Secret takeaways:

Solana (SOL) had among its worst weeks of 2025, down 18% in the previous 7 days, tracking just Hyperliquid amongst the leading 20 crypto properties in losses.

The drop puts SOL/USD on track for its least expensive weekly candle light close considering that late August, sustaining speculation over a push towards the $120 level.

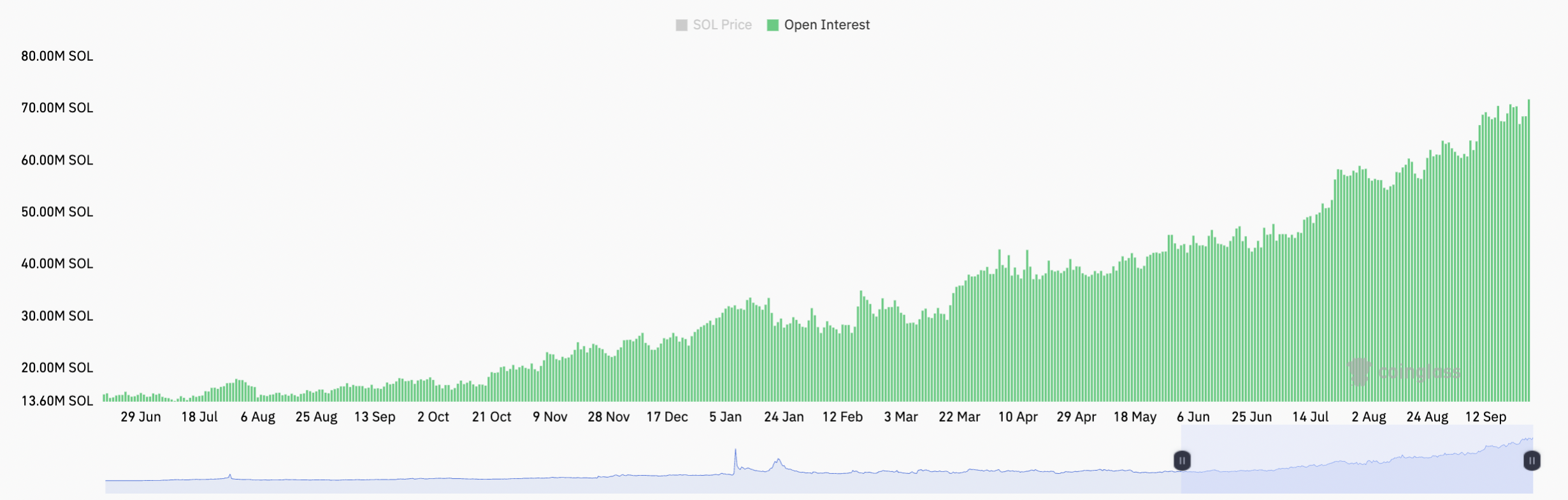

CoinGlass information programs Solana’s futures open interest (OI) struck a record 71.8 million SOL with $14.5 billion at the time of composing on Thursday. Likewise, continuous financing rates turned favorable to 0.0043% from -0.0065% with the dive in OI.

Related: Australian physical fitness company tanks 21% on Solana treasury gamble

Greater open interest and increasing financing rates in the middle of falling costs might lead to an overleveraged market where the longs are captured off guard.

The present market structure prefers the bears, based upon other metrics, too. Net taker volume leans sell-heavy, revealing more aggressive sellers are actioning in.

On the other hand, area CVD dropped lower, recommending that the sell-off is primarily spot-driven, which might likewise be translated as in the bears’ favor.

In addition, information from DefiLlama reveals compromising network metrics, such as a 16% reduction in the overall worth secured Solana DeFi procedures and an 11% reduction in everyday deals over the last 7 days.

As Cointelegraph reported, Solana’s decreasing network activity and competitors from other layer-1 blockchains are considerable headwinds for any short-term cost gains.

SOL cost technicals: Will Solana review $120?

SOL cost action in between Aug. 2 and Sept. 25 has actually caused an establishing inverted V-shaped pattern on the everyday chart.

Bears reserved earnings on this rally, leading to a sharp correction to the present levels and midway to the bottom of the pattern.

On the other hand, the relative strength index (RSI) slopes downward, reducing from 69 to 37 considering that Sept. 18, showing increasing bearish momentum and still not “oversold.”

As the cost looks for to finish the inverted V-shaped pattern, it might drop even more towards the pattern’s neck line around the $155 need zone, representing a 22% cost drop from the present cost.

Zooming out, a double-top development on the weekly chart mean a possible go back to the pattern’s neck line at $120, as revealed listed below. Such a relocation would bring the overall losses to 40% from the present levels.

Nevertheless, the bulls have a likelihood of break in the short-term. The RSI is now substantially “oversold” on much shorter timespan.

As Cointelegraph reported, SOL cost might extend its sag towards the $150-$ 110 variety if the assistance at $200 is lost.

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.