Bottom line:

-

Bitcoin does not have volatility drivers thanks to a United States public vacation and a Federal Reserve “nothingburger,” crypto market individuals state.

-

United States trade war due dates start to take spotlight for danger properties.

-

BTC cost action is still anticipated to leave its narrow variety this month.

Bitcoin (BTC) turned slow on June 19 as analysis selected crucial crypto volatility dates.

July, August bring brand-new crypto drawback threats

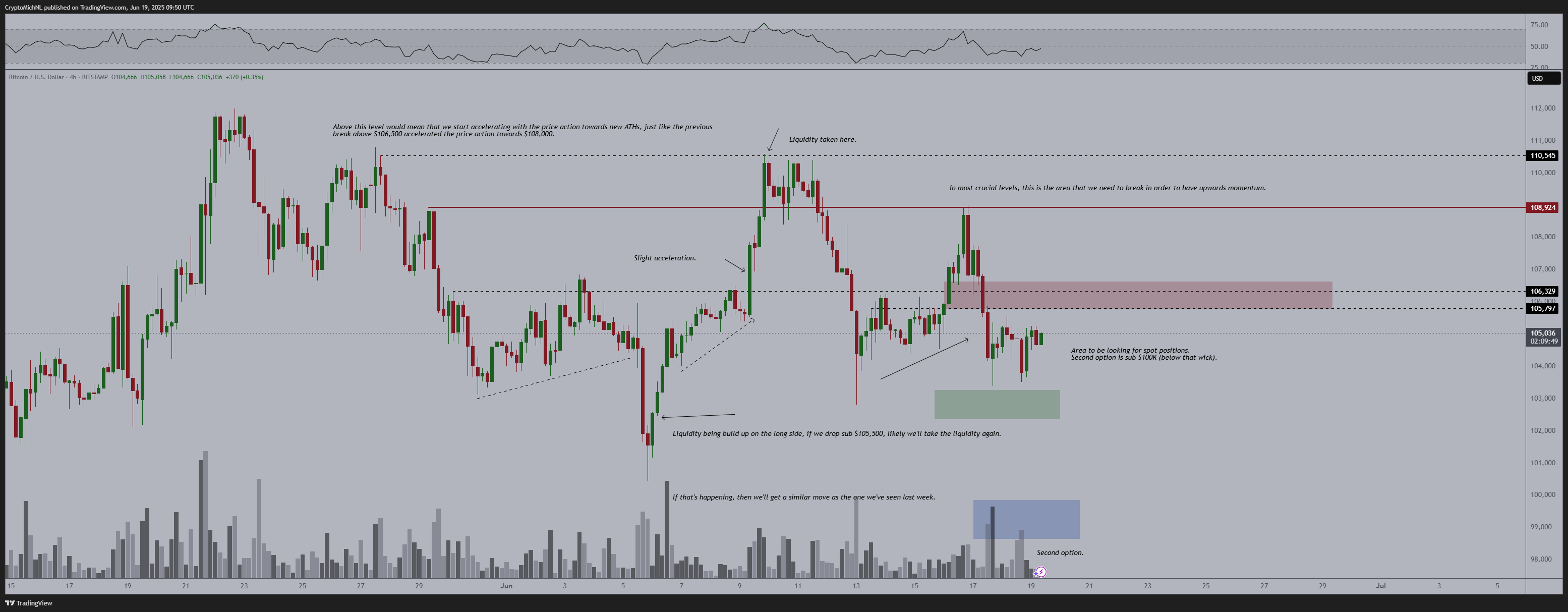

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD acting in a narrow variety while stopping working to protect $105,000 as assistance.

A mix of geopolitical unpredictability, paired with stagnant Federal Reserve policy, along with the United States Juneteenth vacation keeping stock exchange closed, added to sideways BTC cost action.

On the subject of the Fed, which chose to hold rate of interest stable at its June 18 conference, trading company QCP Capital highlighted authorities’ aversion to move rapidly.

” Officials restated their choice for a ‘wait and see’ method, pending higher clearness on inflation’s trajectory,” it composed in its most current publication to Telegram channel customers.

