Dogecoin (DOGE) rate has actually leapt by around 7% in the last 24 hr to reach $0.181 on March 25. The memecoin was trading for $0.189 at its intraday top, its greatest level in practically 2 weeks.

DOGE/USD four-hour rate chart. Source: TradingView

Secret elements driving the DOGE costs higher today consist of:

-

A DOGE reserve effort carried out by the Dogecoin Structure

-

Danger appetitive healing on alleviating trade war worries.

-

A timeless flag pattern on the DOGE rate chart.

Dogecoin Structure purchases 10 million DOGE

DOGE’s continuous rate increase accompanies the launch of the Authorities Dogecoin Reserve, a relocation created to support the memecoin and increase institutional self-confidence.

Bottom line:

-

On March 24, the Dogecoin Structure exposed the production of the “Authorities Dogecoin Reserve” targeted at supporting DOGE’s long-lasting rate stability and trustworthiness.

-

As part of the effort, the structure has actually acquired 10 million DOGE worth around $1.80 million.

-

The Structure’s tactical DOGE purchase takes place at a time when traders are carefully enjoying indications of institutional entry into the memecoin sector, especially with the prospective launch of area Dogecoin ETFs in the United States.

Source: @CryptoWizardd

-

Since March 25, crypto wagering platform Polymarket was revealing 72% chances in favor of a Dogecoin ETF launch by the year’s end, up from 27% on Jan. 1.

Altcoins are exceeding Bitcoin in the middle of threat rally

Dogecoin’s gains today appear along with a more comprehensive altcoin market rally led by alleviating trade war stress.

Secret takeaways:

Bitcoin and TOTAL2 market capitalization efficiency in the last 5 days. Source: TradingView

-

On the other hand, Bitcoin’s market cap has actually decreased 0.61% in the very same duration.

-

It reveals that traders are turning capital from Bitcoin into altcoins like Dogecoin.

-

The divergence appears in the middle of indications of alleviating trade war stress.

-

On March 24, United States President Donald Trump signified two times that trading partners would get possible exemptions or decreases.

-

Financiers accepted higher-risk properties in the middle of enhancing macro belief, preferring riskier altcoins over more secure bets like Bitcoin.

