Bitcoin (BTC) might recover $100,000 as assistance and rally towards $107,000 in the coming days, driven by a mix of encouraging technical and basic metrics.

Secret takeaways:

-

Bitcoin’s breakout is getting traction, backed by bullish technicals and fading selling pressure.

-

Macro signals lean bullish, with liquidity growth and divergence in between BTC and gold.

Rising triangle, bull cross raise BTC rally chances

Bitcoin validated its breakout from a multi-week rising triangle previously today and moved into a book post-breakout retest stage.

After pressing above the pattern’s upper border near $95,000, BTC drew back to retest the previous resistance as assistance before bouncing greater, a relocation usually related to legitimate breakouts instead of incorrect relocations.

Holding this recovered level keeps the “genuine breakout” structure undamaged and protects the pattern’s determined upside unbiased near $107,000, obtained by including the triangle’s optimum height to the breakout point, by February.

At the exact same time, Bitcoin’s day-to-day chart approached a possible bullish crossover in between the 20-day (green) and 50-day (red) rapid moving averages (EMAs).

The last time BTC printed a comparable bull cross, the BTC rate advanced by approximately 17% over the following month, reinforcing the case for pattern extension if the signal is validated.

Bitcoin long-lasting holders lower selling

Bitcoin’s breakout acquired trustworthiness as selling pressure from long-lasting holders continued to fade.

Information tracking UTXOs invested by OG Bitcoin holders, coins inactive for more than 5 years, revealed that circulation into current regional tops had actually slowed materially.

Since January, the 90-day average of invested outputs peaked near 2,300 BTC previously in the cycle however later on decreased towards the 1,000 BTC level, recommending less coins striking the marketplace.

Previously in the rally, OG selling had actually risen to levels well above the previous booming market, showing an abnormally appealing exit window developed by area ETF need, much deeper liquidity, and institutional involvement.

” This recommends that OGs have actually likewise decreased their selling,” stated expert DarkFrost, including:

” Their selling pressure, which can often be enormous, has actually plainly reduced, and the dominating pattern now appears to lean more towards holding instead of circulation.”

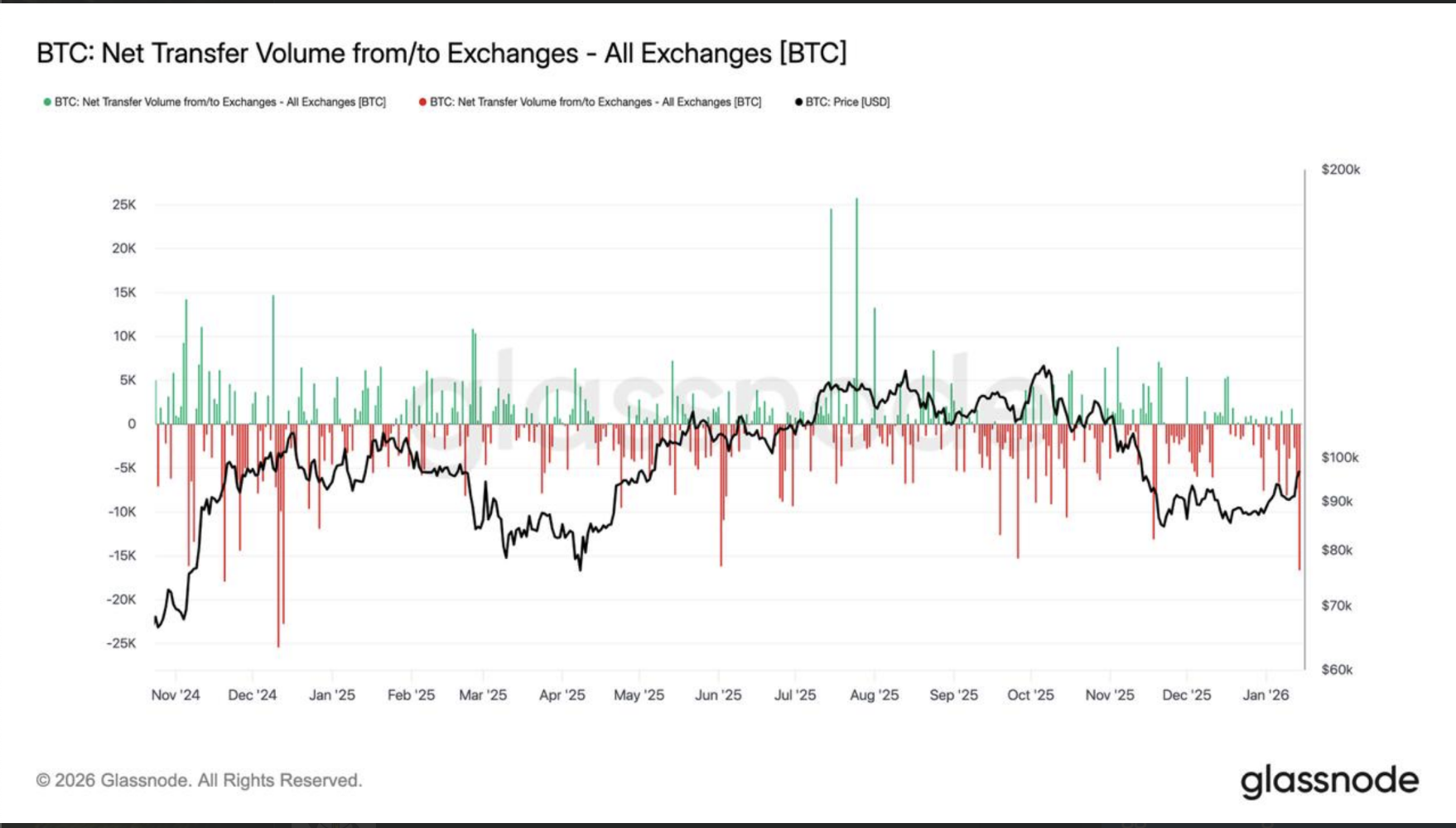

The downturn in OG selling likewise lined up with the biggest net Bitcoin outflows from exchanges considering that December 2024.

