Secret takeaways

-

Bear raids include intentional efforts by whales to drive down crypto rates utilizing short-selling, FUD and massive sell-offs to set off panic and benefit from the dip.

-

These raids produce volatility, trigger liquidations and damage retail self-confidence. Nevertheless, they can likewise expose weak or deceptive jobs.

-

Indications consist of abrupt cost drops, high trading volume, lack of news and fast healings, showing cost control instead of natural market patterns.

-

Traders can defend against bear raids by utilizing stop-loss orders, diversifying portfolios, keeping an eye on whale activity and trading on credible, regulated platforms.

Not all market relocations are natural in the vibrant world of crypto trading; some are crafted to make fast earnings. One such method is the bear raid, typically driven by effective market gamers called whales.

These traders tactically utilize short-selling, where they obtain and offer properties at existing rates, intending to buy them less expensive once the cost drops.

So, how precisely does this method play out?

This post dives into what a bear raid is and how it operates. It likewise covers how bear raids affect the crypto market, what the indications are and how retail financiers can safeguard their interests.

What is a bear raid?

A bear raid is an intentional method to drive down the cost of a property, generally through aggressive selling and the spread of worry, unpredictability and doubt (FUD). The method goes back to the early days of standard stock exchange, where prominent traders would team up to control rates for revenue.

Execution of a bear raid includes offering big volumes of a targeted possession to flood the marketplace. The sharp boost in supply develops down pressure on the cost. At the exact same time, the criminals flow unfavorable reports or beliefs, typically through media, to magnify worry and unpredictability. As panic sets in, smaller sized or retail financiers typically sell their holdings, even more speeding up the cost drop.

Bear raids vary from natural market declines. While both result in falling rates, a bear raid is managed and deliberate, implied to benefit those holding brief positions. Natural declines are driven by more comprehensive financial patterns, market corrections or genuine modifications in financier belief.

Bear raids are typically thought about a type of market control. Regulative companies keep an eye on trading activities, examine suspicious patterns and punish deceptive practices such as pump-and-dump plans or wash trading. To boost openness, they need exchanges to carry out compliance steps, consisting of KYC (Know Your Consumer) and AML (Anti-Money Laundering) procedures. By enforcing fines, restrictions, or legal action, regulators work to keep reasonable markets and safeguard financiers.

Regulators try to prevent cryptocurrency market control by implementing stringent guidelines and oversight. In the United States, the Securities and Exchange Commission (SEC) concentrates on crypto properties that certify as securities, while the Product Futures Trading Commission (CFTC) manages products and their derivatives. Under the marketplaces in Crypto-Assets Guideline (MiCA) law, enforcement in the EU is the duty of monetary regulators in the member states.

Did you understand? In 2022, over 50% of Bitcoin’s everyday trading volume was affected by simply 1,000 addresses– frequently called whales– highlighting their market-shaking power.

Who performs bear raids?

In the crypto world, “whales” are huge financiers efficient in carrying out bear raids. Since of their considerable holdings of cryptocurrencies, whales can affect market patterns and cost motions in methods smaller sized retail traders can not.

Compared to other traders, whales run on a various scale, thanks to their access to more capital and advanced tools.

While you may be trying to find short-term gains or just following patterns, whales typically utilize tactical purchasing or offering to produce cost shifts that benefit their long-lasting positions. Their relocations are thoroughly prepared and can impact the marketplace without you even recognizing it.

If you are a routine crypto trader, you may be familiar with the huge crypto motion in between wallets. Such massive transfer of crypto triggers panic or enjoyment in the cryptocurrency neighborhood. For instance, when a whale moves a big quantity of Bitcoin (BTC) to an exchange, it might signify a possible sell-off, triggering rates to dip. On the other hand, getting rid of coins from exchanges to self-custodial wallets may recommend long-lasting holding, which can result in a rate growth.

The reasonably low liquidity of crypto markets offers whales such impact over crypto trading. With less purchasers and sellers compared to standard monetary markets, a single big trade can considerably swing rates. This indicates whales can control market conditions, purposefully or not, typically leaving retail traders having a hard time to maintain.