-

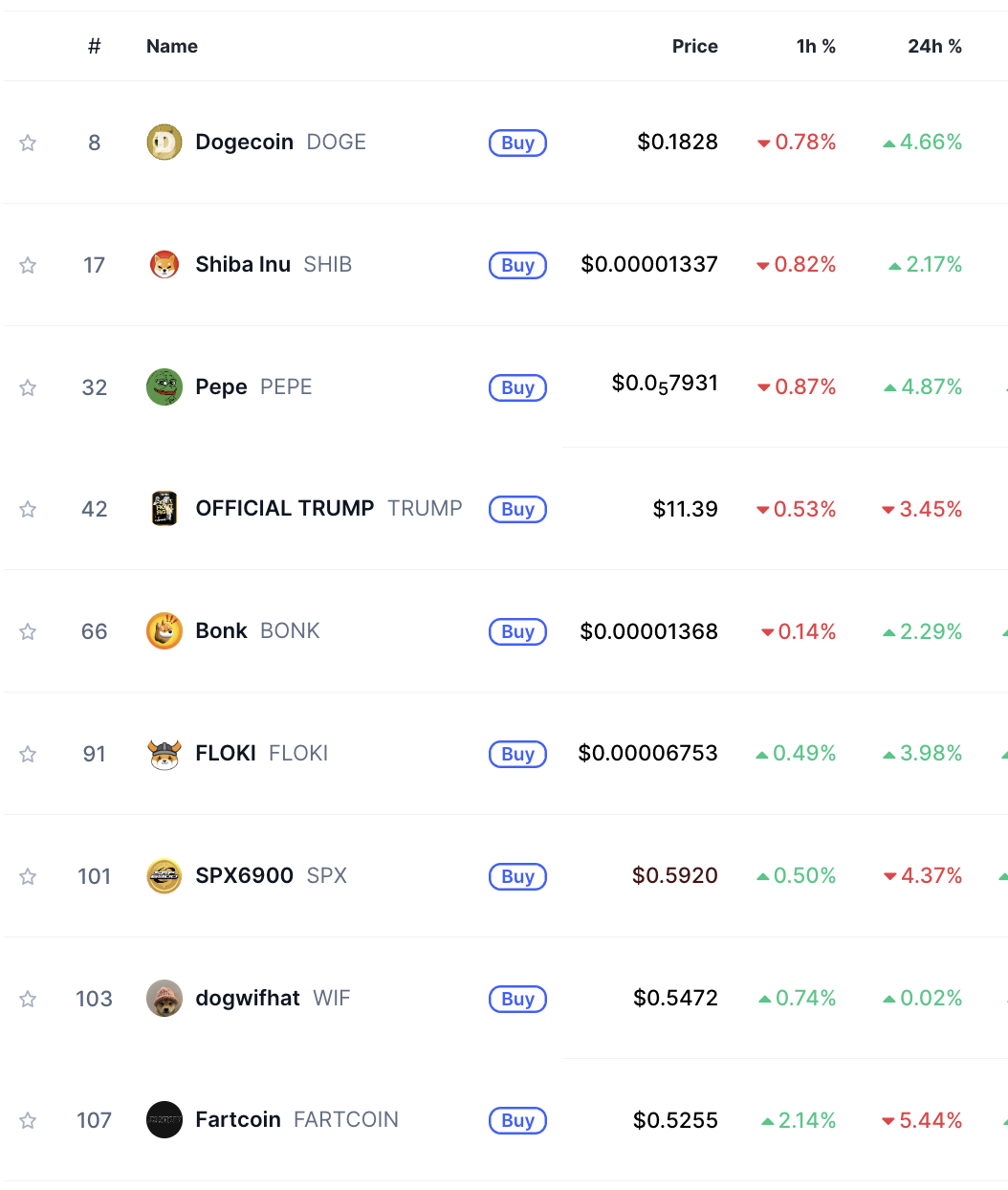

Memecoins typically draw in retail-driven buzz throughout altcoin rallies, as revealed listed below by means of the efficiency of top-level joke cryptocurrencies on a 24-hour adjusted timeframe.

