Secret takeaways:

-

SUI is up 23% in the previous 24 hr and 73% weekly, surpassing top-cap cryptocurrencies.

-

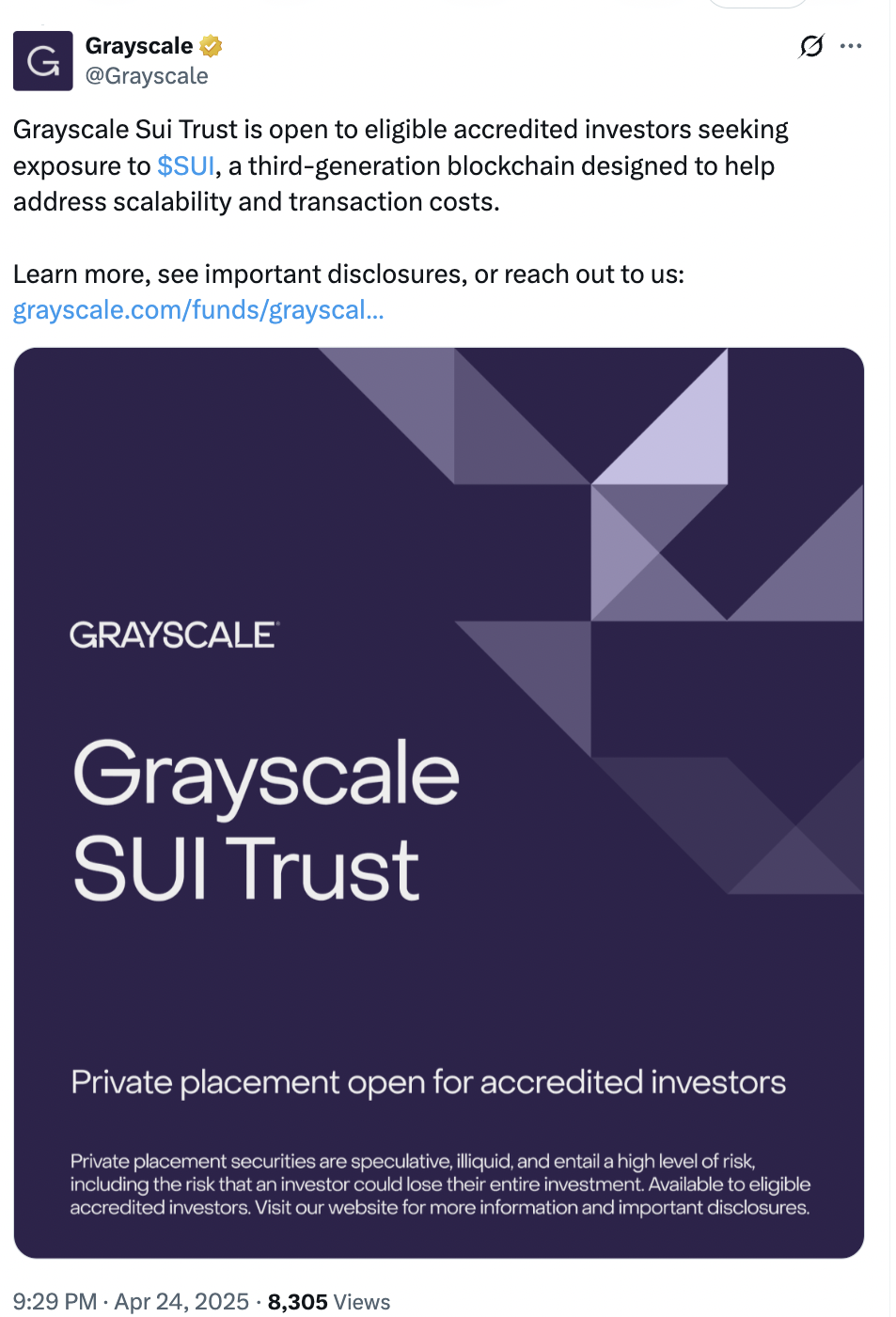

The launch of the Grayscale SUI Trust and the xPortal/xMoney Mastercard collaboration enhanced financier self-confidence.

-

SUI’s TVL is up 40%, and everyday DEX volumes rise by 177%, signifying strong environment trust and energy.

Sui (SUI) cost was up 23% in one day, to trade at $3.67 on April 25. This belongs to a dominating rebound that started on April 21 and has actually seen Sui increase more than 73% over the last 7 days.

Information from Cointelegraph Markets Pro and TradingView reveals SUI increased from a low of $2.11 on April 21, climbing up as much as 77% to an intraday high of $3.71 on April 25.

SUI’s efficiency over the last 7 days made it the greatest gainer amongst the leading 100 cryptocurrencies by market cap.

