Bitcoin (BTC) sought to bolster increased help on the March 20 Wall Avenue open as bulls broke out of a key downtrend.

BTC/USD 1-hour chart. Supply: Cointelegraph/TradingView

Trump pledges to make US “Bitcoin superpower”

Knowledge from Cointelegraph Markets Professional and TradingView confirmed BTC/USD returning above $86,000.

Now circling the each day open, Bitcoin continued to construct on energy which got here the day prior due to encouraging macroeconomic alerts from the US Federal Reserve.

Rumors of an additional announcement on crypto by the US authorities administration helped BTC value motion to succeed in two-week highs.

President Donald Trump was on account of ship digital remarks on the third day of the Blockworks Digital Asset Summit 2025 occasion in New York.

Trump doubled down on his pledge to not promote confiscated US Bitcoin, in addition to finish regulatory mechanisms resembling Operation Chokepoint 2.0. No new info on BTC purchases, nonetheless, was delivered.

He mentioned:

“Collectively we are going to make America the undisputed Bitcoin superpower and the crypto capital of the world.”

In so doing, BTC/USD reclaimed two key shifting common development traces, together with the 200-day easy shifting common (SMA), a key help part throughout bull markets.

Analyzing the present panorama, fashionable dealer and analyst Rekt Capital targeted on an identical reclaim of the 200-day exponential shifting common (EMA).

“Bitcoin has most not too long ago Day by day Closed above the 200 EMA and actually is now within the strategy of retesting it into new help,” he wrote in a part of his newest content material on X, calling the development line a “long-term gauge of investor sentiment in the direction of BTC.”

BTC/USD 1-day chart with 200 SMA, EMA. Supply: Cointelegraph/TradingView

An extra X publish revealed a extra spectacular feat from bulls, with the each day chart exhibiting a breakout from a downtrend on Bitcoin’s relative energy index (RSI) — one thing in place since November 2024.

“Bitcoin has damaged the Day by day RSI Downtrend relationship again to November 2024,” Rekt Capital confirmed.

BTC/USD 1-day chart. Supply: Rekt Capital/X

Evaluation: Markets might “get up” to hawkish Fed

Persevering with on the macro image, buying and selling agency QCP Capital was cool on the outlook.

Associated: Peak ‘FUD’ hints at $70K ground — 5 Issues to know in Bitcoin this week

It warned that the preliminary risk-asset bounce on the again of the Fed determination might simply reverse.

“Past the instant pleasure, the Fed’s tone was notably cautious. Policymakers downgraded economic system development projections to 1.7% (a 0.4% discount), whereas elevating their inflation forecast to 2.8%, signaling a rising threat of stagflation,” it wrote in its newest bulletin to Telegram channel subscribers.

“Moreover, the Fed’s dot plot revealed a extra hawkish shift from the one in December, with the variety of officers forecasting no charge cuts in 2025 rising to 4.”

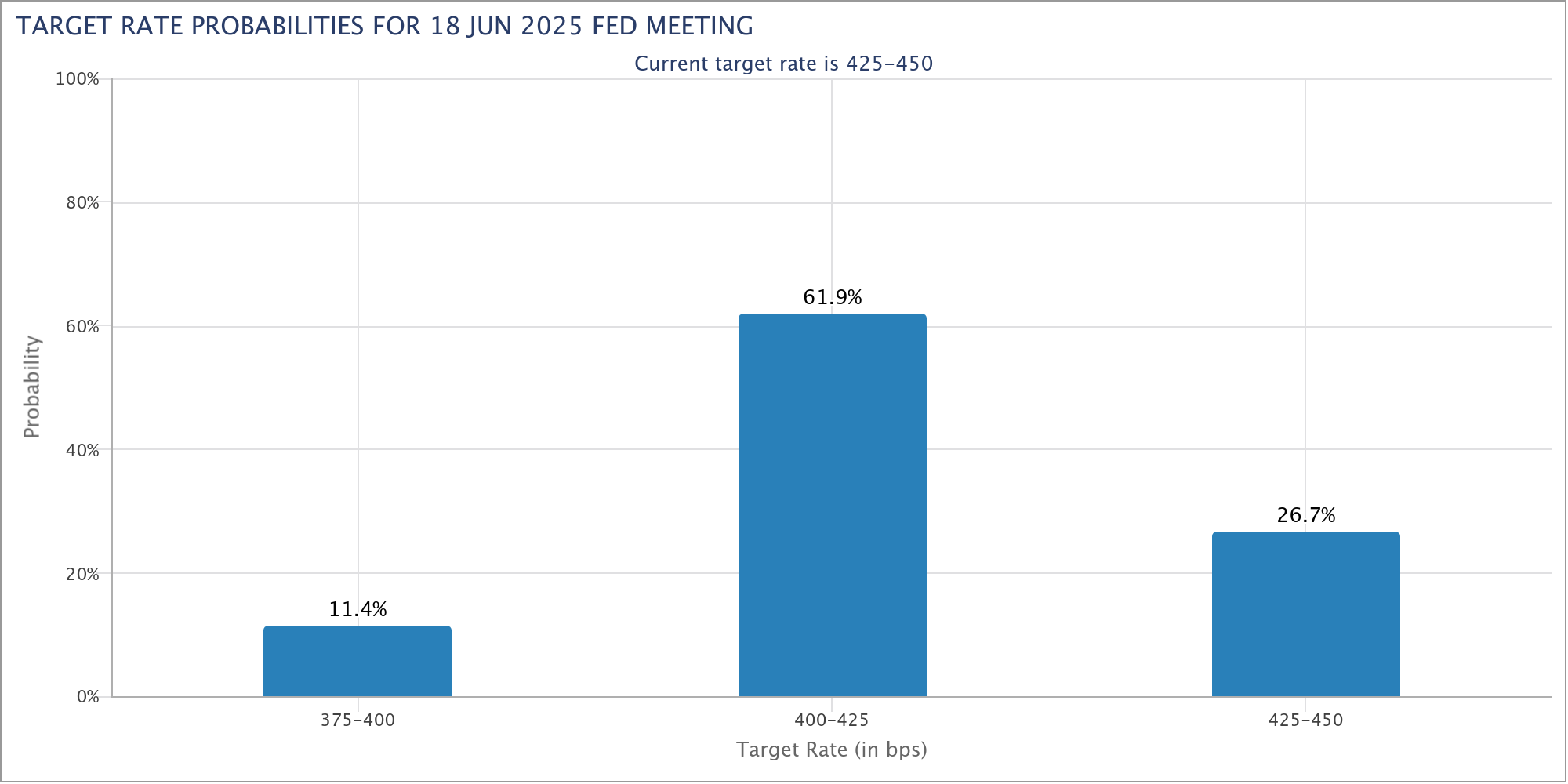

Fed goal charge possibilities for June FOMC assembly. Supply: CME Group

The newest knowledge from CME Group’s FedWatch Software confirmed markets retaining bets of rate of interest cuts occurring no earlier than June.

“Will the rally maintain, or will traders get up to the fact that dangers stay firmly in play?” QCP queried.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.