XRP (XRP) cost has actually recuperated by practically 30% in the last 2 weeks, led by a crypto market rebound, and Ripple’s long-running legal fight versus the United States Securities and Exchange Commission (SEC) concerns an end.

XRP/USD everyday cost chart. Source: TradingView

The cryptocurrency’s rebound is likewise taking place inside the boundaries of a timeless bullish extension pattern, guaranteeing additional gains in the coming weeks.

XRP in proportion triangle puts 75% rally in play

XRP’s bullish technicals look like it forms what seems a balanced triangle pattern.

An in proportion triangle is thought about a timeless bullish extension setup that forms after the cost combines inside a variety formed by assembling trendlines after a strong uptrend.

As a guideline of technical analysis, the setup fixes when the cost breaks above the upper trendline, possibly increasing as high as the length of the optimum range in between the upper and lower trendlines.

XRP/USD weekly cost chart. Source: TradingView

Since March 21, XRP bounced after checking the triangle’s lower trendline, considering an increase towards the upper trendline– around the peak point at the $2.35 level– by April. The supreme target for this possible breakout is $4.35 by June, up 75% from the present cost levels.

On the other hand, a drop listed below the lower trendline might revoke the bullish setup, setting XRP on the course towards $1.28. The bearish target is acquired by deducting the triangle’s optimum height from the possible breakdown point at $2.35.

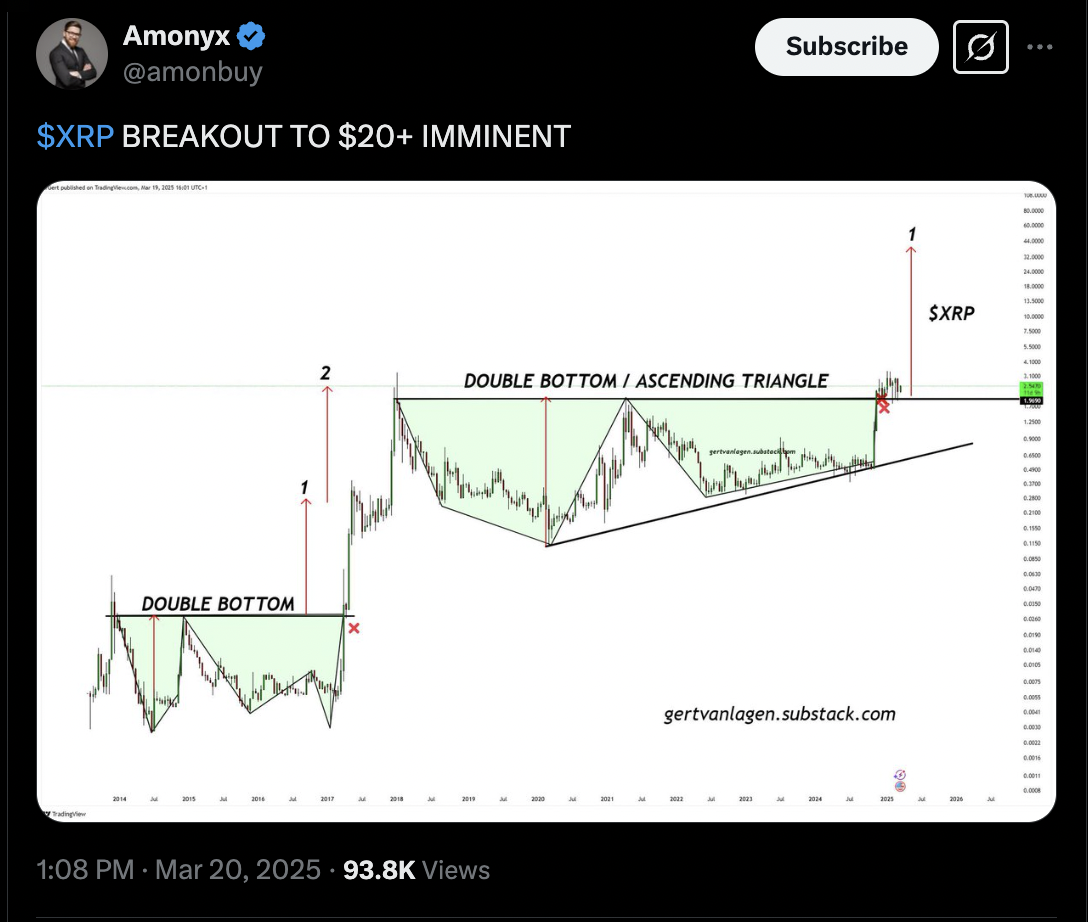

Source: Amonyx

XRP basics improve upside outlook

The bullish technical setup is establishing in line with a current flurry of favorable occasions around Ripple and XRP.

Especially, the cryptocurrency climbed up by as much as 7.85% to reach $2.41 on March 21, 2 days after the SEC dropped its appeal versus Ripple.

The rally got momentum after crypto exchange Bitnomial willingly dismissed its suit versus the SEC before releasing the very first CFTC-regulated XRP futures in the United States.

Source: Alva

Futures agreements permit traders to hypothesize on XRP’s cost without straight holding the possession, increasing total market activity. This deepens liquidity, minimizing slippage and making it simpler to carry out big trades.

Nevertheless, according to crypto legal representative John Deaton, Ripple still deals with a legal difficulty in the type of an injunction provided by Judge Analisa Torres, which limits the business from offering XRP to institutional financiers.

Related: XRP’s function in United States Digital Property Stockpile raises concerns on token energy– Does it belong?

He informed Cointelegraph that the judgment can possibly restrict Ripple’s capability to disperse XRP straight to institutional financiers, specifically banks and banks, including:

” If Ripple certainly wishes to have the ability to release XRP to banks in America straight, I believe the problem is that injunction. How do you surpass that injunction?”

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.