Secret takeaways

-

Token opens release formerly locked tokens into flow, typically resulting in increased volatility and rate drops.

-

Vesting schedules (cliff + direct release) goal to line up early stakeholders’ rewards with long-lasting job success.

-

VCs utilize sophisticated methods such as OTC offers, staggered sales and derivatives to leave beneficially and prevent crashing the marketplace.

-

Market timing, belief and token allowance size impact when and how VCs offer their opened tokens.

Token opens are turning points in the crypto market, typically triggering considerable rate volatility.

For retail financiers, they can seem like a high-stakes gamble. However for investor (VCs) and other institutional gamers who get big allotments of job tokens, these occasions are thoroughly determined tactical chances.

Comprehending how these crypto whales deal with token opens can offer indispensable lessons for daily traders.

Token opens and their mechanics (tokenomics, discussed)

At its core, a token unlock is the release of formerly limited tokens into the distributing supply. These tokens are generally part of a job’s vesting schedule, a pre-determined strategy that slowly launches tokens to early financiers, employee and consultants over a set duration.

Vesting schedules generally consist of:

-

Cliff duration: A preliminary lock-up stage where no tokens are launched. This can last from a couple of months to over a year, making sure long-lasting dedication from receivers.

-

Direct vesting: After the cliff, tokens are launched incrementally, typically daily, weekly or month-to-month, over the staying vesting duration.

The main function of vesting is to line up the interests of early stakeholders with the long-lasting success of the job, avoid instant disposing of tokens and handle market supply.

Nevertheless, regardless of these objectives, unlock occasions typically result in increased selling pressure, as an unexpected rise in distributing supply can surpass need, triggering rate drops.

You might have seen this play out consistently. Tasks like Pyth (PYTH), Arbitrum (ARB) and Aptos (APT) have actually experienced significant rate devaluation around their significant unlock occasions.

Even more recent tokens like Ethena (ENA) have actually revealed comparable patterns. Typically, smart traders expect these occasions, resulting in pre-unlock sell-offs as the marketplace braces for increased supply.

Did you understand? Over $600 million worth of tokens unlock each week, and about 90% of those occasions result in price drops.

How VCs trade crypto

VCs run with a various set of tools and goals than retail financiers. Their objective is to create considerable returns on their early-stage financial investments, and token opens are important points for understanding those gains.

They utilize advanced methods to optimize their earnings while lessening market interruption:

