Bitcoin (BTC) and Ethereum’s native token, Ether (ETH) continue to seach for cost stability after trading at particular intraday lows of $66,171 and $1,912 on Thursday.

As this procedure runs its course, brand-new analysis from Bloomberg experts examines how the area BTC and ETF holders are faring amidst continual cost weak point and slowing exchange-traded funds (ETFs) inflows.

Secret takeaways:

-

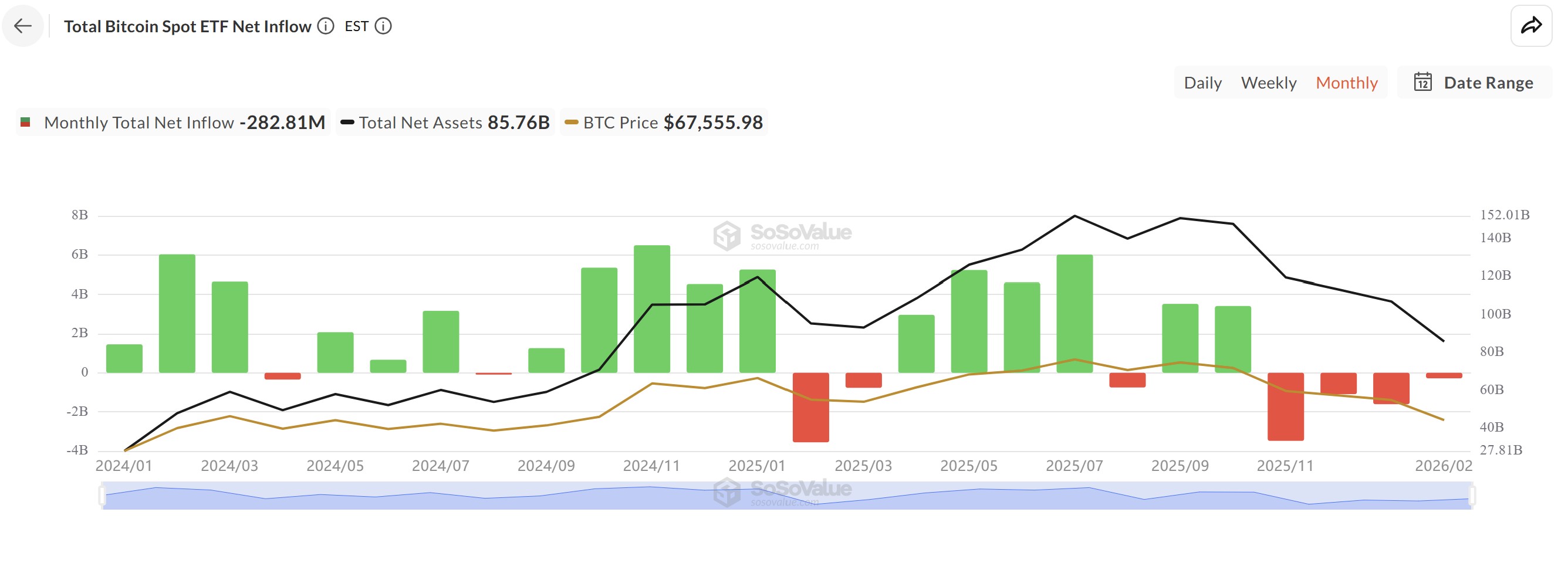

Net worth of the area Bitcoin ETF possessions was up to $85.76 billion from $170 billion (Oct 2025 peak), with the 2026 net circulations at approximately -$ 2 billion.

