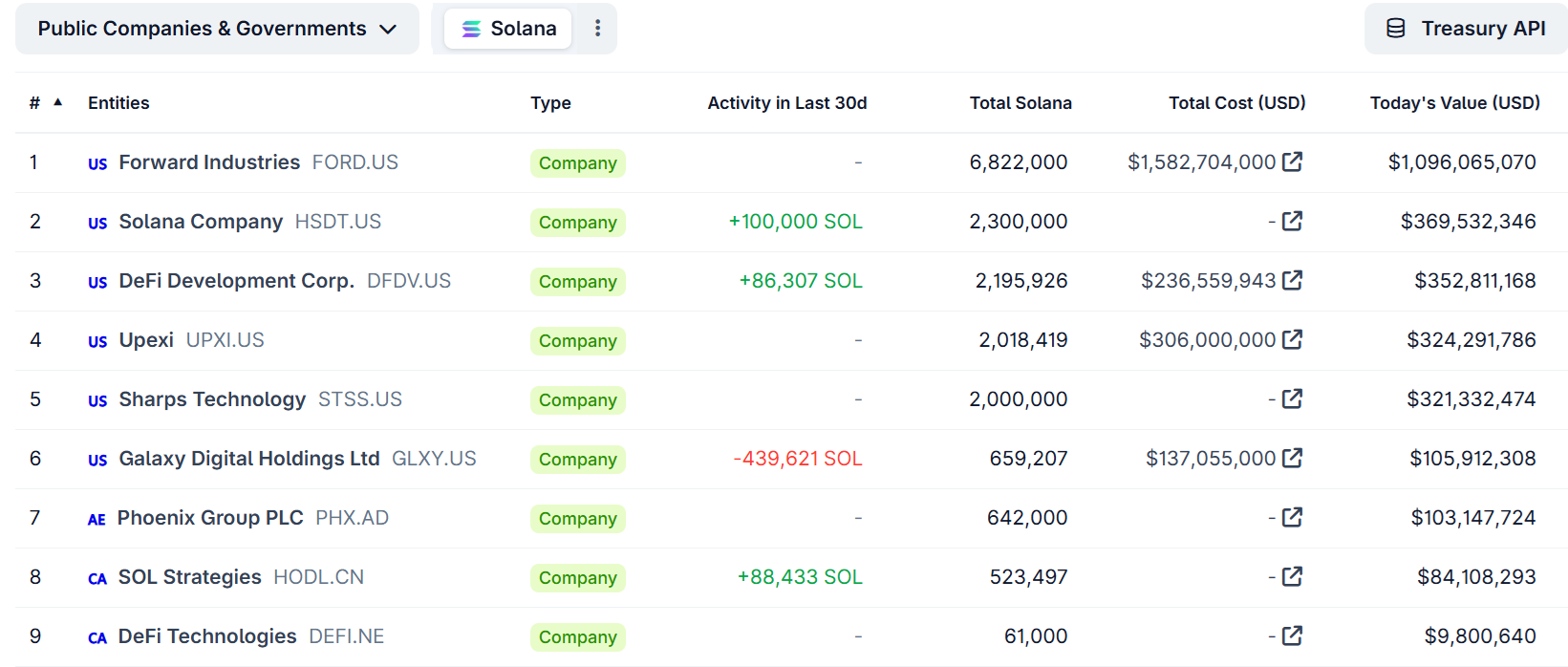

Given that their launching in United States markets on Oct. 28, area Solana ETFs have actually drawn in $343 million in net inflows. On the other hand, the REX-Osprey SOL + Staking ETF has actually built up an extra $286 million in possessions. Nevertheless, the total favorable impact of these instruments has actually been partially balanced out by outflows from business minimizing their SOL holdings.

The sale of 439,621 SOL by Galaxy Digital Holdings (GLXY) has actually raised issues about the sustainability of Solana’s business reserve method. Forward Industries (FORD) holds the biggest position, with 6.82 million SOL, a figure that has actually stayed constant over the previous one month, according to CoinGecko information.

Related: SOL’s next stop might be $300– 3 forces forming Solana’s next significant rally

The chances still prefer SOL exceeding the more comprehensive altcoin market, supported by Solana’s constant development in onchain activity and its supremacy in DApps earnings. Nevertheless, the course towards $250 will likely depend upon a decrease in dangers surrounding the expert system sector and a cooling of geopolitical stress connected to the continuous worldwide trade war.

This post is for basic info functions and is not planned to be and ought to not be taken as legal or financial investment suggestions. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.