XRP (XRP) has actually backtracked almost 63% from its multi-year high of $3.66 to trade at $1.36 on Wednesday, a technical setup that might have bearish ramifications for its cost, according to a market expert.

Secret takeaways:

-

XRP appeared bearish listed below $1.40, with chart technicals indicating an additional drop towards $0.70-$ 1.

-

Relentless area XRP ETFs inflows, whale build-up and a rise in active addresses might revoke the bearish outlook.

Where will XRP cost bottom?

In a Tuesday post on X, Chart Geek stated that previous fractals from the month-to-month Gaussian Channel indication recommend that XRP might drop lower over the coming weeks or months.

Related: XRP traders more positive as BTC, ETH state of mind turns sour: Santiment

The Gaussian Channel is a technical analysis indication utilized to recognize patterns, area possible support/resistance levels, and overbought/oversold conditions.

The chart listed below programs that whenever the XRP cost rallied, it has actually remedied to retest the upper regression band of the Gaussian Channel, which is presently at $1.16.

Historically, this has actually resulted in 3 to 4 months of “more decrease towards the middle regression band of the Gaussian Channel before marking a structure and continuing the trajectory greater,” the expert stated, including:

” The middle regression band presently binds around $0.70, which is likewise a previous year-long resistance level seen back in 2023/2024, and hasn’t been backtested for assistance.”

Chart Geek included that this situation will be confirmed if the XRP drops listed below the regional lows of $1.12, reached on Friday.

On the other hand, expert Crypto Patel stated that while a drop to $1 would supply an excellent entry zone for XRP purchasers, the “finest build-up zone” might be lower at $0.50-$ 0.70.

” Currently, XRP/USDT is ~ 70% below the current ATH. After a historic 96% drawdown from $3.28 to $0.1050 in 2018,” a comparable crash is “not likely,” the technical expert stated, including:

” A restorative retracement listed below $1 stays possible.”

As Cointelegraph reported, the chances of XRP falling listed below $1 increased as soon as the cost was turned down by the 200-week moving typical around $1.40.

Exists wish for an XRP cost healing?

Regardless of XRP’s cost weak point, institutional need and whale build-up continued.

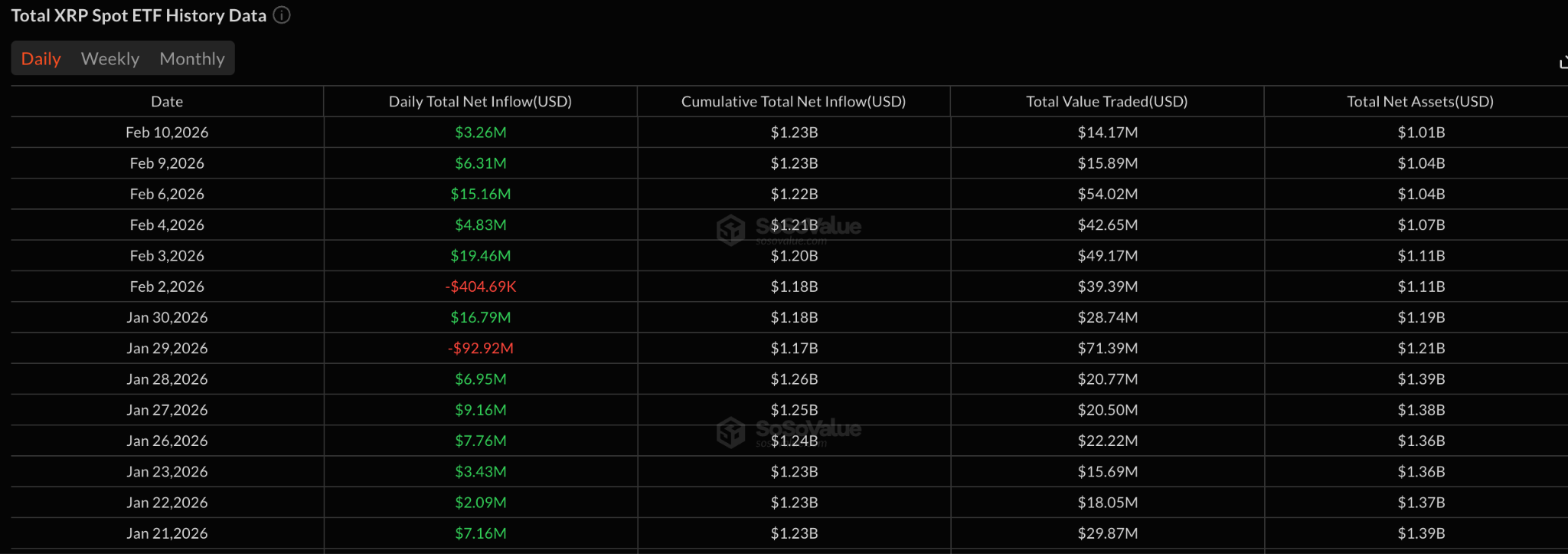

Introduced in late 2025, area XRP ETFs have actually now reached $1.23 billion in cumulative net inflows. The $3.26 million inflows on Tuesday marked the 5th successive day of inflows, bringing the overall properties under management to $1.01 billion.