-

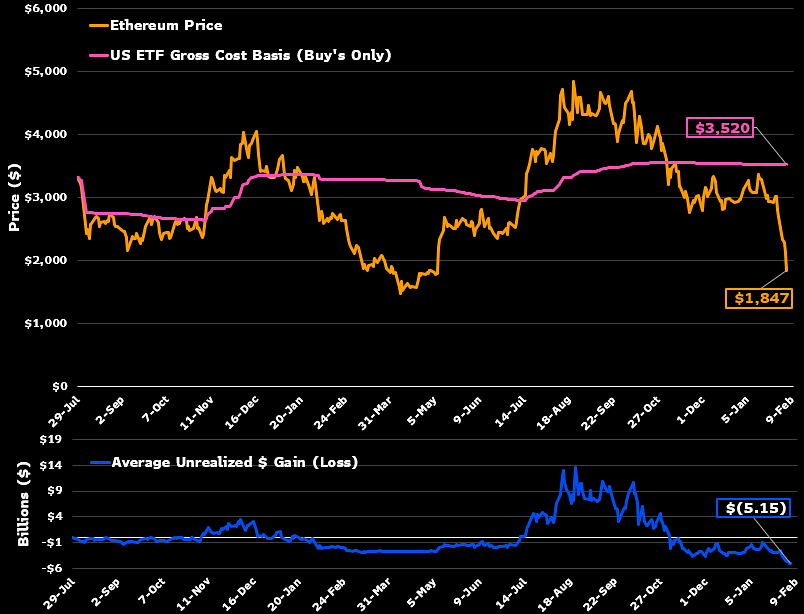

The area Ether ETF possessions worth dropped to $11.27 billion from $30.5 billion, with ETH trading near $2,000 vs. a $3,500 expense basis.

-

Just about 6% of Bitcoin ETF possessions left throughout the current slump, suggesting minimal capitulation.

Bitcoin, Ether ETF possession worths agreement as inflows stall

Bloomberg expert James Seyffart stated that the Ether ETF holders are “being in an even worse position” than Bitcoin ETF financiers. With ETH listed below $2,000, well listed below the approximated $3,500 typical expense basis, i.e., the typical cost at which area ETF financiers collected their positions, the drawdown has actually surpassed 50% at its current low of $1,736.

By contrast, Bitcoin is presently priced at $66,171, likewise listed below its approximated $84,063 ETF expense basis, though the drawdown is especially less at 21%.

Seyffart kept in mind that the overall net inflows into ETH ETFs have actually decreased by just about $3 billion, recommending most ETH ETFs financiers have actually held their positions throughout the current dip.

Possessions kept in the area Bitcoin ETF peaked at $170 billion in October 2025 and now stand at $85.76 billion. The inflows slowed dramatically after mid-2025, with $13.7 billion taped in the very first half of the year, $7.64 billion in the 2nd half, and approximately $2 billion in outflows year-to-date. Given that July 2025, the cumulative web streams total up to $5.64 billion.

Last Thursday, senior Bloomberg ETF expert Eric Balchunas kept in mind that just about 6% of overall Bitcoin ETF possessions left throughout the current selloff. BlackRock’s IBIT has actually decreased to $51 billion from $100 billion at its peak worth, however it stays among the fastest ETFs to reach $60 billion in possessions.

Related: Bitcoin miner outflows surge in January, however public sales stay minimal