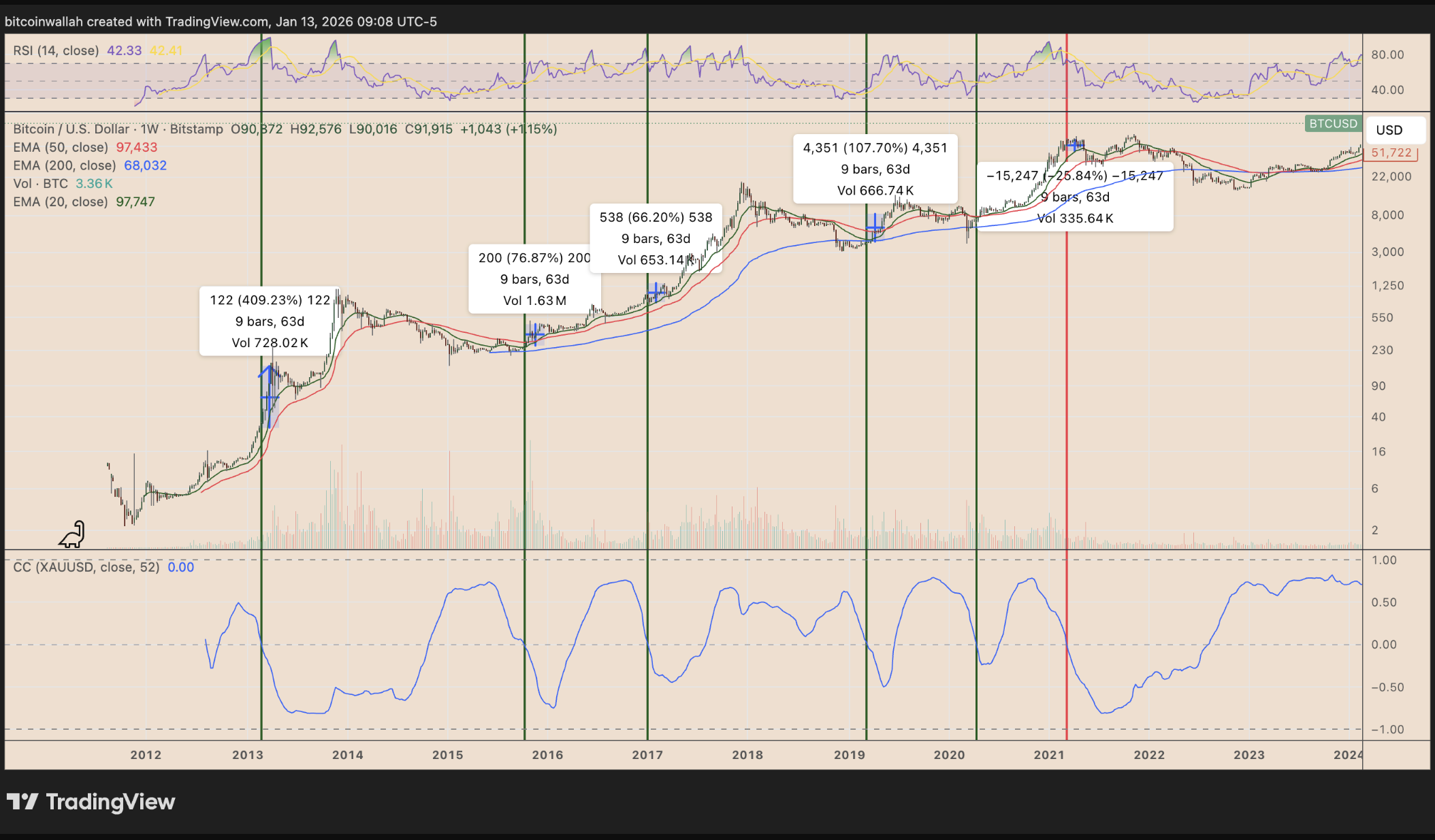

Unfavorable Bitcoin-gold connection: Bullish for BTC?

Another macro signal lined up with the breakout thesis originated from Bitcoin’s historic relationship with gold.

In previous circumstances where BTC’s connection with gold turned unfavorable, Bitcoin rallied by approximately 56% within approximately 2 months. The only exception in Might 2021 was driven by exogenous shocks, consisting of China’s mining crackdown and required deleveraging.

Since 2026, the setup appeared more beneficial, supported by increasing worldwide liquidity and completion of the Federal Reserve’s quantitative tightening up.

Related: Bitcoin ‘groove’ to return regardless of gold, Nasdaq spotlight: Arthur Hayes

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding. While we make every effort to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage developing from your dependence on this info.