Secret takeaways:

XRP (XRP) extended its drop on Friday, dropping 3% over the last 24 hr to trade at $1.93. The failure to hold above $2 now puts the altcoin’s healing possibilities in concern, with traders asking just how much even more it can fall.

Traditional XRP pattern targets $0.88

The XRP/USD set has actually formed a loudspeaker pattern in the weekly timespan, recommending that a much deeper correction remained in shop for the altcoin.

A loudspeaker pattern, likewise called an expanding wedge, kinds when the cost produces a series of greater highs and lower lows. As a technical guideline, a breakout listed below the pattern’s lower limit might activate a sharp drop.

Related: ETF altseason? Solana, XRP funds buck crypto’s market sell-off

In XRP’s case, the pattern will be validated once the cost breaks above the lower pattern line around $1.80.

The determined target for this pattern is $0.88, or a 54% boost from the existing level.

Secret levels to see before this target is reached are the 100-week basic moving average (SMA) at $1.60 and the 200-week SMA at $1.05.

The weekly RSI dropped to 39 on Friday, below very overbought levels of 91 in December 2024, recommending gradually increasing downward momentum over this duration.

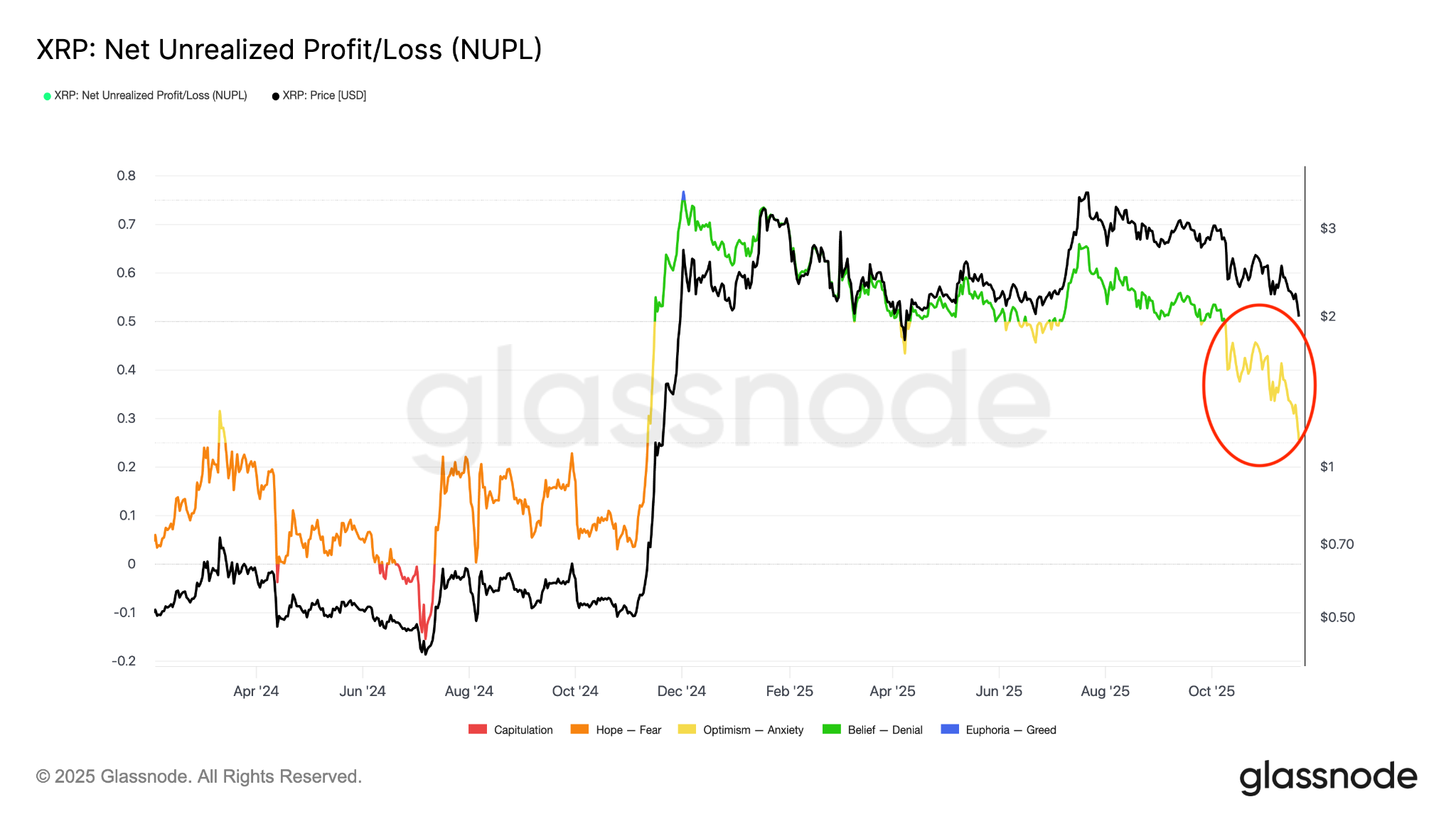

