Property supervisor Requirement Chartered forecasts that Binance’s community token, BNB, might more than double in cost this year, according to an expert report examined by Cointelegraph.

The possession supervisor sees BNB’s cost increasing to around $1,275 per token by the end of 2025 and as high as $2,775 by the end of 2028, according to the research study report.

Since Might 6, BNB trades at almost $600 per coin, for a completely watered down worth (FDV) of around $84 billion, according to information from CoinMarketCap.

” BNB has actually traded nearly precisely in line with an unweighted basket of Bitcoin and Ethereum because Might 2021 in regards to both returns and volatility,” Geoff Kendrick, an expert at Requirement Chartered, composed in the research study note.

” We anticipate this relationship to continue to hold, driving BNB’s cost from around USD 600 presently to USD 2,775 by end-2028.”

Related: Just how much Bitcoin can Berkshire Hathaway purchase?

” Old-fashioned” network

The BNB token is the native cryptocurrency of Binance BNB Chain, a layer-1 (L1) blockchain network associated with the world’s biggest central exchange (CEX).

The BNB Chain has less designer activity than L1s such as Ethereum or Avalanche, and its community is relatively “old-fashioned,” Requirement Chartered stated.

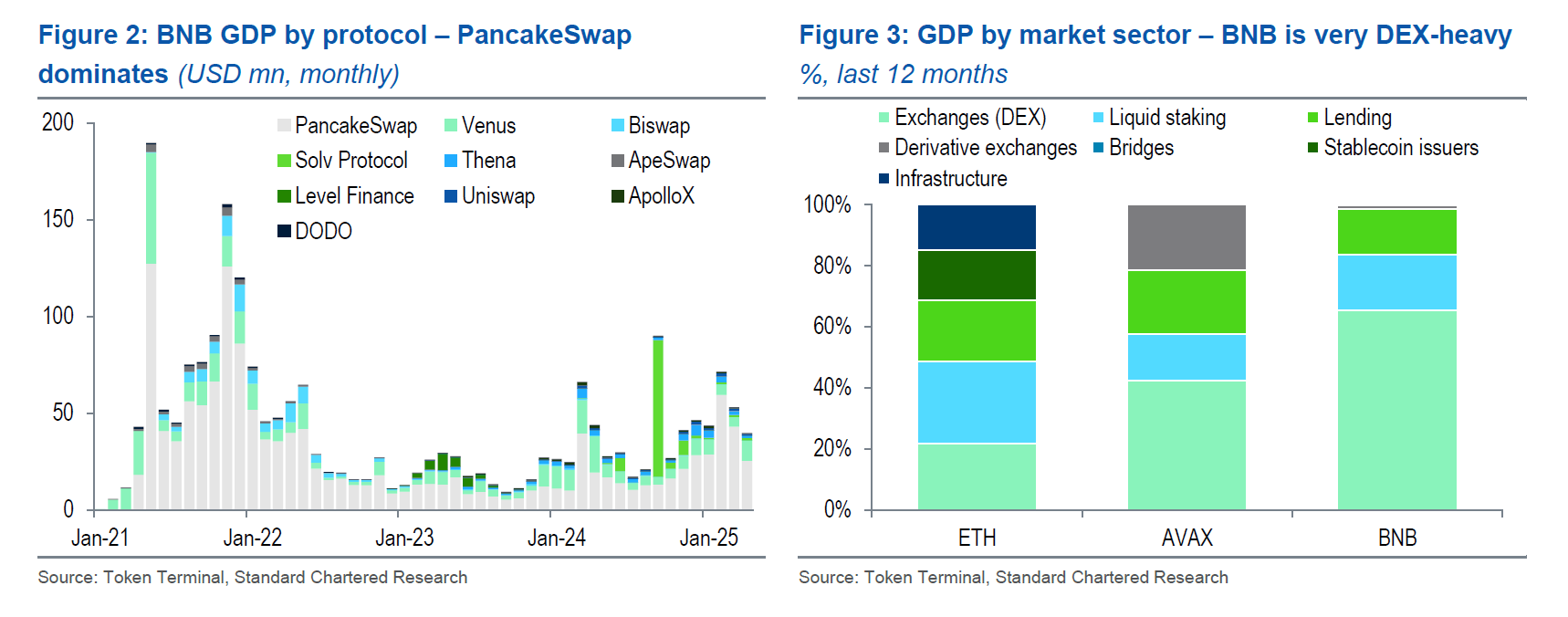

More than 60% of the network’s onchain financial activity includes decentralized exchanges (DEXs), compared to a more varied spread on other L1s, it stated.

Nevertheless, the possession supervisor kept in mind that this might likewise function as a source of stability for BNB Chain.

” Presuming Binance stays among the biggest CEXs, BNB’s worth motorists are not likely to alter anytime quickly,” Geoff Kendrick, an expert at Requirement Chartered, composed in the research study note.

” Offered this, we see prospective for BNB to function as a kind of criteria, or average, for digital possession costs more broadly,” he included.

BNB Chain is the fourth-largest L1, with almost $6 million overall worth locked (TVL), according to information from DeFiLlama.

On Might 5, possession supervisor VanEck submitted to note the very first BNB exchange-traded fund (ETF) in the United States.

Publication: Monetary nihilism in crypto is over– It’s time to dream huge once again