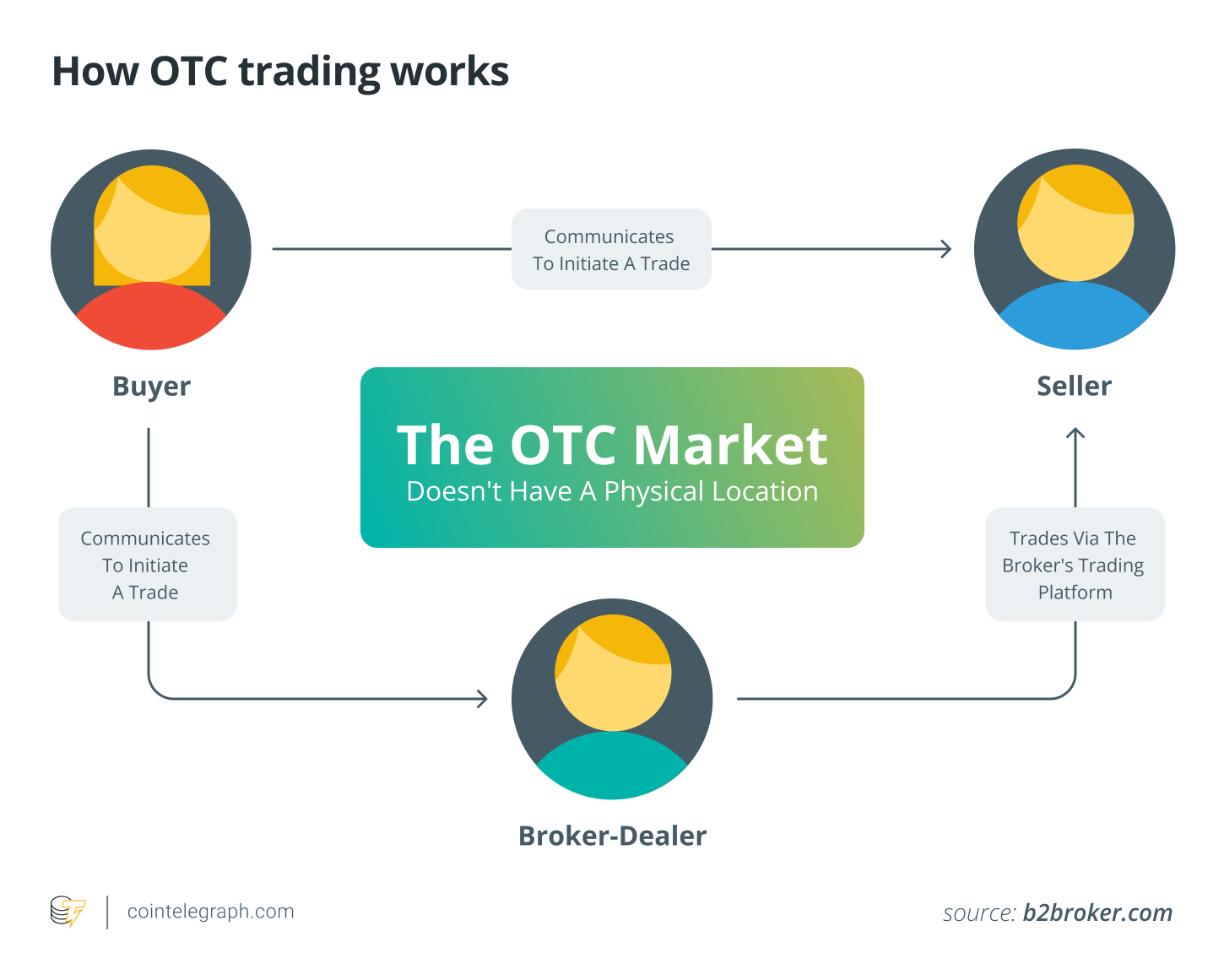

1. Over The Counter (OTC) offers

Among the most typical and efficient approaches for VCs to unload big token amounts is through OTC desks. Rather of offering on public exchanges, which might trigger huge slippage and crash rates, VCs negotiate straight with purchasers. These purchasers are generally other organizations, high-net-worth people or perhaps market makers.

-

How it works: A VC approaches an OTC desk with a big block of tokens to offer. The desk sources a purchaser (or several purchasers) and assists in a personal deal at a worked out rate, typically a little listed below the existing market rate.

-

Advantages for VCs: It prevents slippage, keeps privacy, avoids market panic, and enables tailored offer structures.

2. Staggered sales and steady circulation

While not constantly completely timed, VCs typically go for a staggered method instead of a single, huge dump. They may offer parts of their opened tokens throughout market rallies, building up throughout dips to minimize their typical expense basis. This calculated circulation intends to recognize earnings without excessively depressing the marketplace.

3. Advanced hedging

Maybe the most intricate VC technique includes hedging unlock direct exposure. Months before an unlock, VCs can participate in acquired agreements to secure a market price, successfully de-risking their position.

-

Shorting futures and continuous swaps: By taking a brief position on a futures agreement that mirrors the token’s rate, VCs can benefit from a cost drop, balancing out prospective losses from their opened tokens.

-

Put alternatives: Buying put alternatives provides the right to offer their tokens at a particular rate, despite how low the marketplace goes.

-

Offering call alternatives: On the other hand, they may offer call alternatives versus their future unlock tokens, producing superior earnings while devoting to cost a particular rate if the alternative is worked out.

