Secret takeaways:

-

Solana’s double-bottom listed below $180 signals prospective cost healing to $250.

-

Institutional need for SOL increases with $156 million in weekly ETP inflows, driven by buzz for prospective Solana ETF approvals.

Solana (SOL) cost formed a possible double-bottom pattern listed below $180 on the everyday chart, a setup that might assist SOL cost recuperate towards $250 in the weeks ahead.

Solana Bollinger Bands might result in a healing

Veteran chartist John Bollinger states it might be “time to take note,” finding prospective W-bottom turnarounds on Ether and Solana utilizing his Bollinger Bands structure.

The call follows SOL cost double-dipping near the $175 location before supporting, indicating a larger relocation might remain in the cards.

Related: Solana creator brews up brand-new perp DEX ‘Percolator’

This is a motivating indication from Solana, according to Bollinger. The Bollinger Bands (BB) indication utilizes basic discrepancy around a basic moving average to figure out both most likely cost varieties and volatility.

Bollinger Bands are forming the 2nd low of a W-shaped pattern development– a double-pronged bottom followed by an exit to the advantage– on the everyday chart.

In this circumstance, SOL’s drop to $172 on Oct. 11 was the very first bottom, and Friday’s drop to $174 was the 2nd, retesting the lower limit of the BB.

If validated, Solana’s cost might recuperate from the present levels, initially towards the neck line of the W-shaped pattern at $210, before increasing towards the target of the dominating chart pattern at $250.

” Solana is looking really positive here, with the RSI nearing a momentum breakout and the MACD heading for a bullish cross,” stated crypto YouTuber Lark Davis in an X post on Monday.

An accompanying chart revealed SOL cost forming a possible W (double-bottom) in the everyday amount of time.

” Rate target here is $250 if the W verifies, which will take place on a neck line break.”

The crucial thing now is for “bulls to hold the 200-day EMA,” Lark Davis included.

As Cointelegraph reported, a brand-new uptrend will start as soon as purchasers drive the cost above the 20-day EMA, presently sitting at $200.

Financiers increase direct exposure to Solana

Institutional need for SOL financial investment items seems increasing, according to information from CoinShares.

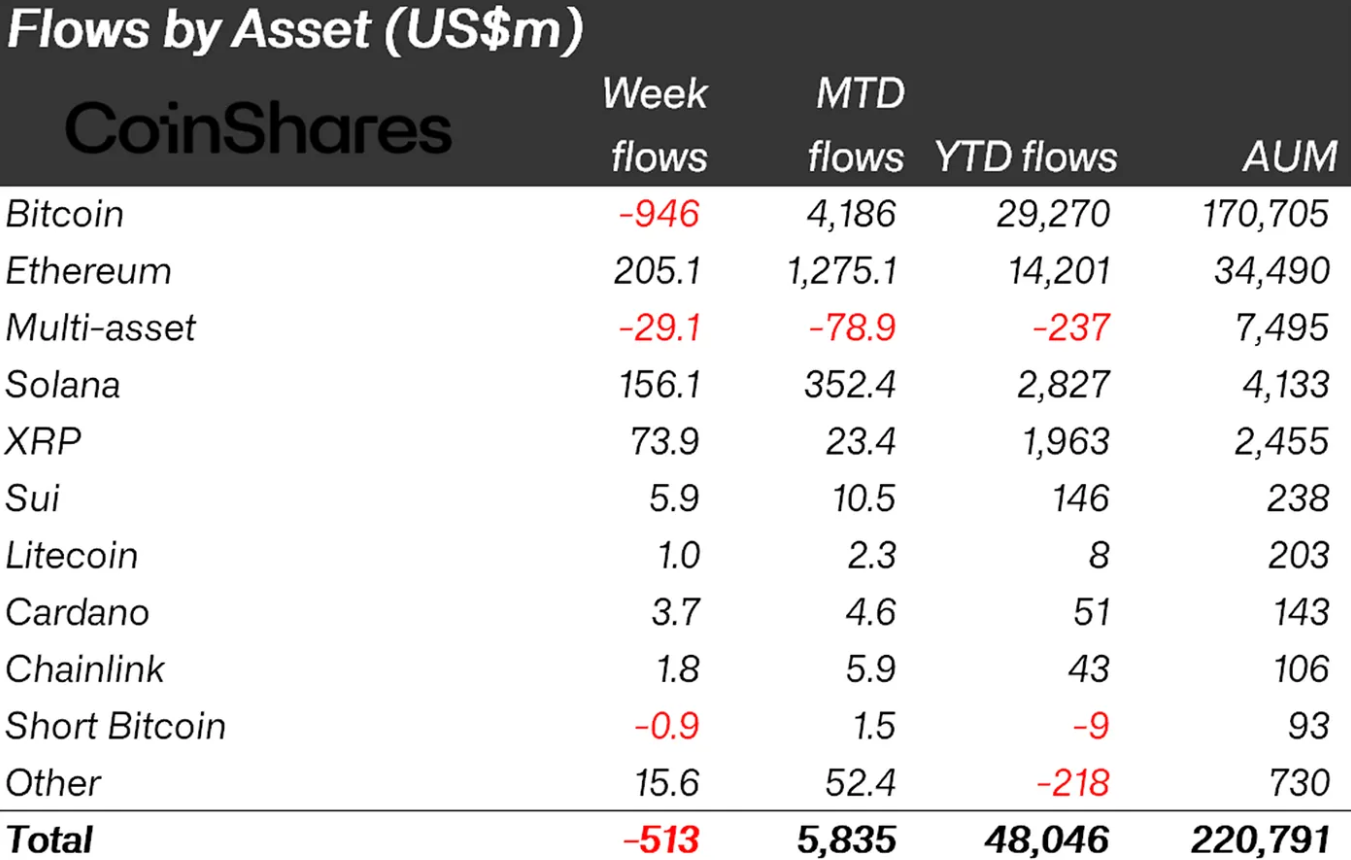

SOL exchange-traded items (ETPs) published weekly inflows of $156.1 million in the week ending Oct. 17, bringing their inflows for the year to $2.8 billion.

Alternatively, international crypto financial investment items taped net outflows of $513 million, with financiers especially de-risking from Bitcoin (BTC), the only significant property to see outflows amounting to $946 million recently.

CoinShares’ head of research study, James Butterfill, stated:

” Buzz for the Solana ETF launches drove inflows.”

The United States Securities and Exchange Commission (SEC) is anticipated to select 9 area Solana ETF applications, which have actually been postponed by the federal government lockdown.

Approvals might open billions in institutional capital, as seen with REX-Osprey Solana Staking ETF, SSK, which debuted on July 2 with over $33 million in first-day volume.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.