Secret takeaways:

-

Bullish technicals recommend that SOL rate can reach $1,000 if the resistance in between $210-$ 250 is broken.

-

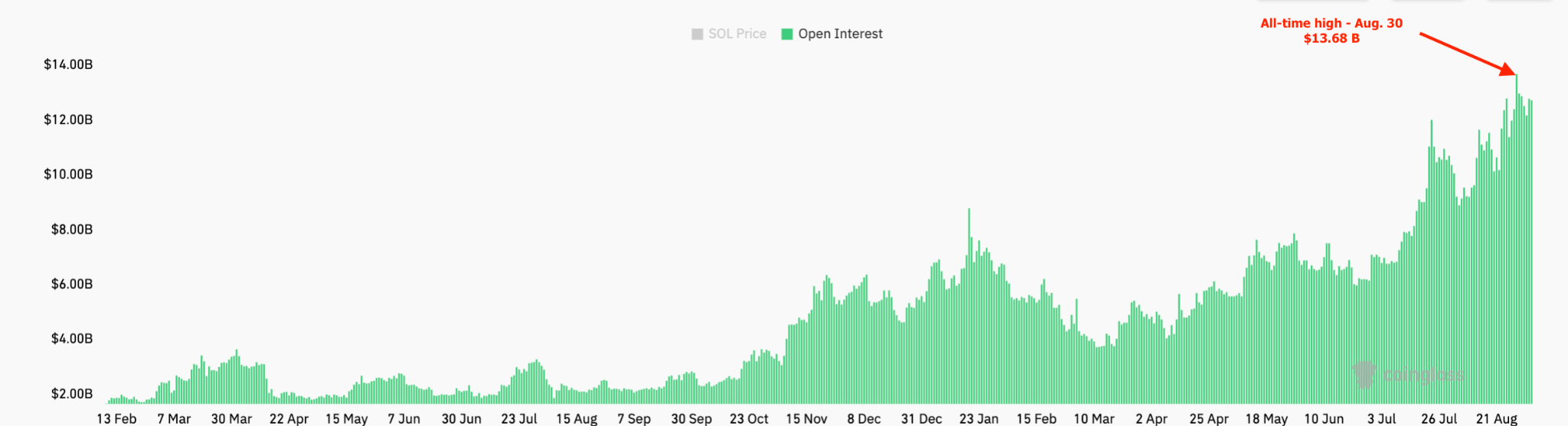

Solana’s open interest has actually rallied to a record high of $13 billion, indicating high speculative interest.

After dropping to $155 on Aug. 3, Solana’s (SOL) rate has actually recuperated over 36% to an intraday high of $210 on Wednesday. Lining up with this rebound, Solana’s technicals now recommend that $1,000 SOL rate is still in the cards.

SOL rate technicals target $1,000

Solana’s rate action has actually painted a bullish loudspeaker pattern on the weekly chart, which might move SOL to 4 digits, information from Cointelegraph Markets Pro and TradingView programs.

A loudspeaker pattern, likewise referred to as an expanding wedge, types when the rate produces a series of greater highs and lower lows. As a technical guideline, a breakout above the pattern’s upper limit might activate a parabolic increase.

Related: Solana vs. Bitcoin chart indicate explosive SOL rate breakout to $300

The pattern will be validated once the rate breaks above the upper pattern line around $330, clearing the course for a rally towards the determined target of the pattern at $1,057, or a 400% boost from the present level.

The relative strength index has actually increased from 49 to 61 given that early August, showing that the bullish momentum is gradually developing.

SOL rate has actually likewise broken out of a cup-and-handle chart pattern on the weekly chart, as revealed listed below. The rate still trades above the upper limit of the cup’s manage of the pattern at $160, a verification that the breakout was still in play.

Bulls are now concentrated on pressing SOL above the cup’s neck line at $250 to continue the rally.

Above that, Solana’s rate might increase as high as $$ 1,030, based upon Fibonacci retracement analysis.

Solana’s weekly chart reveals a “bullish multimonth setup, which generally results in strong relocations,” stated crypto expert Gally Sama in an X post on Tuesday, including:

” Target stays $1000 for $SOL once we break out of this variety.”

As Cointelegraph reported, SOL requires a definitive break above $210 to increase the opportunities of a rise to $260 and later on into rate discovery.

