Secret takeaways:

-

XRP rate rose 22% over the last 24 hr, reaching a brand-new all-time high of $3.66.

-

Beneficial regulative action in the United States is including tailwinds.

-

Momentum indications recommend XRP has more space to run: bull pennant targets $14.

XRP (XRP) rate set a historical turning point, increasing to its greatest level on Friday as significant cryptocurrency costs passed the United States Home and traders stacked in.

XRP market cap passes $200 billion turning point

The XRP market cap has actually risen 12% over the last 24 hr and 63% in the last one month, exceeding the $210 billion mark for the very first time to a record high of $216 billion on Friday.

XRP’s day-to-day trading volume has likewise more than doubled on the day to $22.5 billion, strengthening the strength of the bulls.

Related: XRP rate ‘extremely unusual’ setup eyes 60% gain past $3, experienced trader states

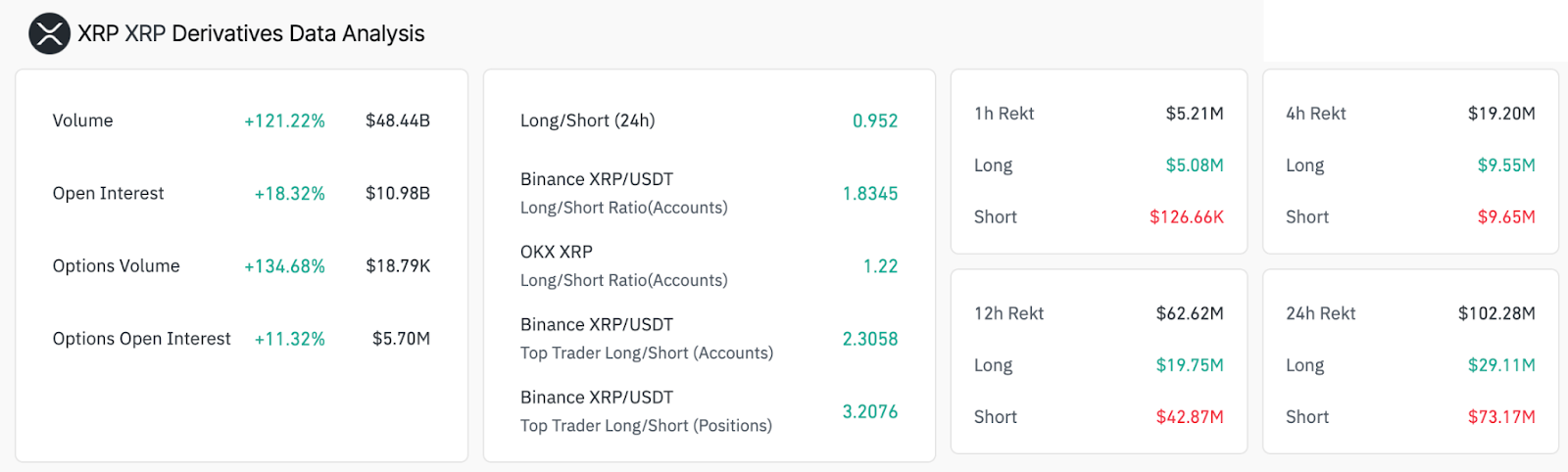

The derivatives market too saw its trading volume more than double over the last 24 hr to $48.44 billion while the open interest reached a brand-new record of $10.98 billion.

The rate gains were partly sustained by $73.17 million in other words XRP position liquidations, compared to simply over $29 million in long liquidations.

Brand-new crypto guideline improves XRP rate

XRP’s rally came as 3 crucial pieces of crypto legislation passed the United States Legislature, with the GENIUS Act set to develop a federal structure for stablecoins.

This lines up with Ripple’s RLUSD stablecoin aspirations, improving financier self-confidence.

UPDATE: All 3 crypto costs have actually passed your house– Clearness Act (294-134), GENIUS Act (308-122), and Anti-CBDC Act (219-210).

The GENIUS Act now heads to President Trump’s desk for signing tomorrow afternoon at the White Home. pic.twitter.com/f42VfXuT59

— Cointelegraph (@Cointelegraph) July 17, 2025

Ripple’s application for a United States banking license previously this month, along with a Federal Reserve master account, positions it for much deeper combination into the monetary system.

However currently, institutional need is growing as business like VivoPower and Webus strategy to buy $421 million in XRP for their business treasuries.

