XRP’s (XRP) onchain market structure looks like a setup that caused considerable losses in 2022 after the rate lost a crucial assistance level.

Secret takeaways:

-

XRP’s onchain structure mirrors the February 2022 setup that caused a 68% rate drop.

-

XRP bulls should recover $2 to prevent a much deeper correction towards $1.10.

-

XRP area ETFs taped a net outflow of $53.32 million, their second-ever day of outflows and the biggest considering that launch.

Previous signal preceded 68% XRP rate drop

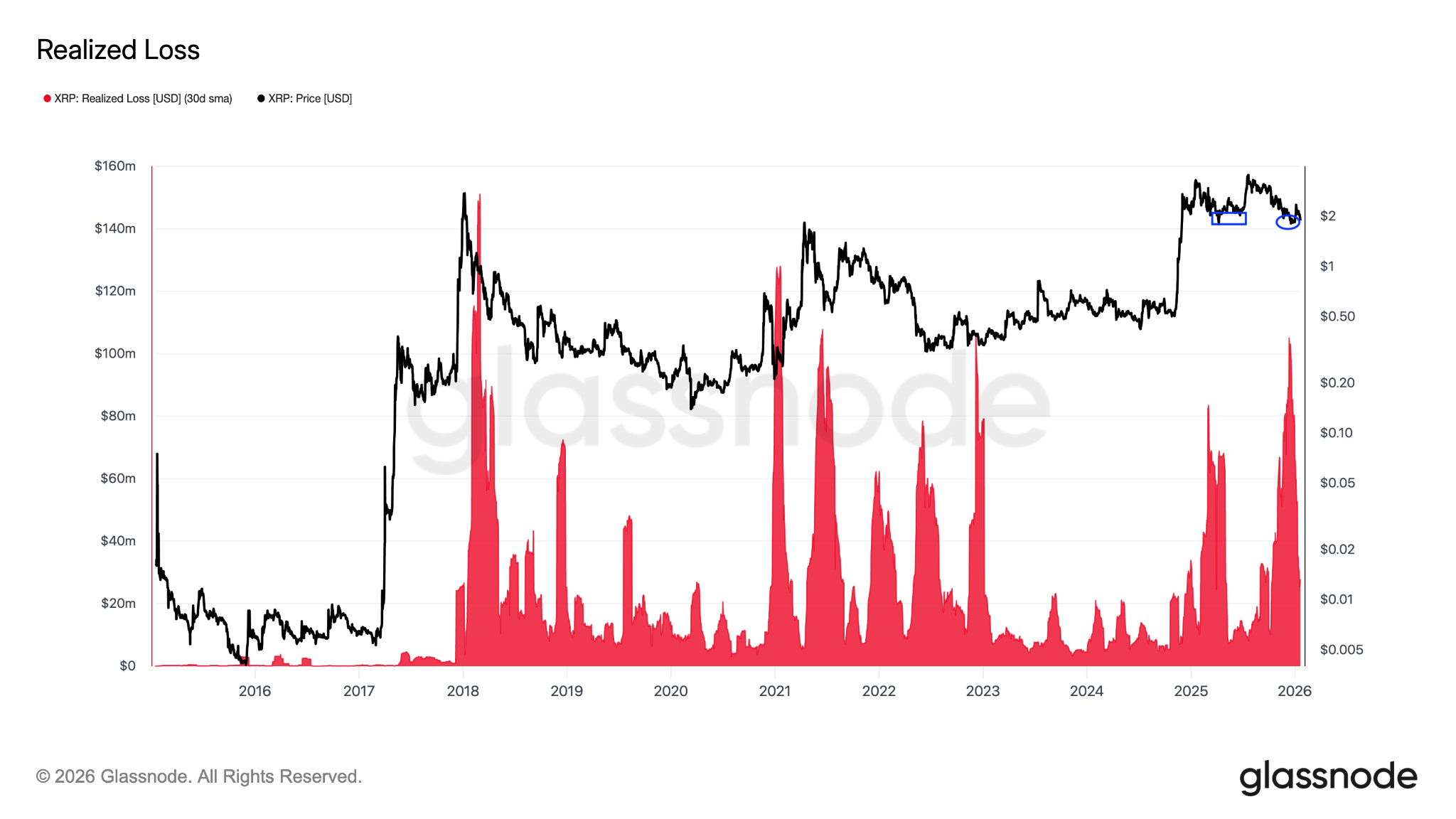

Information from Glassnode alerted that XRP’s existing market structure “carefully looks like that of February 2022,” an event that eventually preceded months of weak point.

” XRP financiers active over the 1W– 1M window are now collecting listed below the expense basis of the 6M– 12M mate,” the marketplace intelligence company stated in a current post on X.

Related: New SEC submissions press on self-custody and DeFi guideline

This produces a circumstance where more recent purchasers remain in revenue, while mid-term holders rest on losses. This space produces overhead pressure gradually if essential assistance levels are not recovered.

Glassnode included:

” As this structure continues, mental pressure on the top purchasers continues to develop gradually.”

A comparable pattern was seen in February 2022 when XRP was trading at $0.78, which caused a 68% drawdown to $0.30 by June 2022.

If history repeats itself, XRP might be up to as low as $1.40 if the assistance in between $1.80 and $2 does not hold.

$ 2 level ends up being a crucial mental zone

The $2 level is a crucial mental limit for XRP in the brief to medium term. In an earlier analysis, Glassnode discovered that each retest of $2 considering that early 2025 set off $500 million to $1.2 billion in weekly recognized losses, recommending holders picked to leave their positions and cut their losses.

” This highlights how greatly this level affects costs habits.”

When the rate slides listed below this essential $2 level, pressure constructs on holders who got XRP at greater levels, while more recent purchasers build up at lower levels.

A 2022 fractal enhances the significance of this level, recommending the rate might see a much deeper correction if it is not recovered quickly.

For instance, the $0.55 level was likewise a crucial assistance level in the past. It supported the rate in between April 2021 and Might 2022, with each subsequent retest compromising the assistance. The assistance ultimately broke in Might 2022, causing a 48% drop to $0.28.

Likewise, losing the assistance at $2 might set off a down spiral, with the rate bottoming simply listed below the 200-week moving average at $1.03, simply as in 2022.

As Cointelegraph reported, XRP’s break listed below the 50-day SMA at $2 shows that the bears are back in the video game, with the disadvantage threat reaching $1.25.

XRP ETFs tape their 2nd day of outflows

On Tuesday, area XRP ETFs taped their 2nd day of outflows considering that launch, amounting to $53 million, according to information from SoSoValue. This was $13 million greater than the only other outflow of $40 million taped on Jan. 7.

These outflows signal care amongst institutional financiers or profit-taking amidst wider crypto market weak point and risk-off belief, contributing to the sell-side pressure.

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we aim to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might consist of positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage emerging from your dependence on this info.