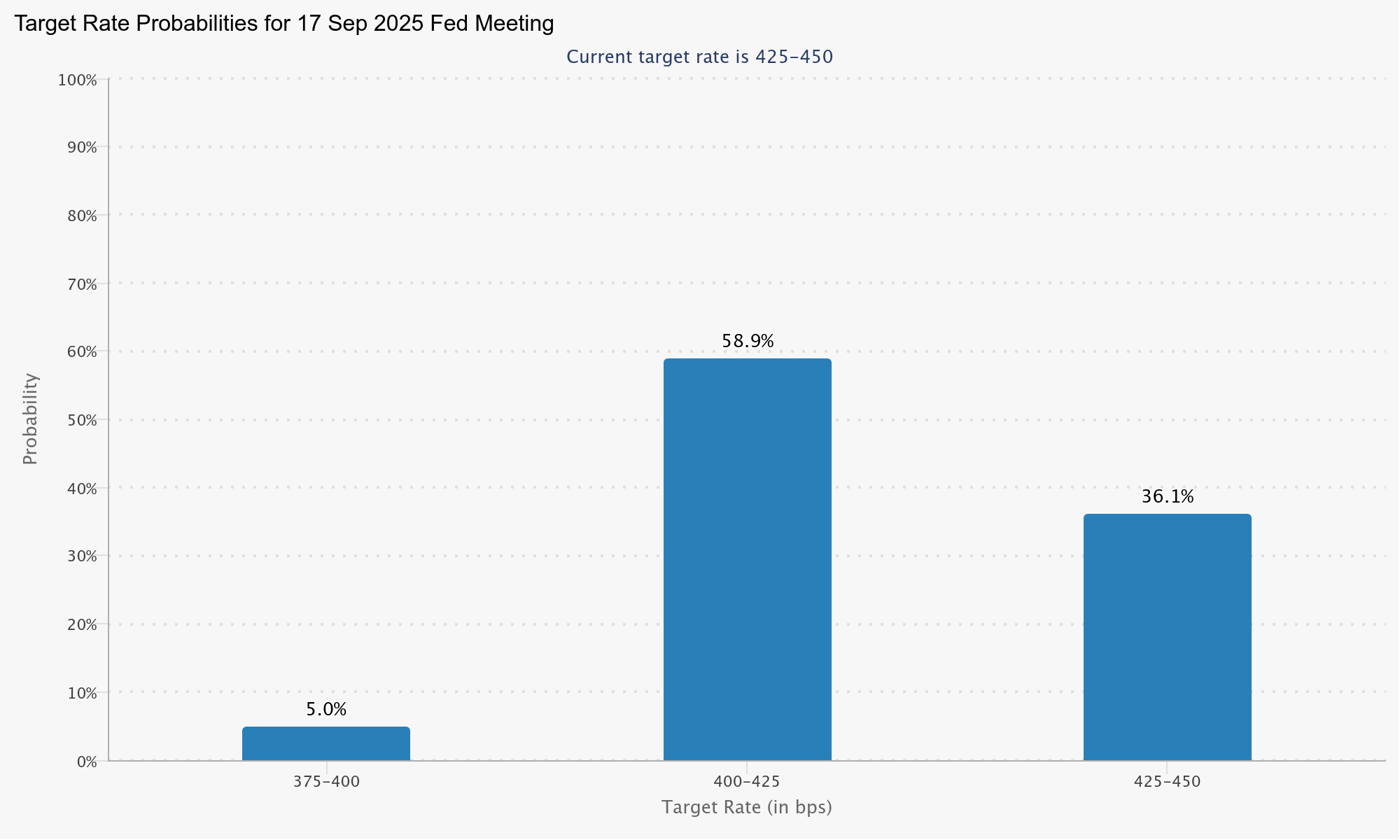

Information from CME Group’s FedWatch Tool revealed markets still preferring a rate cut in September.

QCP rather concentrated on future due dates in the continuous United States trade war as the most likely source of crypto and risk-asset volatility.

” Settlements stay stagnant, and leakages have actually ended up being repeated. Markets might now be less reactive to incremental tariff headings,” it argued.

Secret dates consist of July 14, when the EU is because of enforce vindictive tariffs on United States items, and Aug. 12, when the tariff time out on China ends.

” These upcoming dates might inject episodic drawback volatility into danger properties,” QCP included, keeping in mind that a “steady result” in China’s case was still more most likely.

Bitcoin shakes off FOMC “nothingburger”

On much shorter timeframes, Bitcoin traders continued to wait on a volatility driver to shock the variety.

Related: $ 112K BTC was not ‘booming market peak’: 5 things to understand in Bitcoin today

Popular trader Daan Crypto Trades saw great chances of this happening in the 2nd half of June, and even today.

” Still spending time the $105K location which is the middle of the regular monthly variety and right at the regular monthly open,” he informed X fans in part of his most current analysis.

” Cost has actually been compressing and it’s clear that the marketplace is awaiting a huge transfer to take place. The data still greatly prefer an additional displacement today and particularly this month.”

Fellow trader Alter signed up with those seeing a prospective journey to take quote liquidity at around $103,000.

$BTC

Update:

Still slicing around however eyes on that $105K ask liquidityNext location for good quote liquidity $103K however once again $105K pivot will determine https://t.co/xpovzGurYR pic.twitter.com/EKWyveMJMp

— Alter Δ (@ 52kskew) June 19, 2025

Crypto trader, expert and business owner Michaël van de Poppe on the other hand, explained the Fed occasion as a “nothingburger.”

” I expect we’ll see a test of $106K and breakout north in the coming days,” he anticipated on the day.

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.