Secret takeaways:

-

XRP rally remains in an excellent position to rally towards $3.98–$ 4.32 this month following an RSI golden cross.

-

Profit-taking stays soft, recommending more powerful holder conviction ahead of October’s ETF choices.

XRP (XRP) is back above the mental $3 mark, reigniting speculation that it might be preparing for another huge relocation. A repeating technical signal on its multiday chart is reinforcing that bullish case.

RSI golden cross signals 30-40% XRP increase next

XRP’s 3-day relative strength index (RSI) has actually simply flashed a golden cross, with the indication closing above its 14-period moving average. This recommends that momentum is moving back in favor of the bulls.

For example, XRP’s cost increased by over 75% a month after the RSI golden cross in June. Likewise, it leapt by more than 28% and an eye-popping 575% after a comparable crossover print in April and November in 2015.

The current crossover comes as XRP retests support at its 50-period rapid moving average (EMA), a level that has actually regularly lined up with previous RSI golden cross rallies.

The confluence of the $3 breakout, 50-period EMA assistance, and RSI crossover raises XRP’s chances of increasing towards the 1.0 Fibonacci retracement level at $3.39 in October, up 11% from the existing levels.

The XRP/USD set might increase even more towards the 1.618 Fibonacci extension level, situated near $4.32, which represents an around 40% boost, by October or November if it decisively closes above $3.39.

Related: XRP cost: Why October will be the most bullish month of 2025

Another bullish setup, a coming down triangle breakout, indicate a $3.98 target– up 30% from existing rates– as XRP climbs up above the pattern’s upper trendline, more enhancing the RSI golden cross signal.

XRP profit-taking ends up being less extreme

XRP’s newest rally above $3 has actually not set off the exact same sort of severe profit-taking that marked its previous booming market tops, onchain information programs.

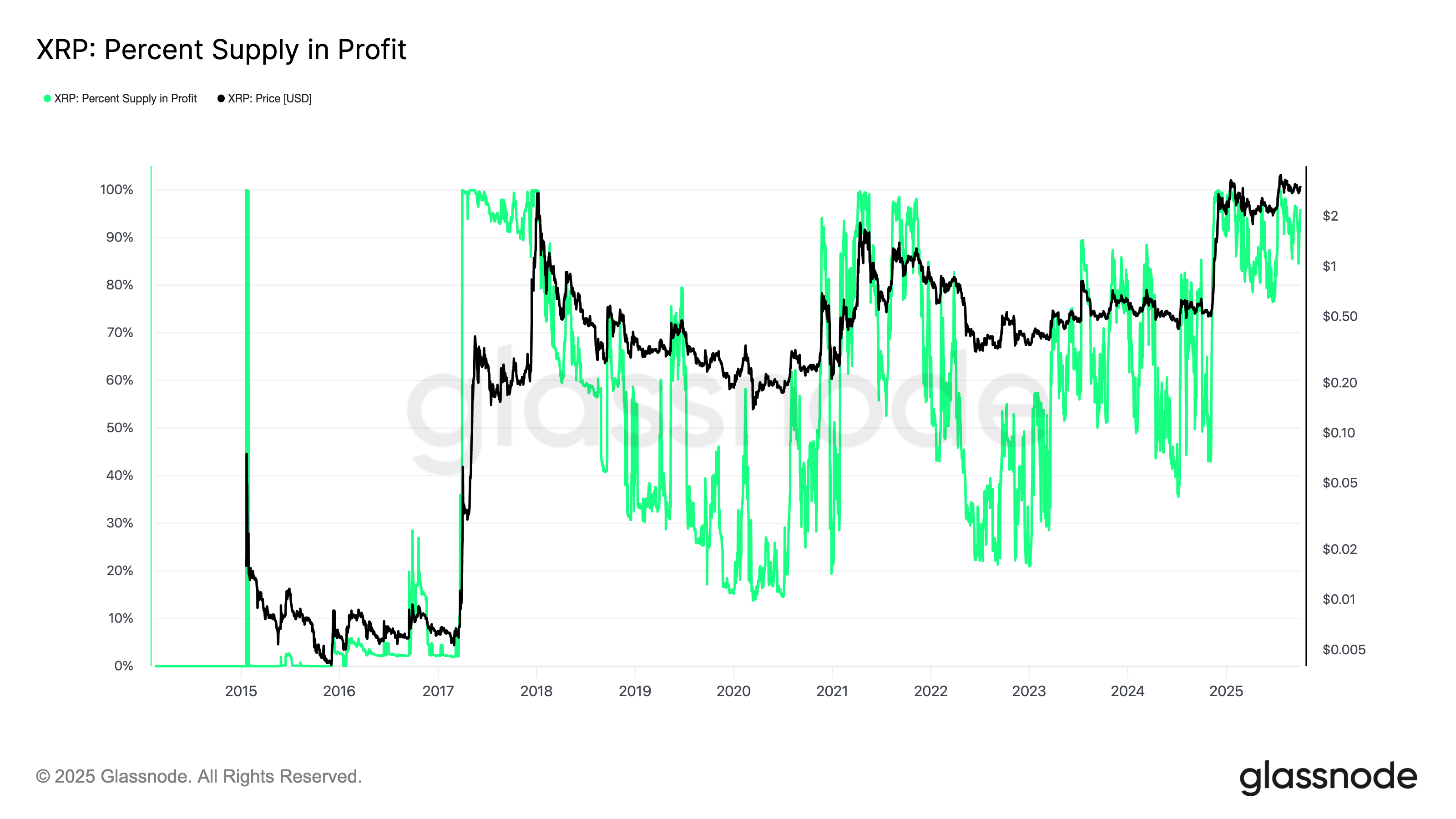

The percent supply in revenue– the share of flowing XRP trading above its expense basis– has actually stayed raised and fairly steady considering that the November 2024 breakout, according to Glassnode information.

In earlier cycles, spikes towards 90– 100% revenue levels typically accompanied fast sell-offs and sharp drawdowns. This time, nevertheless, XRP holders seem working out more perseverance.

The steadiness recommends that long-lasting financiers are less excited to squander in the near term, showing more powerful conviction in the continuous pattern, especially ahead of several XRP ETF choices in October.

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.