SUI cost buoyed by favorable principles

SUI’s gains are mainly sustained by increasing financier self-confidence following the Grayscale SUI Trust launch and SUI’s tactical collaboration with xPortal and xMoney to provide a virtual Mastercard throughout Europe.

” SUI’s formally out of stealth mode,” stated pseudonymous expert Kyledoops in an April 24 post on X.

” Grayscale simply introduced a trust, social chatter is blowing up, and it’s [SUI] now sitting above AVAX and LINK in market cap,” Kyledoops revealed, including:

” This isn’t simply retail buzz– Wall Street is entering the SUI zone. Momentum feels various this time. It’s genuine. And it’s speeding up.”

On April 23, Grayscale introduced the Grayscale SUI Trust, which makes it possible for financiers to get direct exposure to SUI. The trust is now open up to all qualified certified financiers.

Contributing to the tailwinds is SUI’s newest collaboration with xPortal and xMone, which presented a virtual Mastercard, making it possible for 2.5 million European users to invest the token at over 20,000 merchants by means of Apple Pay and Google Pay.

Sui’s growing DeFi environment

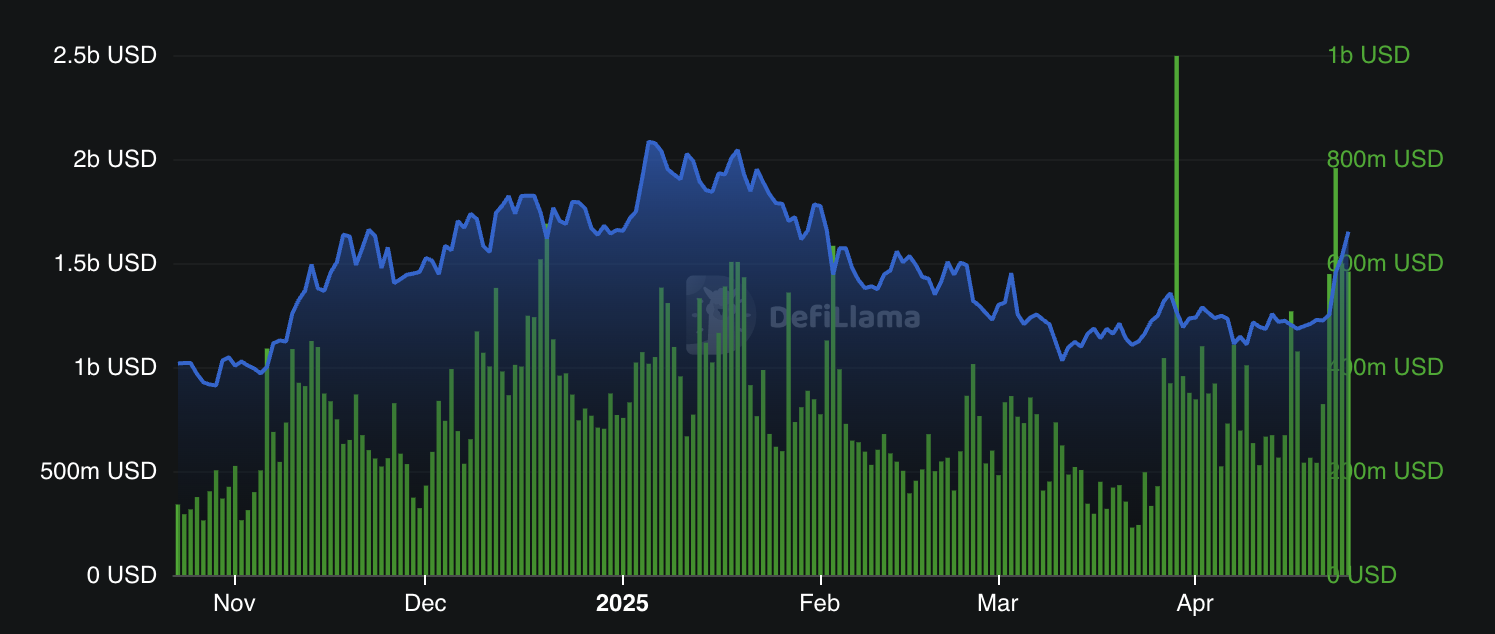

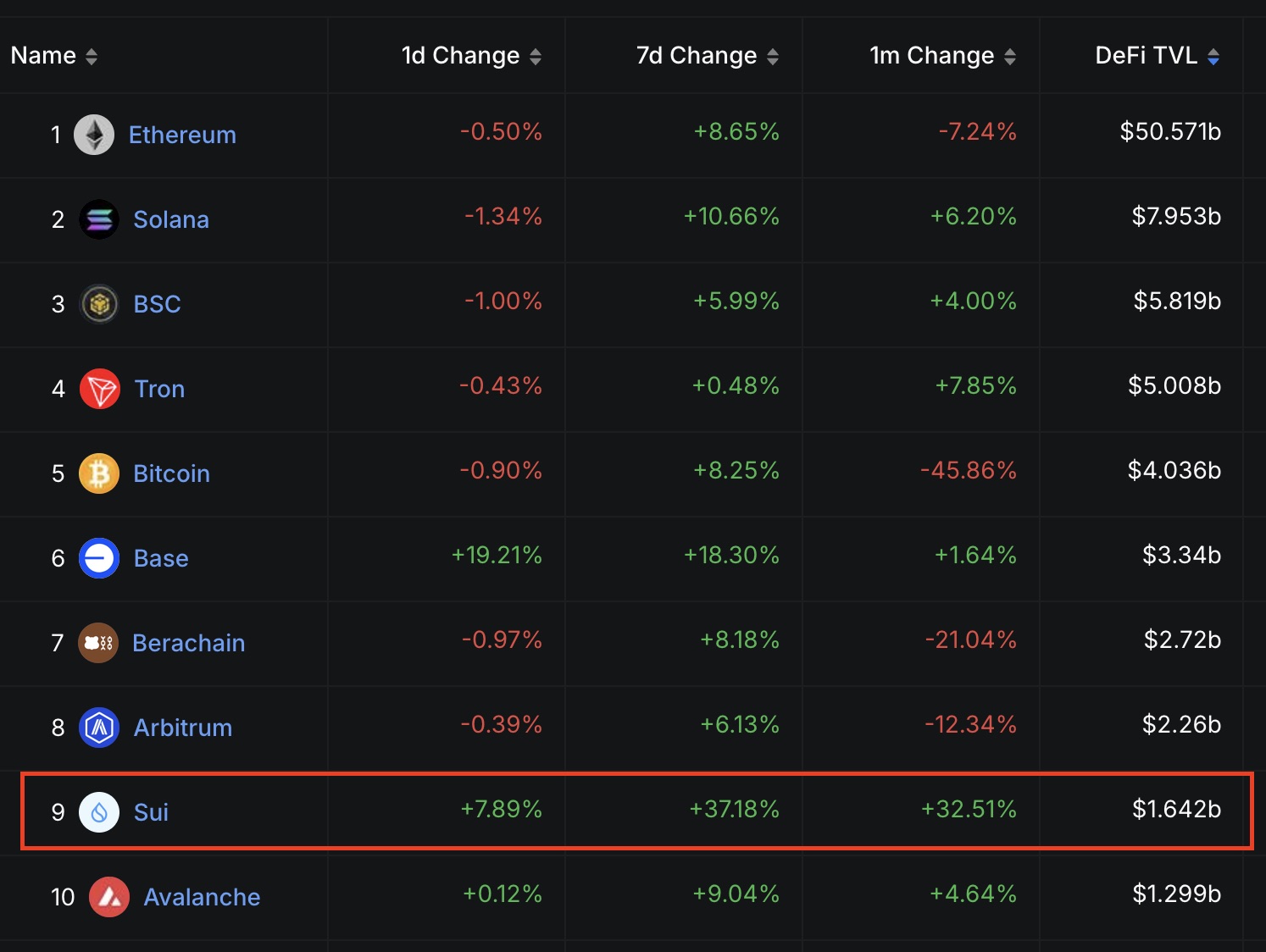

Sui stays amongst the leading 10 layer-1 blockchains, with over $1.65 billion in overall worth locked (TVL) on the network. The chart listed below programs that the SUI’s TVL has actually increased about 40% over the last 7 days.