” Institutional need and XRP ETF inflows continue, with relentless area ETF net inflows highlighting institutional self-confidence,” trader Levi stated in a current post on X.

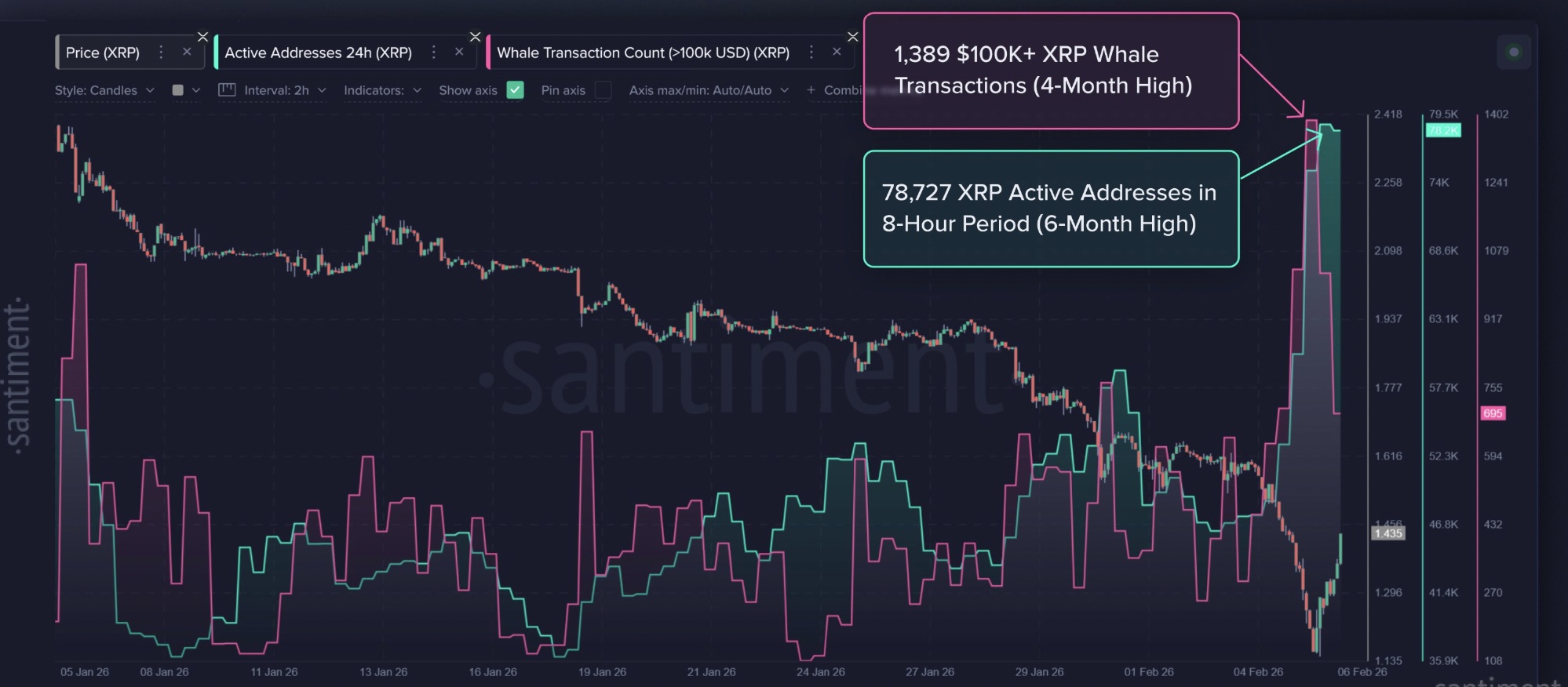

XRP’s newest rebound to $1.50 from $1.12 came as speculators talked about whether the cost would fall listed below $1, market intelligence platform Santiment stated in a current post on X.

Another wish for the bulls is that whales collected throughout the crash as deals including over $100,000 in XRP increased to four-month highs of 1,389.

The variety of active addresses on the XRP Journal “all of a sudden swollen to 78,727 in simply one 8-hour candle light– the greatest in 6 months,” Santiment stated, including:

” These are both significant signals of a rate turnaround for any property.”

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding. While we make every effort to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that go through dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage developing from your dependence on this details.