Secret takeaways:

-

XRP open interest stays raised regardless of the current drop, recommending traders are still holding leveraged positions.

-

Low onchain activity on the XRP Journal raises doubts about sustainable cost gains above the $3 resistance level.

XRP (XRP) has actually fallen 15% considering that reaching $3.66 on July 18. This relocation was accompanied by a $2.4 billion drop in XRP futures open interest, a metric that shows the overall worth of exceptional leveraged positions. Traders now fear that regular market volatility might set off cascading liquidations, possibly driving XRP listed below $2.60.

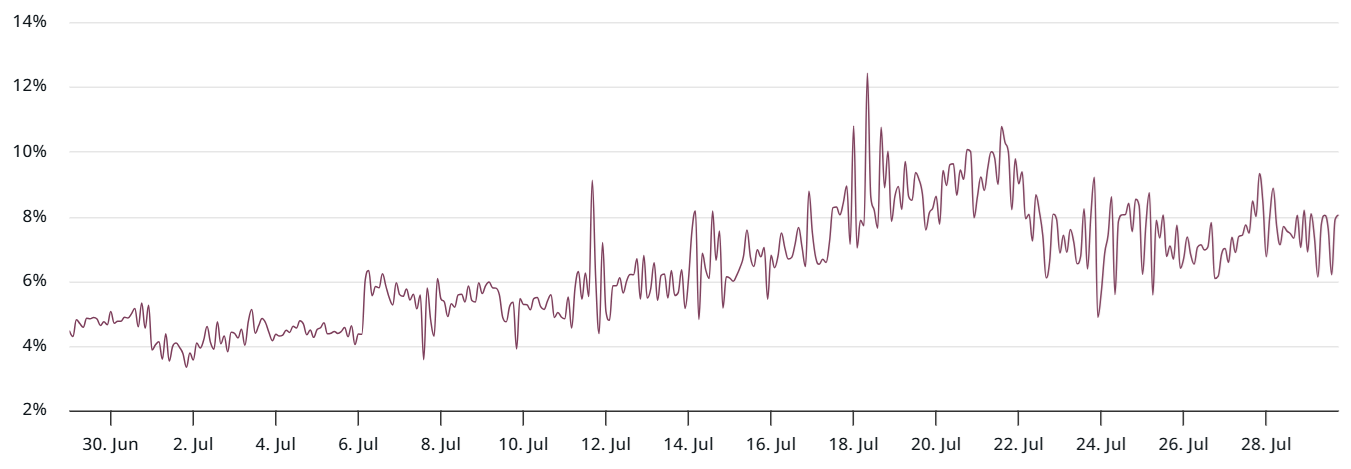

The chart above plainly reveals that utilize sustained the 68.7% rally in between July 1 and July 18, when XRP reached $3.66 from $2.17. Aggregate XRP futures open interest reached an all-time high of $11.2 billion on July 18, before being up to the present $8.8 billion level– a 21% drop in United States dollar terms. This decrease has actually triggered speculation that some financiers might have moved their focus somewhere else.

Even determined in XRP systems, the present 2.82 billion agreements represent a 12% decline from the peak. One might argue that much of the extreme bullish utilize has actually currently been eliminated, considered that liquidations amounted to $325 million throughout the 2 weeks ending July 25. Still, open interest stays 48% greater than one month back in XRP terms, leaving legitimate factors for care.

XRP futures hold stable regardless of $3 retest and ETF speculation

To evaluate whether whales and market makers are revealing higher issue for the $3 assistance, it works to evaluate regular monthly futures rates. Under neutral conditions, these agreements typically trade at a 5% to 10% annualized premium compared to area markets.

Over the previous week, regular monthly XRP futures have actually regularly traded at a 6% to 8% premium, suggesting that neutral belief was not interfered with by the $3 retest. Significantly, even as XRP briefly increased above $3.60, there was no rise in need for bullish utilize, lowering the danger of cascading liquidations under regular market swings.

Related: Trump’s Reality Social Bitcoin ETF amongst numerous crypto funds postponed by SEC

Part of the current optimism surrounding XRP originates from speculation about the approval of an area exchange-traded fund (ETF) in the United States, especially after Ether (ETH) items exceeded $18 billion in properties under management. Such an occasion might benefit numerous altcoins, consisting of Litecoin (LTC), Solana (SOL), and Cardano (ADA).

Nevertheless, in addition to genuine build-up patterns, the marketplace has actually likewise been affected by incorrect claims of numerous banks embracing the XRP Journal and of a Ripple collaboration with SWIFT, the worldwide payment messaging system. These unproven reports gain traction on social networks, drawing in trader attention regardless of an absence of trustworthy proof.

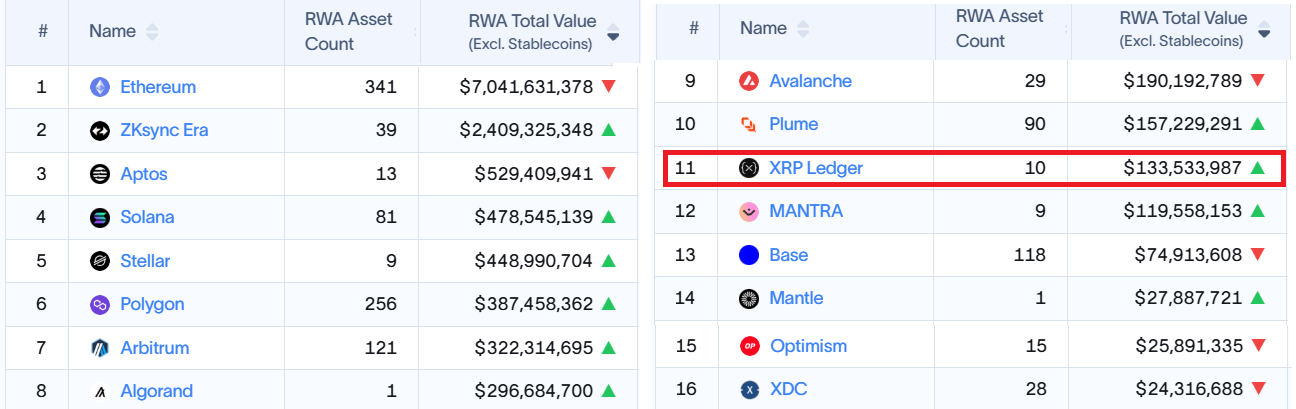

In practice, decentralized financing (DeFi) applications on the XRP Journal have yet to get considerable adoption. According to RWA.xyz information, just $134 million in tokenized properties exist on the network, well except a top-10 ranking and listed below Avalanche’s $190 million.

Likewise, decentralized exchange (DEX) activity on the XRP Journal does not position it amongst the leading 50 blockchains, according to DefiLlama. By contrast, the Sui blockchain processed $13.3 billion in 30-day DEX volumes, while Sei managed $1.43 billion over the exact same duration.

Despite the fact that XRP derivatives presently show neutral market conditions, traders will likely look for clear proof of continual need for the XRP Journal before the cost can develop constant bullish momentum above $3.

This post is for basic details functions and is not meant to be and must not be taken as legal or financial investment suggestions. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.