On March 19, Ripple CEO Brad Garlinghouse revealed that the business had actually been cleared by the United States Securities and Exchange Commission concerning a supposed $1.3 billion unregistered securities offering. Following the news, XRP (XRP) rose to $2.59, however the gains slowly faded as the cryptocurrency experienced a 22% correction, dropping to $2.02 by March 31.

Financiers fret that a much deeper rate correction looms, as XRP is trading 39% listed below its all-time high of $3.40 from Jan. 16. Furthermore, XRP continuous futures (inverted swaps) show strong need for leveraged bearish bets.

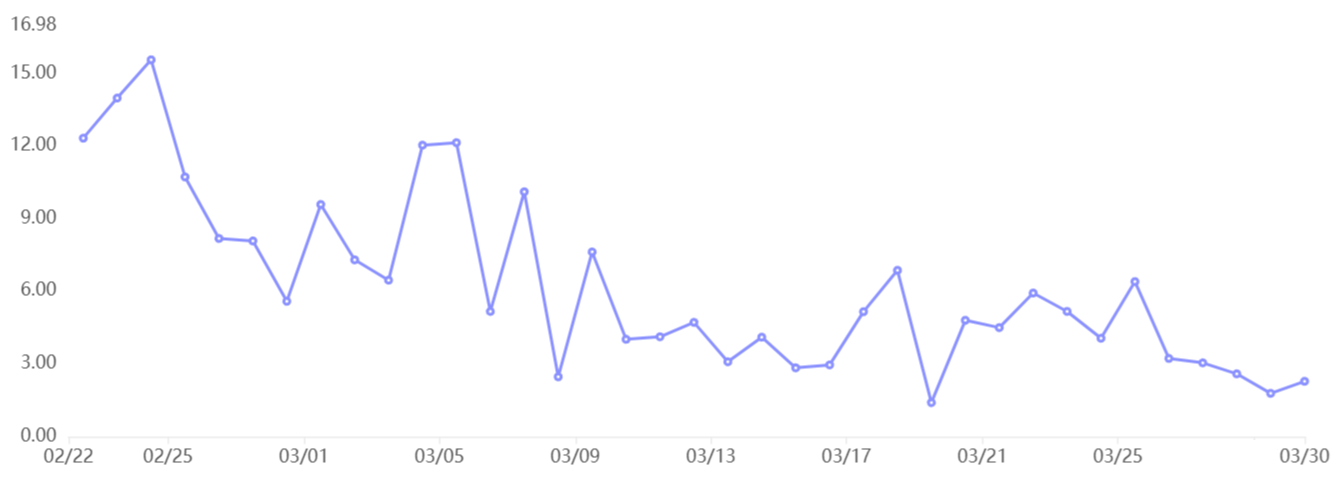

Need for bearish bets increased amidst XRP’s decrease

The financing rate turns favorable when longs (purchasers) look for more utilize and unfavorable when need for shorts (sellers) controls. In neutral markets, it generally varies in between 0.1% and 0.3% per 7 days to balance out exchange threats and capital expenses. Alternatively, unfavorable financing rates are thought about strong bearish signals.

XRP futures 8-hour financing rate. Source: Laevitas.ch

Presently, the XRP financing rate stands at -0.14% per 8 hours, equating to a 0.3% weekly expense. This suggests that bearish traders are spending for utilize, showing weak financier self-confidence in XRP. Nevertheless, traders need to likewise examine XRP margin need to identify whether the bearish belief extends beyond futures markets.

Unlike acquired agreements, which constantly need both a purchaser and a seller, margin markets let traders obtain stablecoins to purchase area XRP. Similarly, bearish traders can obtain XRP to open brief positions, expecting a cost drop.

XRP margin long-to-short ratio at OKX. Source: OKX

The XRP long-to-short margin ratio at OKX stands at 2x in favor of longs (purchasers), near its least expensive level in over 6 months. Historically, severe self-confidence has actually pressed this metric above 40x, while readings listed below 5x preferring longs are generally viewed as bearish signals.

President Trump enhanced XRP awareness, leading the way for future rate gains

Both XRP derivatives and margin markets signal bearish momentum, even as the cryptocurrency gains traditional limelights. Significantly, on March 2, United States President Donald Trump pointed out XRP, together with Solana (SOL) and Cardano (ADA), as prospective prospects for the nation’s digital possession tactical reserves.

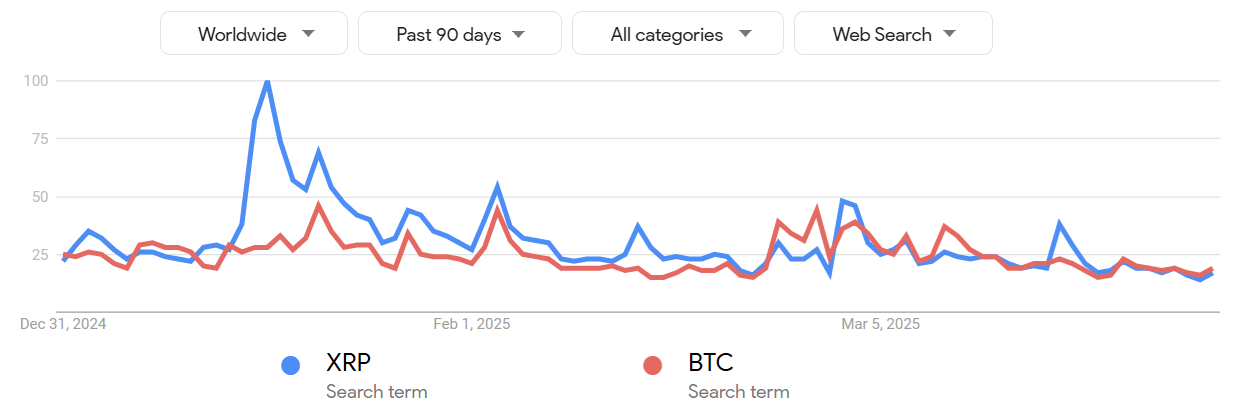

Google search patterns for XRP and BTC. Source: GoogleTrends/ Cointelegraph

For a short duration, Google search patterns for XRP outmatched those of BTC in between March 2 and March 3. A comparable spike happened on March 19 following Ripple CEO Garlinghouse’s discuss the awaited SEC judgment. As the third-largest cryptocurrency by market capitalization (omitting stablecoins), XRP gain from its early adoption and high liquidity.

Related: Is XRP rate around $2 a chance or the booming market’s end? Experts weigh in

Interactive Brokers, an international standard financing brokerage, revealed on March 26 its growth of cryptocurrency offerings to consist of SOL, ADA, XRP, and Dogecoin (DOGE). Given that 2021, the platform has actually supported trading in Bitcoin (BTC), Ether (ETH), Litecoin (LTC), and Bitcoin Money (BCH) sets.

The broader adoption by standard intermediaries, integrated with increasing Google search patterns, even more enhances XRP’s position as a leading altcoin. It likewise sets the phase for increased inflows as soon as macroeconomic conditions enhance and retail financiers actively look for altcoins with strong marketing appeal as options to standard financing, such as Ripple.

This post is for basic details functions and is not planned to be and need to not be taken as legal or financial investment guidance. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.