Did you understand? Bear raids typically set off automated liquidations in leveraged positions, often triggering crypto rates to nosedive by over 20% in minutes.

Real-world examples of whales making money from falling rates

In crypto, cases of bear raids are typically tough to verify due to privacy. However, these examples of occurrences when whales made benefit from falling cryptocurrency rates will assist you comprehend how such circumstances work:

Terra Luna collapse (May 2022)

A Bank for International Settlements (BIS) report revealed that throughout the 2022 crypto market crash, activated by the collapse of Terra (LUNA), whales earned a profit at the cost of retail financiers. Smaller sized retail financiers mainly acquired cryptocurrencies at lower rates, whereas whales mostly sold their holdings, making money from the slump.

In Might 2022, the Terra blockchain was quickly suspended following the failure of its algorithmic stablecoin TerraUSD (UST) and the associated cryptocurrency LUNA, leading to a loss of almost $45 billion in market price in one week. The business behind Terra declared personal bankruptcy on Jan. 21, 2024.

FTX collapse (November 2022)

In November 2022, close monetary ties in between FTX and Alameda Research study triggered a domino effect: a bank run, stopped working acquisition offers, FTX’s personal bankruptcy and criminal charges for creator Sam Bankman-Fried.

Yet once again, as FTX collapsed, retail financiers hurried to purchase the dip. Whales, nevertheless, offered crypto wholesale right before the high cost decrease, according to the exact same BIS report that talked about the fall of Terra Luna.

Chart 1. B highlights a transfer of wealth, where bigger financiers liquidated their holdings, disadvantaging smaller sized financiers. Additionally, Chart 1.C exposes that following market shocks, big Bitcoin holders (whales) lowered their positions, while smaller sized holders (described as krill in the report) increased theirs. The cost patterns show that whales offered their Bitcoin to krill before considerable cost drops, protecting earnings at the krill’s cost.

Bitconnect (BCC) shutdown (January 2018)

Bitconnect, a cryptocurrency appealing uncommonly high returns by means of a supposed trading bot, experienced a remarkable collapse in early 2018. In spite of reaching a peak appraisal of over $2.6 billion, the platform was extensively presumed of running as a Ponzi plan.

The token suffered a high fall of over 90% in worth within hours. While this was not a timeless bear raid, the abrupt exit of experts and whale sell-offs, integrated with unfavorable promotion, produced a cascading impact that ravaged retail financiers.

Did you understand? Whale wallets are tracked so carefully that some platforms provide real-time informs for their trades, assisting retail traders expect possible bear raids.

How whales perform bear raids in crypto, crucial actions

In the crypto area, whales can perform bear raids by leveraging their huge holdings to set off sharp cost drops and benefit from the following panic. These methods generally unfold in a couple of actions:

-

Action 1: Building up a position: Whales start by taking positions that will gain from falling rates, such as shorting a cryptocurrency or preparing to purchase big amounts once the cost drops.

-

Action 2: Starting the raid: Next, the whale sets off the sell-off by discarding big volumes of the targeted crypto possession. This abrupt rise in supply triggers the cost to drop greatly, shaking market self-confidence.

-

Action 3: Spreading Out FUD: To take full advantage of the effect, whales might spread out FUD utilizing collaborated social networks projects or phony news. Reports like unfavorable regulative action or insolvency can spread out rapidly, triggering retail traders to offer in panic.

-

Action 4: Setting off sell-offs: The mix of noticeable big sell orders and unfavorable belief causes other financiers to offer their holdings, magnifying the down pressure on the possession’s cost.

-

Step 5: Benefiting from the dip: Once the cost plunges, the whale actions in to either redeem the possession at a lower cost or close their brief positions for a revenue.

The whales’ playbook: How do they control the marketplace?

Crypto whales utilize advanced methods to perform bear raids and control the marketplace to their benefit. These methods provide whales an edge over retail traders, allowing them to control rates and revenue while the latter are delegated handle the mayhem:

-

Trading bots and algorithms: Advanced bots enable whales to perform big sell orders in milliseconds, setting off sharp cost drops. Before the marketplace can respond, the whales turn the circumstance in their favor.