Compared to other top-layer networks, SUI is well ahead of its competitors in regards to TVL gains on the everyday, weekly and regular monthly timespan, as displayed in the chart below.

SUI’s everyday DEX volumes have actually increased by more than 177% over the recently, to $599 million. This is substantially greater than the 68% and 67% boosts on BNB Chain and Solana, respectively.

Related: Rate forecasts 4/23: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, LINK, AVAX, SUI

Although Ethereum stays the undeniable leader at $10.6 billion, this has actually decreased by more than 14% over the last 7 days.

Are brand-new all-time highs coming for SUI?

From a technical point of view, SUI cost got momentum after breaking out of a falling wedge pattern, as revealed on the everyday chart listed below.

After breaching a multimonth resistance trendline near $2.20, SUI reached the wedge’s technical target at $3.30.

Bulls are now concentrated on all-time highs of $5.35, reached on Jan. 6.

The relative strength index (RSI) has actually increased from 45 to 78 given that April 20, strengthening the strength of the bullish momentum.

Nevertheless, to sustain the continuous healing, SUI cost needs to very first conquer the resistance in between $4.50 and $5.10, before entering into cost discovery.

Based Upon Elliott Wave analysis of the weekly chart, pseudonymous expert Bitcoinsensus set a “huge” cost target of $11.50 for SUI.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.