Secret takeaways:

-

Solana’s stablecoin supply increased by 156% in 2025, to strike a brand-new record at $12 billion.

-

Solana’s TVL grew by 25% to $7.65 billion, with 27.7% decentralized exchange volume share, leading Ethereum and BNB Chain.

-

SOL cost formed a bull flag, with a rate target at $220.

Solana’s native token, SOL (SOL) stopped working to keep its bullish momentum after reaching $156 on April 25, however a variety of information points recommends that the altcoin’s benefit is not over.

SOL stablecoin market cap strikes $13 billion

Solana’s stablecoin supply has actually increased by 156% in 2025, rising previous $13 billion to strike a brand-new all-time high.

Stablecoins on Solana just recently rose previous $13B in issuance, setting a brand-new ATH@calilyliu on why Solana is purpose-built for moving digital dollars at web speed pic.twitter.com/WYPPg0LEG6

— Solana (@solana) May 5, 2025

Circle’s USDC (USDC) stays the stablecoin of option for Solana users, with a 77% market share.

Stablecoins are important to Solana’s decentralized financing (DeFi) community, driving liquidity and increasing SOL need as it’s utilized for deal costs and staking, possibly pressing its cost up.

Increased stablecoin inflows traditionally associate with cost rallies, as seen in between December 2023 and August 2024, when a 230% rally in SOL cost was accompanied by a 160% boost in stablecoin inflows from $1.55 billion to $4.06 billion.

Solana TVL and deal depend on the increase

Solana stays the second-largest blockchain in regards to overall worth locked (TVL) and ranks initially in DEX volumes.

Solana’s TVL has actually increased from $6.1 billion on April 9 to $7.65 billion on Might 6, a boost of over 25% in practically one month.

Favorable indications consist of a 44% boost in deposits on Sanctum, a liquid staking application, and 25% development on Jito and Kamino.

Solana’s day-to-day deal count has actually likewise increased by 25% over the last month to 57.77 million deals.

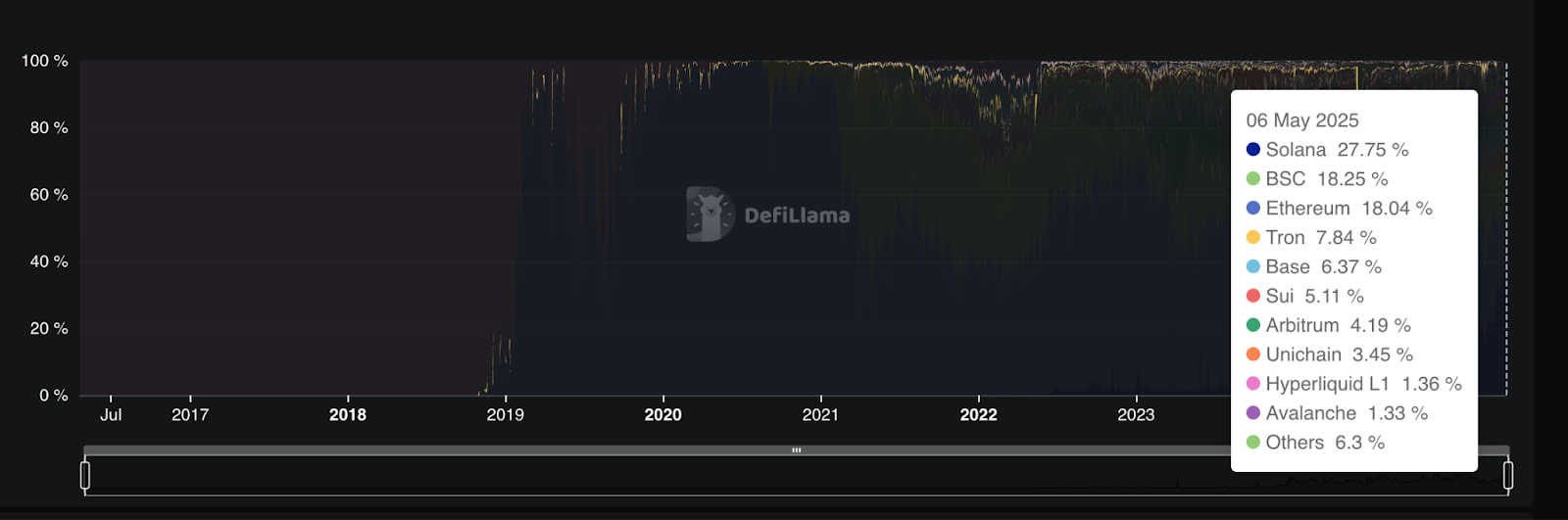

While Ethereum and BNB Chain offer competitors in regards to onchain volumes, the Solana network is the indisputable leader with day-to-day DEX volumes standing at $2.61 billion at the time of composing. Solana likewise commands a 27.7% DEX volume market share, ahead of BNB Chains and Ethereum’s 18%.

SOL bull flag indicate $220

SOL cost has actually formed a bull flag chart pattern in the day-to-day timeframe, as displayed in the chart below.

A bull flag pattern is a bullish setup that forms after the cost combines inside a down-sloping variety following a sharp cost increase.

Bull flags generally fix after the cost breaks above the upper trendline and increases by as much as the previous uptrend’s height. This puts the upper target for SOL cost at $220, up 53% from the existing cost.

Crypto expert RisHad stated that SOL cost requires to hold the $120 – $130 assistance to increase the possibilities of approaching $178 and beyond.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.