On the other hand, XRP’s Net Latent Profit/Loss (NUPL) has actually moved from bliss to rejection, and now stress and anxiety is sneaking in.

With more than 41.5% of XRP holders undersea at existing rates, there is a possibility of increased sell-side pressure as financiers count their losses. Such setups in 2018 and 2021 preceded sharp corrections, raising the possibility of comparable pullbacks over the next couple of weeks.

XRP recognized losses increase to seven-month highs

XRP dropped to an intraday low of $1.81, levels last seen in April, according to information from Cointelegraph Markets Pro and TradingView.

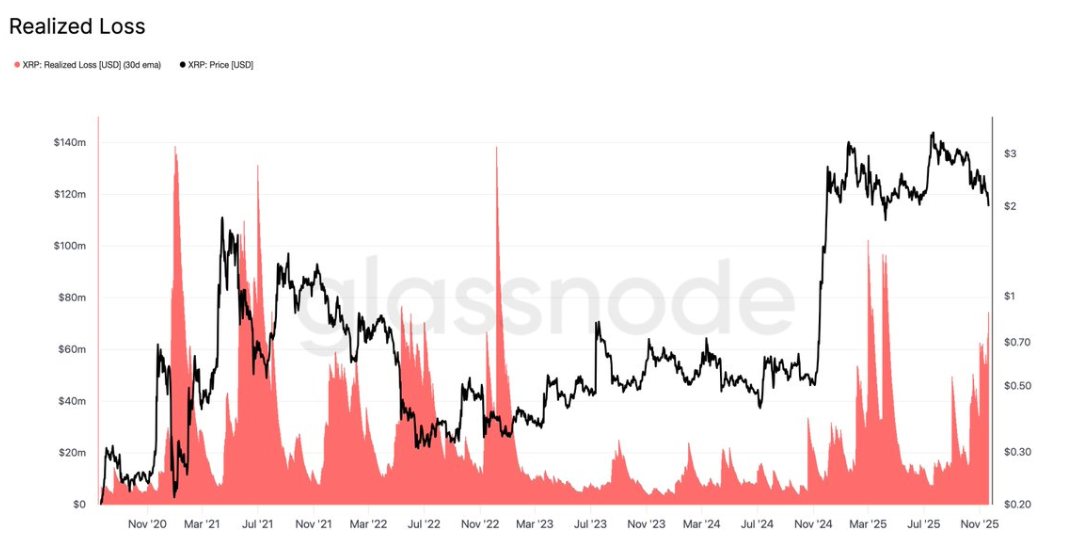

Installing selling pressure has actually triggered lots of financiers to cost a loss, similar to significant historical market crashes.

Understood losses on XRP have actually risen to levels not seen because April, according to blockchain information platform Glassnode.

” The 30D-EMA of day-to-day recognized losses has actually surged to about $75M each day,” Glassnode stated in an X post on Friday.

Glassnode’s observation came minutes before XRP slipped listed below $2, marking a 50% decrease from its multi-year high of $3.66 taped in mid-July.

As Cointelegraph reported, absence of onchain need and relentless profit-taking by whales might enhance XRP’s sell-off threats.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.