Secret takeaways:

-

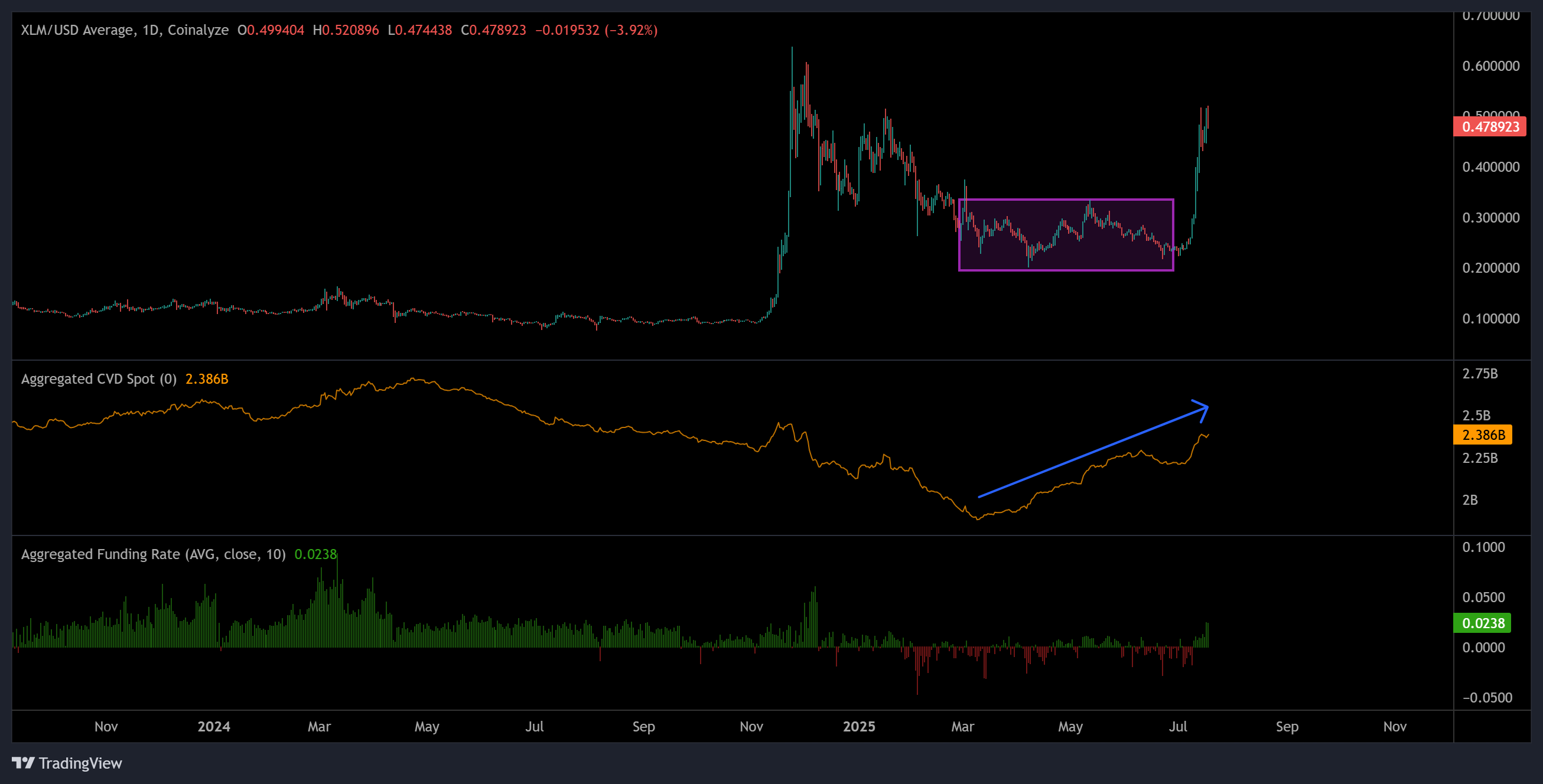

XLM struck an annual high of $0.52, with instant targets set on cycle highs at $0.63.

-

Peter Brandt stated XLM has the most bullish chart, with $0.20 as assistance and $1 as the breakout level.

Excellent Lumens (XLM) rallied to $0.52 on Friday. The relocation follows an 87% over the last 7 days and mirrors comparable gains from XRP (XRP). On Friday, XRP reached brand-new year-to-date highs at $3.65, and XLM might do the same as both properties share a 100-day connection index of 0.95.

Is XLM is the most bullish chart?

Veteran trader and expert Peter Brandt stated XLM presently displays the most bullish market structure amongst all considerable crypto properties. In a current X post, Brandt shared a month-to-month chart of XLM, highlighting the technical conditions needed for a continual rally. He kept in mind,

” XLM MUST MUST stay above Apr low and MUST MUST close decisively above $1. Up until then this chart will stay variety bound.”

According to Brandt’s analysis, the important assistance sits at the April low of $0.20, approximately 58% listed below existing market value. Nevertheless, recovering and holding above the $1 limit stays a powerful obstacle.

XLM’s all-time high stands at $0.93, experienced in 2018, however in the interim, instant resistance zones near $0.62 and $0.80 might draw in considerable selling before any breakout towards $1.

Evaluating the XLM/BTC set uses extra insight to enhance the bullish case. XLM has actually regularly underperformed versus Bitcoin given that the previous cycle, however a bullish break of structure above the 0.000006 level on the BTC set might mark a pattern turnaround. A definitive relocation might catalyze XLM to outshine the wider market, possibly starting a cost discovery stage in Q4 2025.

Related: Dave Portnoy disposed his XRP 2 weeks ago: ‘I wish to weep’

XLM open interest reaches brand-new highs at $589 million

The XLM futures market is getting momentum, with open interest striking a brand-new all-time high of $589 million. Significantly, financing rates stay neutral compared to Q4 2024, showing a well balanced market without any indications of extreme long or brief positioning, an environment frequently preceding considerable cost relocations.

The current uptrend appears spot-driven, as the aggregated cumulative volume delta (CVD) has actually increased greatly to $2.89 billion from $2 billion over the previous 3 months. Remarkably, this boost took place while XLM’s cost had actually been combining in between $0.30 and $0.20 given that March, recommending that big purchasers silently built up throughout this duration of sideways cost action.

Supporting this build-up thesis is the habits of the 90-day area taker CVD. Throughout the debt consolidation stage, taker CVD was buyer-dominant, showing aggressive market purchases exceeding offers. Presently, CVD has actually gone back to neutral levels, and traditionally, XLM has actually revealed its greatest rallies when CVD reduces the effects of after a buyer-dominant stage.

The mix of record-high open interest, an increasing area CVD throughout debt consolidation, and a neutral taker CVD indicate a prospective breakout circumstance as the marketplace gets ready for additional benefit in Q3-Q4 2025.

Related: XRP leaps 22% into cost discovery as market cap strikes a record $210B

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.