Bitcoin ETF streams go into bear-market program

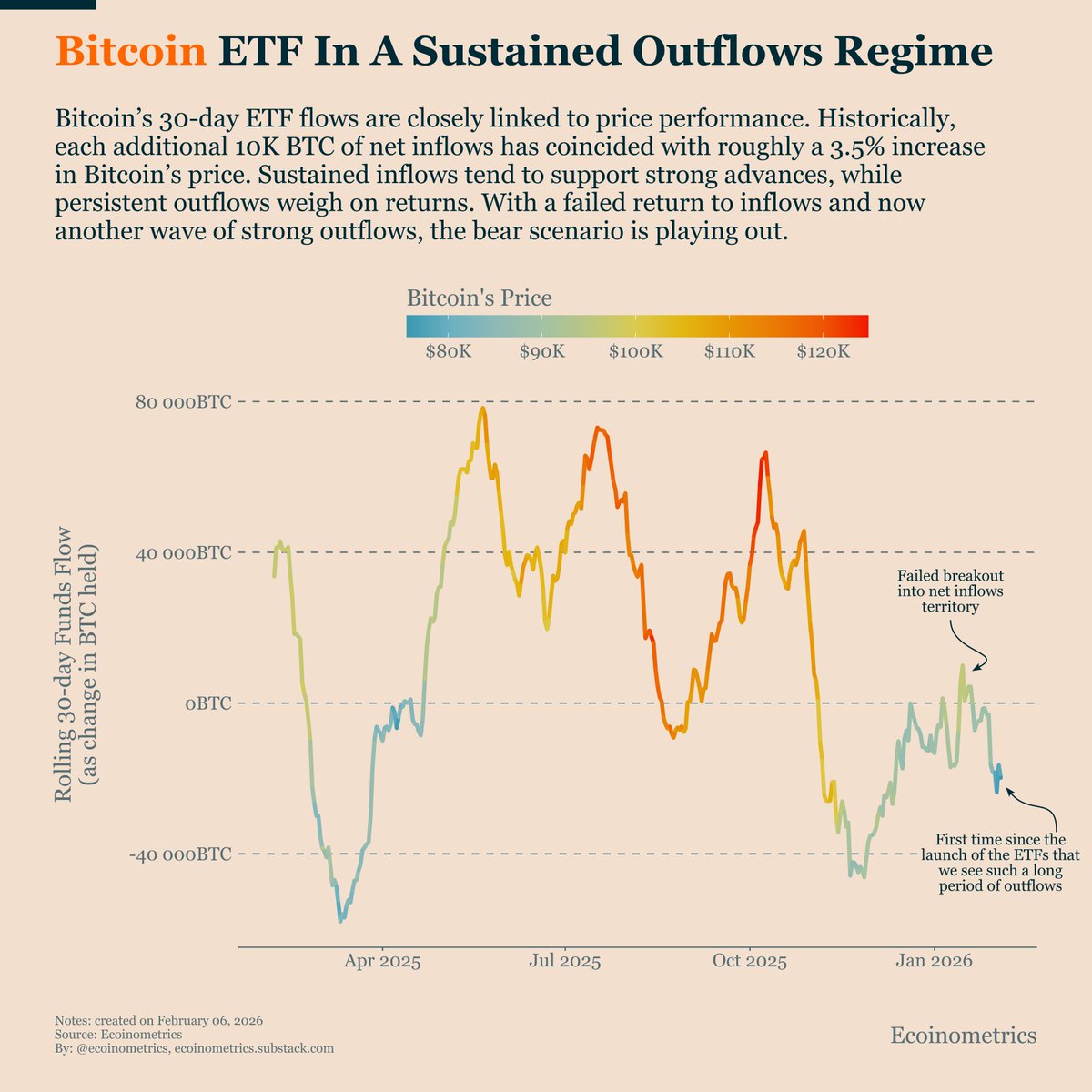

The rolling 30-day Bitcoin ETF circulations have actually turned securely unfavorable following an unsuccessful effort to go back to inflows area. Leaving out a short rebound, this marks the longest stretch of continual outflows because launch.

Glassnode information likewise kept in mind that the 30-day basic moving average of net circulations for both Bitcoin and Ether area ETFs has actually stayed unfavorable for the majority of the previous 90 days. The information reveals no clear indication of restored need.

Macroeconomic newsletter Ecoinometrics stated that the rate of these outflows recommends financiers are actively decreasing direct exposure instead of responding to short-term volatility.

The newsletter included that the mix of cost weak point and continual unfavorable circulations lines up with a “bear-market program” instead of a momentary correction.

Related: Bitcoin futures information reveals bears preparing for an attack on $60K

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding. While we aim to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might consist of positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this info.