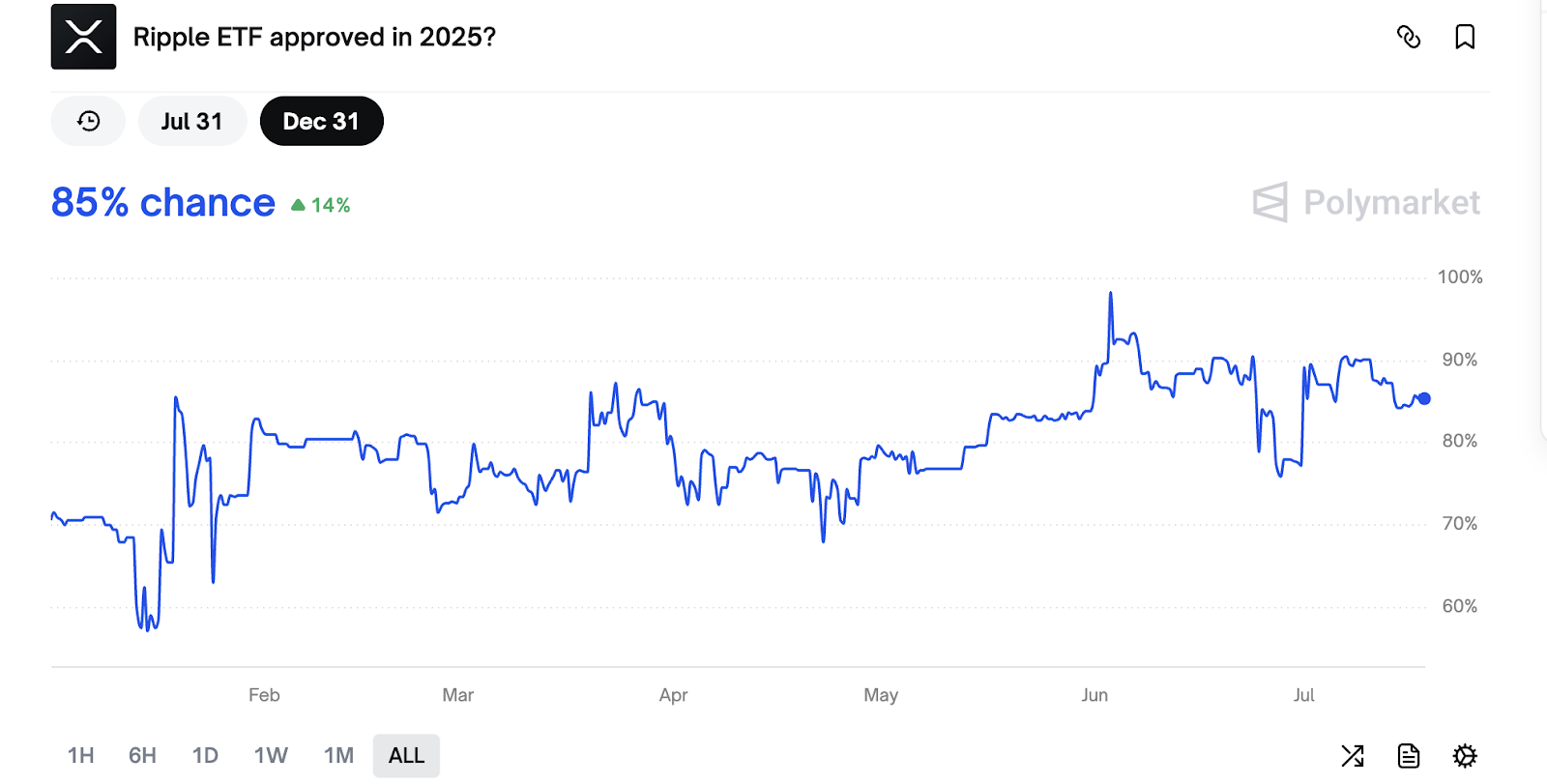

In addition, increasing speculation around prospective United States area XRP exchange-traded fund (ETF) approvals, following the success of Bitcoin and Ethereum ETFs, is assisting fuel optimism.

The chances of the United States Securities and Exchange Commission authorizing an area XRP ETF in 2025 are at 85% since Friday, according to Polymarket information.

These favorable principles, integrated with Ripple’s upcoming resolution of its SEC suit, have actually developed a bullish story, which is driving XRP rate to brand-new heights.

How high will XRP rate go?

The moving typical merging divergence indication (MACD) produced a bullish cross as the XRP/USD trading set confirmed a bull pennant on the weekly chart.

The MACD is a trend-following momentum indication that determines the relationship in between 2 rapid moving averages of the rate. It is utilized to find prospective buy or offer signals, pattern turnarounds, and assess the strength of rate motions.

The MACD has actually produced a “bullish cross on XRP,” stated Mikybull Crypto in an X post on Friday, including:

” The genuine celebration is set to start.”

The weekly relative strength index (RSI), on the other hand, recommends that the XRP has more space to run before reaching overheated levels, such as in the 2018 and December 2024 cycle tops.

” The RSI on the weekly chart is no place near to 2018,” stated pseudonymous expert CryptoHado in an X post on Friday, including:

” We remain in complete rate discovery mode.”

The bull pennant on the weekly chart tasks a 305% rally in XRP rate to $14.

Many experts are persuaded that XRP is on its method to double-digit rates, driven by institutional need and other bullish technical setups.

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.