Authorities Trump (TRUMP) leapt 52% on April 23 after the statement of a special in-person supper for the leading tokenholders with United States President Donald Trump. For some crypto supporters, this marks completion of the bearish market, specifically as Bitcoin (BTC) recuperated above $93,000, however others raise suspicions on how sustainable the TRUMP memecoin rally actually is.

From a simply efficiency viewpoint, the Authorities Trump (TRUMP) memecoin has actually been a dissatisfaction. After overlooking $75 on launch day, its gains rapidly vanished as financiers discovered the high concentration of tokens and the short-term vesting duration.

At very first sight, it is hard to validate TRUMP’s existing market capitalization of $2.6 billion, considered that 80% of the supply was designated to creators and entities managed by Trump.

For contrast, reputable jobs such as Arbitrum (ARB), Jupiter (JUP), and Maker (MKR) hold a capitalization listed below $1.6 billion. Those token appraisals originate from buybacks utilizing treasury reserves or direct advantages in staking and DeFi systems. For example, Arbitrum, a leading Ethereum layer-2 scaling option, holds $2.4 billion in Overall Worth Locked (TVL).

Jupiter, the leading decentralized exchange (DEX) on Solana, boasts $2.3 billion in deposits and has actually accumulated $76.6 million in costs over the previous one month, according to DefiLlama information. On The Other Hand, Sky (previously Maker), the task behind the incredibly effective DAI stablecoin, holds $5.9 billion TVL and $28.6 million in 30-day costs.

TRUMP still ranks in the leading 10 for trading activity

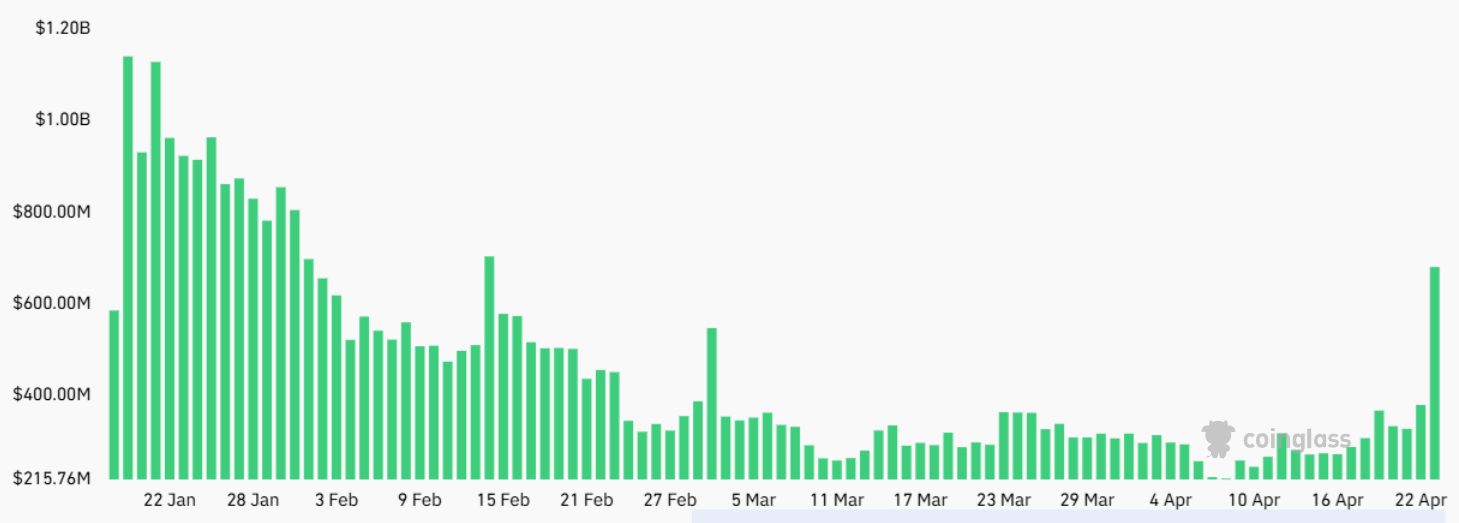

Besides being noted on significant exchanges, consisting of Binance, Bybit, OKX, Coinbase, Upbit, and Kraken, and frequently promoted on social networks by Trump, the memecoin holds an excellent share in derivatives markets. Especially, its futures open interest stands at $700 million, a top-10 overall.

Recognized jobs with market capitalizations over $6 billion, such as Chainlink (LINK), Litecoin (LTC), and Polkadot (DOT) have smaller sized futures open interest than TRUMP. Still, while need for futures markets enables bigger traders to participate in the action, it does not always indicate optimism as longs (purchasers) and shorts (sellers) are matched at all times.