Leading memecoin efficiency on March 25, 2025. Source: CoinMarketCap

Related: Dogecoin millionaires are purchasing dips as DOGE rate eyes 30% rally

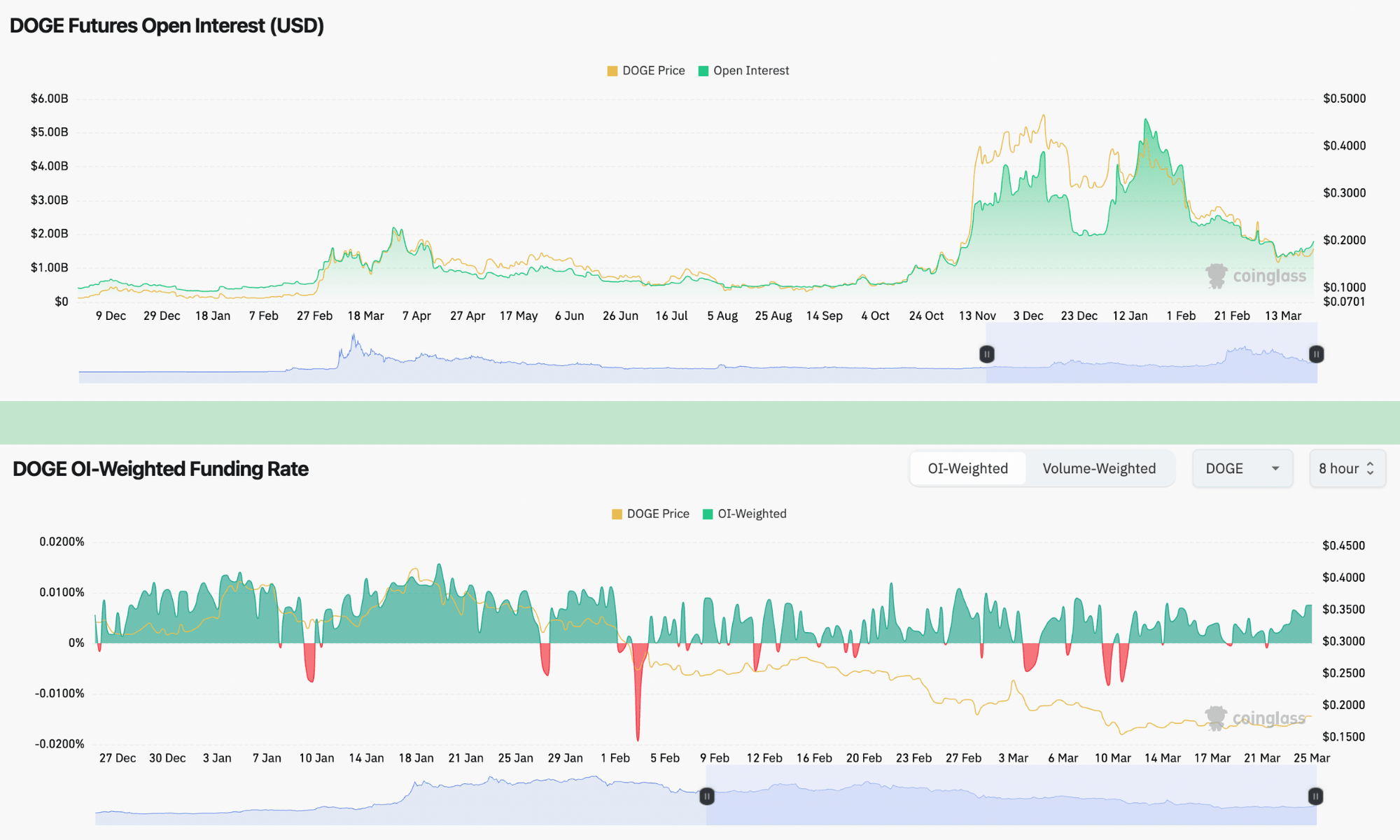

Fairly greater speculation is likewise noticeable in the Dogecoin Futures market, where DOGE open interest (OI) and financing rates are climbing up.

What to understand:

-

Since March 25, DOGE’s OI in the futures market was around $1.80 billion, up from the March 11 low of $1.33 billion, the most affordable in 4 months at the time.

Dogecoin OI, financing rates. Source: Coinglass

-

DOGE’s weekly financing rates at the very same time have actually reached 0.157% from unfavorable levels on March 21.

-

Increasing DOGE open interest and favorable financing rates suggest growing need for leveraged long positions, showing bullish belief.

Dogecoin is bouncing with a bear flag channel

Dogecoin’s rate gains today seem a part of its dominating bear flag pattern.

Secret takeaways:

-

A bear flag pattern types when the rate combines greater inside an increasing parallel channel after going through strong decreases.

-

As a technical guideline, the pattern deals with when the rate breaks listed below the lower trendline and falls by as much as the previous sag’s height.

-

Since March 25, Dogecoin was combining inside the flag channel, with its current bounce happening after checking the most affordable trendline as assistance.

DOGE/USD day-to-day rate chart. Source: TradingView

-

Nevertheless, its general predisposition stays manipulated to the disadvantage, offering it breaks listed below the flag’s lower trendline next.

-

Must it take place, DOGE rate can decrease towards the technical disadvantage target at around $0.117– down around 35% from the existing rate levels– by April.

-

On the other hand, a breakout above the flag’s upper trendline will likely revoke the bearish setup, sending out DOGE’s rate towards the 50-day EMA (the red wave near $0.214) rather.

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.