-

Take advantage of and margin trading: Whales rely (to a big degree) on take advantage of and margin trading to make earnings. Loaning funds allows them to increase their position size and magnify the sales pressure. It sets off more powerful market responses than would be possible with their holdings.

-

Low liquidity on particular exchanges: Whales can put big sell orders in illiquid markets with less individuals and a low volume of trades, triggering out of proportion cost drops. They might even control order books by putting and canceling big phony orders, called spoofing, to fool other traders.

-

Team up with other whales: Whales might team up with other big holders or trading groups to collaborate attacks, making the bear raid more reliable and more difficult to trace.

Effect of bear raids on the crypto market

Bear raids can substantially interrupt the crypto market. Here is how they affect various gamers and the more comprehensive community:

-

Impacts on retail traders: Retail financiers tend to respond extremely throughout a bear raid. The abrupt cost drop and spread of worry typically result in stress offering, leading to heavy losses for the financiers who leave at the bottom. A lot of retail traders offer mentally, not recognizing they are playing into the whale’s method.

-

More comprehensive market effects: Bear raids increase market volatility, making it riskier for brand-new and current financiers. These occasions can shake general self-confidence in the crypto area, causing lowered trading activity and financier doubt. In severe cases, they can even set off liquidations throughout numerous platforms.

-

Prospective favorable results: Bear raids can often have cleaning impacts on the crypto market. Market corrections caused by such raids get rid of misestimated properties from unsustainable highs. In many cases, these raids might expose weak or deceptive jobs, requiring financiers to reassess their options.

Indications of crypto bear raids

Bear raids are deceiving market relocations that look like real declines, typically deceiving traders into offering prematurely. A fast drop in cost might appear like the start of a bearish pattern, causing spontaneous choices by retail traders.

Frequently, these dips are brief and followed by a quick healing once the whales take their earnings. Acknowledging the indications of crypto bear raids is crucial to preventing losses.

Here are a couple of indications of crypto bear raids:

-

An abrupt cost drop that appears to break assistance levels

-

Spike in trading volume throughout a market decrease

-

Quick rebound after the dip

-

Unfavorable belief triggering trader panic

-

No significant news to discuss the drop

How to safeguard yourself from crypto bear raids

To secure your financial investments from crypto bear raids, you can utilize the following methods:

-

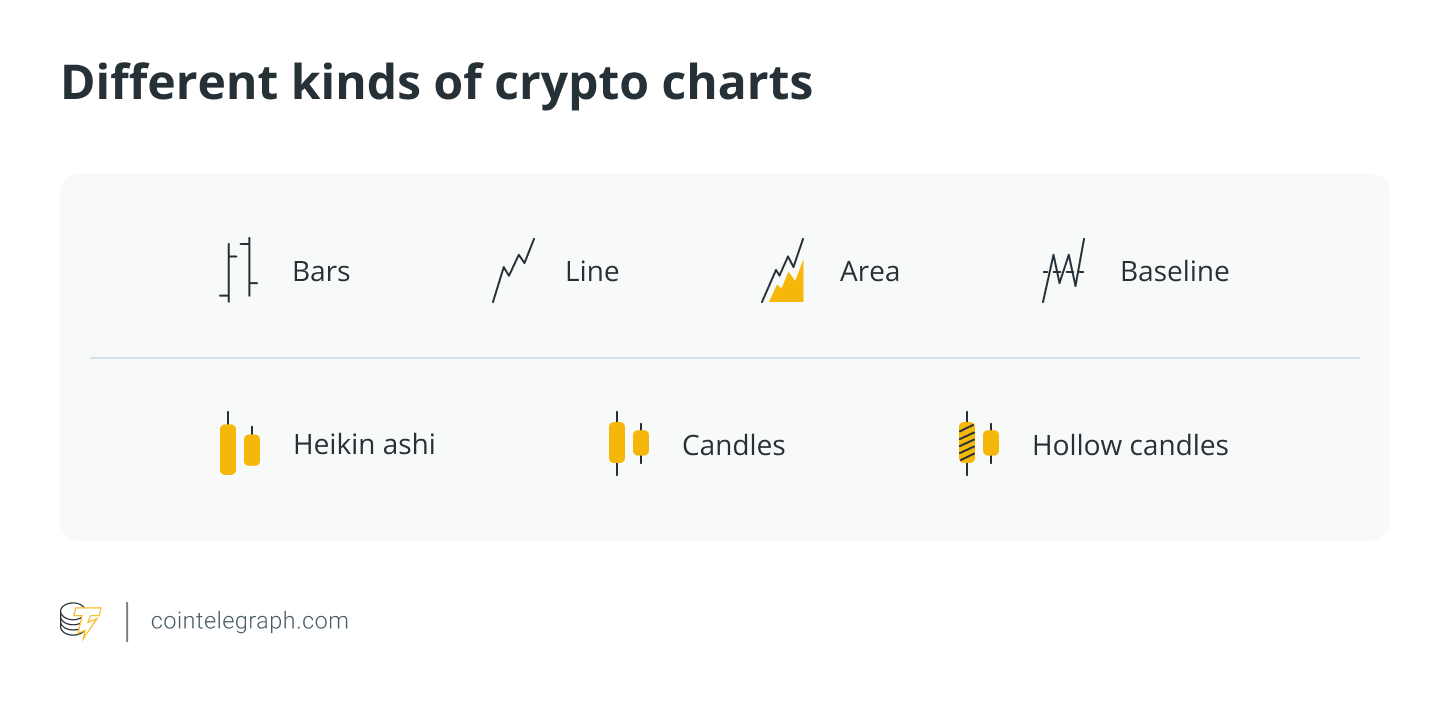

Conduct comprehensive technical analysis: Frequently examine cost charts and signs to recognize real market patterns from manipulative motions.

-

Implement stop-loss orders: Set fixed sell indicate instantly leave positions if rates are up to a specific level, restricting possible losses throughout abrupt declines.

-

Diversify your portfolio: Spread financial investments throughout numerous properties to reduce danger. A well-diversified portfolio is less susceptible to the effect of a bear raid on any single possession.

-

Stay notified: Display market news and advancements to much better expect and react to possible manipulative activities.

-

Usage credible exchanges: Engage with trading platforms that have robust steps versus market control, guaranteeing a fairer trading environment.

The ethical argument: Crypto market control vs free enterprise characteristics

The concepts of free enterprise characteristics starkly contrast to market control methods, such as bear raids.

Advocates of free enterprises prefer very little regulative intervention, arguing that it promotes development and self-regulation. A free enterprise is a financial system in which supply and need figure out the rates of items and services. Still, the decentralized and typically uncontrolled nature of crypto markets has actually made them prone to manipulative practices.

Bear raids need collaborated efforts by criminals to drive down possession rates, deceptive financiers and weakening market stability. Such methods bring losses to retail financiers and deteriorate rely on the monetary system.

Critics explain that without appropriate oversight, these manipulative methods can multiply, causing unreasonable benefits and possible financial damage.

While free enterprise characteristics are valued for promoting performance and development, the ramifications of unattended market control in the cryptocurrency area can be dreadful. Occurrences like bear raids highlight the requirement for well balanced policy to make sure fairness and safeguard financiers.

Crypto guidelines worldwide for market control methods

Cryptocurrency market control, consisting of methods like bear raids, has actually triggered different regulative reactions worldwide. In the United States, the Product Futures Trading Commission (CFTC) categorizes digital currency as products and actively pursues deceptive plans, consisting of market control practices such as spoofing and wash trading. The Securities and Exchange Commission (SEC) has actually likewise acted versus people who have actually controlled digital possession markets.

The European Union has actually executed the marketplaces in Crypto-Assets (MiCA) policy to develop a thorough structure resolving market control and make sure customer defense relating to stablecoins.

These efforts regardless of, the decentralized and borderless nature of cryptocurrencies provides obstacles for regulators. Worldwide cooperation and adaptive regulative structures are necessary to successfully fight market control and secure financiers in the developing landscape of digital financing.

Development short articles

Long and brief positions in crypto, described

A novice’s guide on how to brief Bitcoin and other cryptocurrencies

What is a bear trap in trading and how to prevent it?

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.