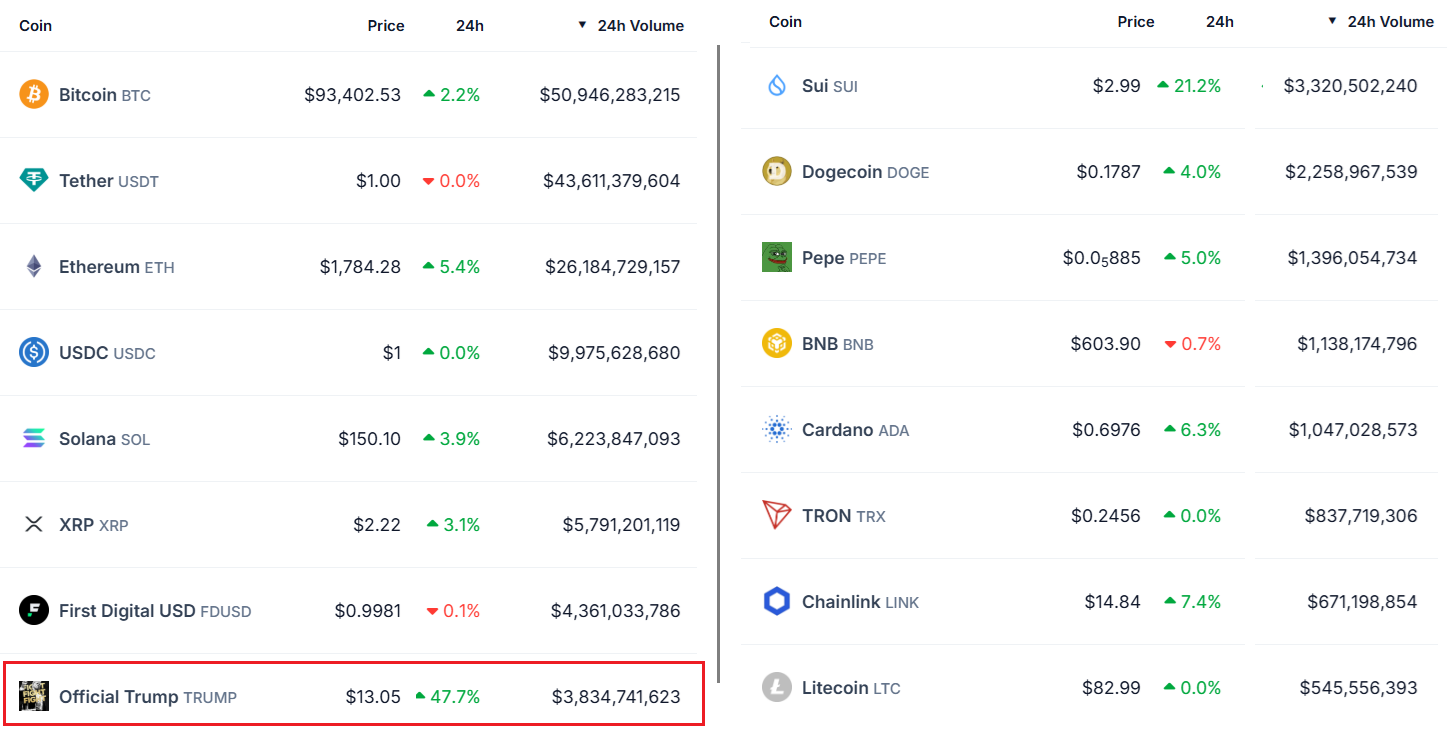

Although TRUMP is presently trading 84% listed below its all-time high, it stays a top-10 token in regards to volume. In truth, leaving out the stablecoins, just 4 cryptocurrencies went beyond TRUMP’s remarkable $3.84 billion 24-hour turnover, according to CoinGecko information.

In spite of the big trading activity, a single advertising occasion with United States President Trump is not likely to develop long lasting need for the TRUMP memecoin, putting the existing $13.50 cost in check. Unless the task relieves financiers’ issues about token opens, there is barely a method to validate the 50% premium versus cryptocurrencies that provide energy and point of views of development.

It deserves keeping in mind that Shiba Inu (SHIB), another memecoin without any genuine energy, currently trades at a $8 billion market capitalization, thus one might quickly argue that a token formally supported by the sitting United States President deserves much more, leading the way for $30 or greater rate targets for TRUMP.

This post is for basic info functions and is not meant to be and need to not be taken as legal or financial investment guidance. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.