-

Delta-neutral methods: VCs typically deal with market makers to produce delta-neutral positions, where they hold their tokens however concurrently take balancing out brief positions in derivatives, guaranteeing they benefit whether the rate increases or down.

VCs disposing tokens: What affects a VC’s choice to offer?

VCs do not make choices in a vacuum. Numerous elements determine their method to opened tokens:

-

Market belief: If the more comprehensive crypto market is bearish or a job’s particular belief is unfavorable, VCs are most likely to offer opened tokens to cut prospective losses. On the other hand, a bullish market may motivate them to hold longer or offer more slowly.

-

Percentage of opened tokens: The bigger the portion of tokens opened relative to the existing distributing supply, the most likely VCs (and the marketplace) are to expect selling pressure.

-

Token recipient type: VCs separate in between tokens opened for early investors/team members (who typically have high revenue intentions) versus those for neighborhood benefits or staking, which tend to have less instant selling pressure.

-

Task basics and turning points: A job striking crucial advancement turning points or protecting brand-new collaborations can impart self-confidence, possibly leading VCs to hold for longer or offer less strongly. On the other hand, missed out on due dates or unfavorable news can set off much faster exits.

-

Portfolio diversity: VCs handle whole portfolios of financial investments. Offering some opened tokens may be part of a more comprehensive technique to rebalance their portfolio, recognize gains to money brand-new financial investments or minimize direct exposure to a single property.

Did you understand? Group and early financier opens trigger the sharpest rate crashes, while ecosystem-building opens can in fact increase rate by approximately +1.2% usually.

VC crypto trading: Criticisms

The power VCs wield over token opens isn’t without its critics. Issues typically focus on viewed unfairness and market adjustment:

Misalignment of interests

Critics argue that time-scheduled opens produce an essential imbalance in between supply (repaired by schedule) and need (unpredictable). VCs, who purchased tokens at very low rates pre-token generation occasion (TGE), can typically recognize significant earnings even if the token rate drops considerably after opens, while retail financiers purchasing post-TGE bear the impact of the selling pressure.