Solana OI rises to tape high

Solana’s open interest (OI) in futures markets struck an all-time high of $13.68 billion on Saturday, indicating strong speculative interest in the derivatives market.

Such high need recommends derivatives traders are banking on SOL’s upward trajectory, possibly magnified by institutional inflows and ETF speculation.

High Open Interest typically precedes substantial rate relocations, as seen in between April and July when a 188% boost in OI preceded an over 103% boost in SOL rate.

The present increase in OI, together with a 17% rate boost to around $217, accompanies the approval of the Alpenglow upgrade, improving financier self-confidence.

The Alpenglow upgrade, authorized with 98.27% assistance, slashes Solana’s deal finality from 12.8 seconds to 150ms, improving throughput to 107,540 TPS.

This improves Solana’s competitiveness versus Ethereum, possibly driving SOL to brand-new all-time highs in 2025, if institutional adoption and DeFi development speed up.

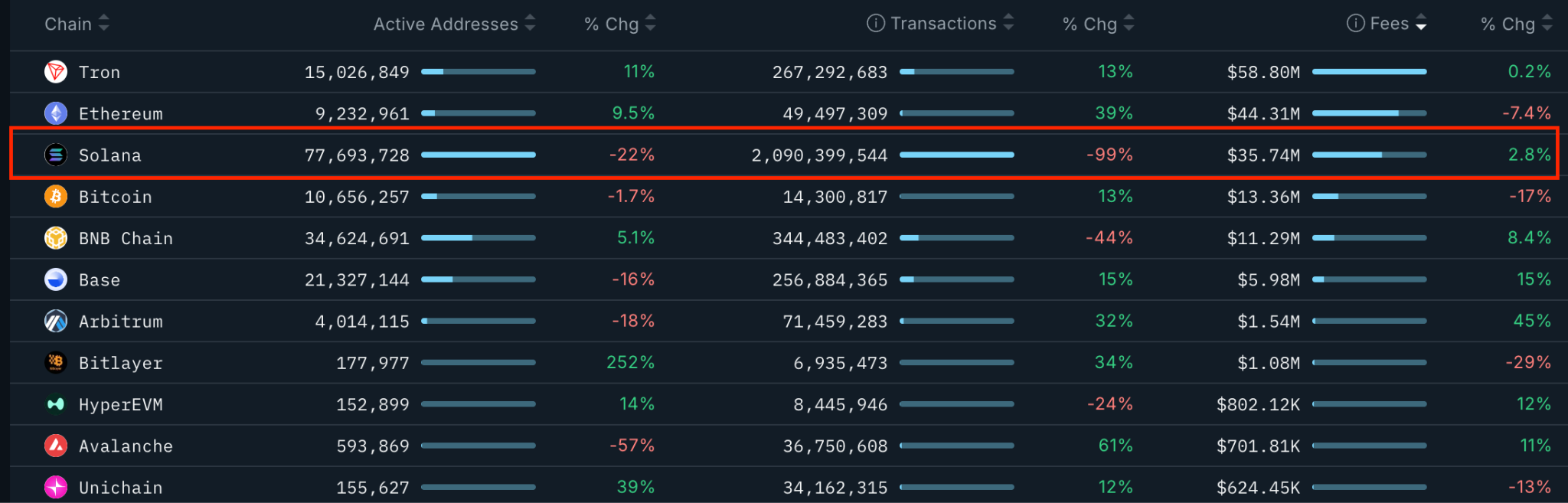

Nevertheless, onchain activity informs a various story. Regardless of Solana’s DeFi environment boasting $12 billion in overall worth locked (TVL) and leading token launches, network activity has actually not scaled proportionally with rate gains.

Over the previous thirty days, Solana’s deal count visited 99%, indicating reducing onchain activity that might reduce SOL’s rate healing.

On the other hand, Ethereum deals increased by 39% throughout the exact same duration, according to Nansen information. Solana’s variety of active addresses likewise fell 22%, revealing reduced network use.

DEX activity on Solana succumbed to the 3rd successive week, with the weekly DEX volumes falling by 65% to $10.673 billion, according to DefiLlama information. These figures are not especially motivating for SOL holders and might be a headwind for any future gains.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.