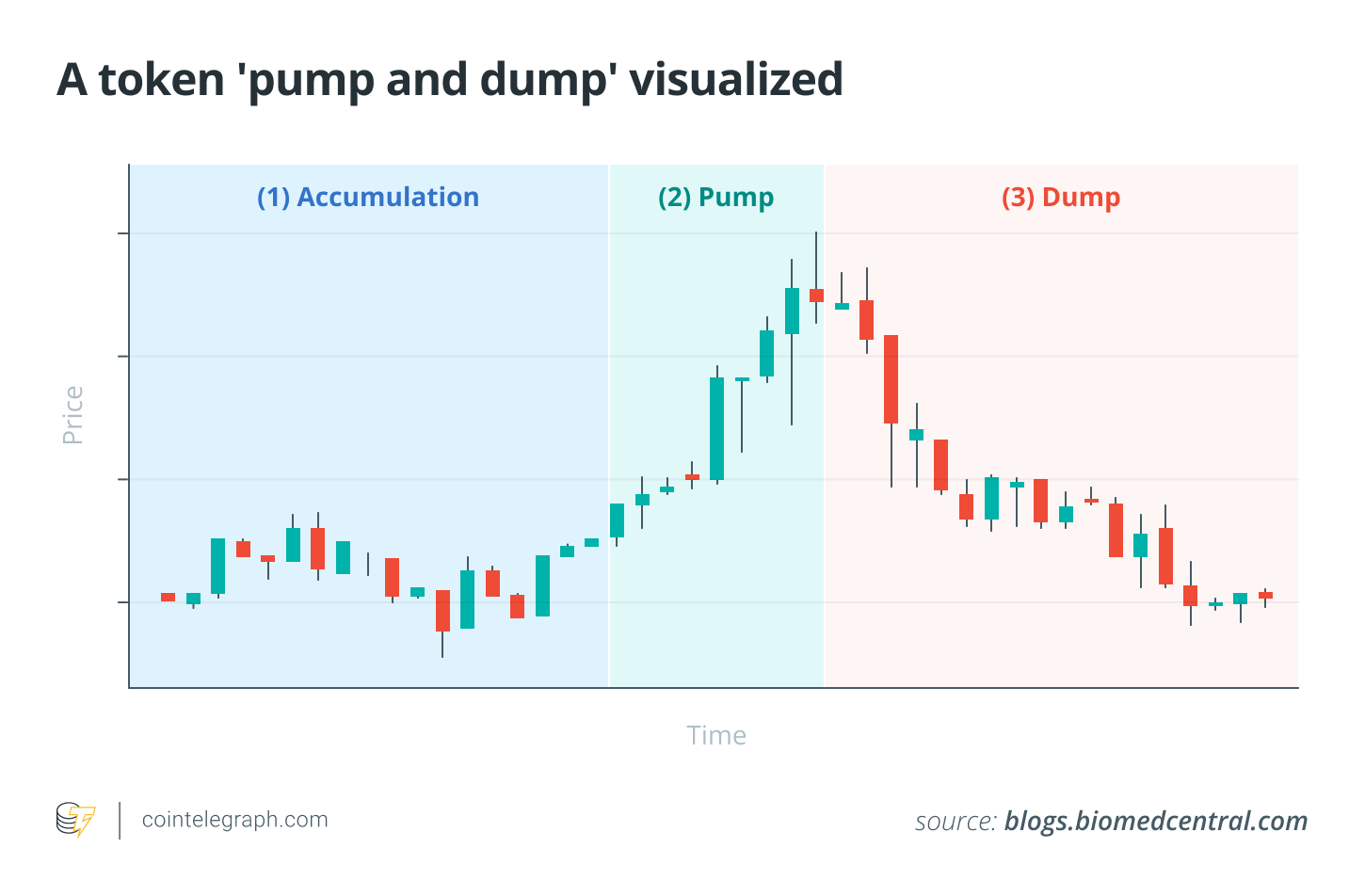

” Artificial” pump and disposes

Some implicate tasks and VCs of collaborating “pump-and-dump” plans, synthetically pumping up token rates through marketing or made news before big opens, just to unload their tokens onto unwary retail financiers.

Details asymmetry

VCs generally have much deeper insights into a job’s health, advancement roadmap and upcoming opens, producing a details benefit over retail financiers.

Nevertheless, it’s likewise crucial to acknowledge the crucial function VCs play. They offer essential early-stage capital that fuels development and advancement within the crypto community. Without VC financing, numerous appealing tasks may never ever get off the ground.

Lessons for retail financiers: Trading methods for crypto opens

While you may not have access to OTC desks or advanced hedging tools, you can still gain from VC habits to make more educated choices around token opens:

-

DYOR: Constantly examine a job’s vesting schedule and unlock dates. Resources like Token Unlocks are indispensable for tracking these occasions. Understand just how much supply will be launched and who the receivers are.

-

Prepare for offering pressure: Presume that big opens, specifically for early financiers or groups, will likely result in increased selling pressure. Think about lowering your direct exposure or setting stop-losses ahead of these occasions.

-

” Purchase the report, offer the news” (or unlock): Rates typically dip in anticipation of an unlock and after that once again after the real occasion. Prevent purchasing ideal before a significant unlock, wishing for a wonder.

-

Search for volume and rate action: Take notice of onchain motions. Big, unusual transfers from understood job or VC wallets to exchanges or OTC desks can signify approaching sales. Search for uncommon trading volume.

-

Understand job basics: Not all opens are similarly bearish. If a job is regularly striking turning points, constructing strong collaborations and showing real-world energy, its long-lasting capacity may soak up a few of the unlock pressure.

Token opens are fundamental to the crypto market’s structure. By comprehending the inspirations and advanced methods utilized by VCs, retail financiers can much better browse these unpredictable durations, changing prospective mistakes into chances for smarter trading.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.