XRP (XRP) rate dropped listed below $1.50 over the weekend, its most affordable level in over 14 months. Now, a bearish technical setup on the charts recommends that the sag might extend throughout February.

Secret takeaways:

-

XRP’s bear pennant on the four-hour chart targets $1.22.

-

XRP futures open interest dropped to $2.61 billion, which provides some wish for the bulls.

XRP rate chart reveals a book bear pennant

On Saturday, XRP rate fell about 14% from a high of $1.75 to a low of $1.50, losing the $1.60 assistance level for the very first time given that November 2024.

The most recent drop has actually put it into the breakdown stage of its bear pennant setup, as revealed on the four-hour chart listed below.

Related: Cost forecasts 1/30: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, BUZZ, XMR

XRP dropped listed below the pennant’s lower trendline on Tuesday, then rebounded to retest it as assistance. The rate is most likely to drop lower if the retest stops working and a four-hour candlestick closes listed below this level at $1.58.

The determined target of the bear pennant, computed by including the height of the preliminary drop to the breakout point, is $1.22, representing a 23% drop from the present rate.

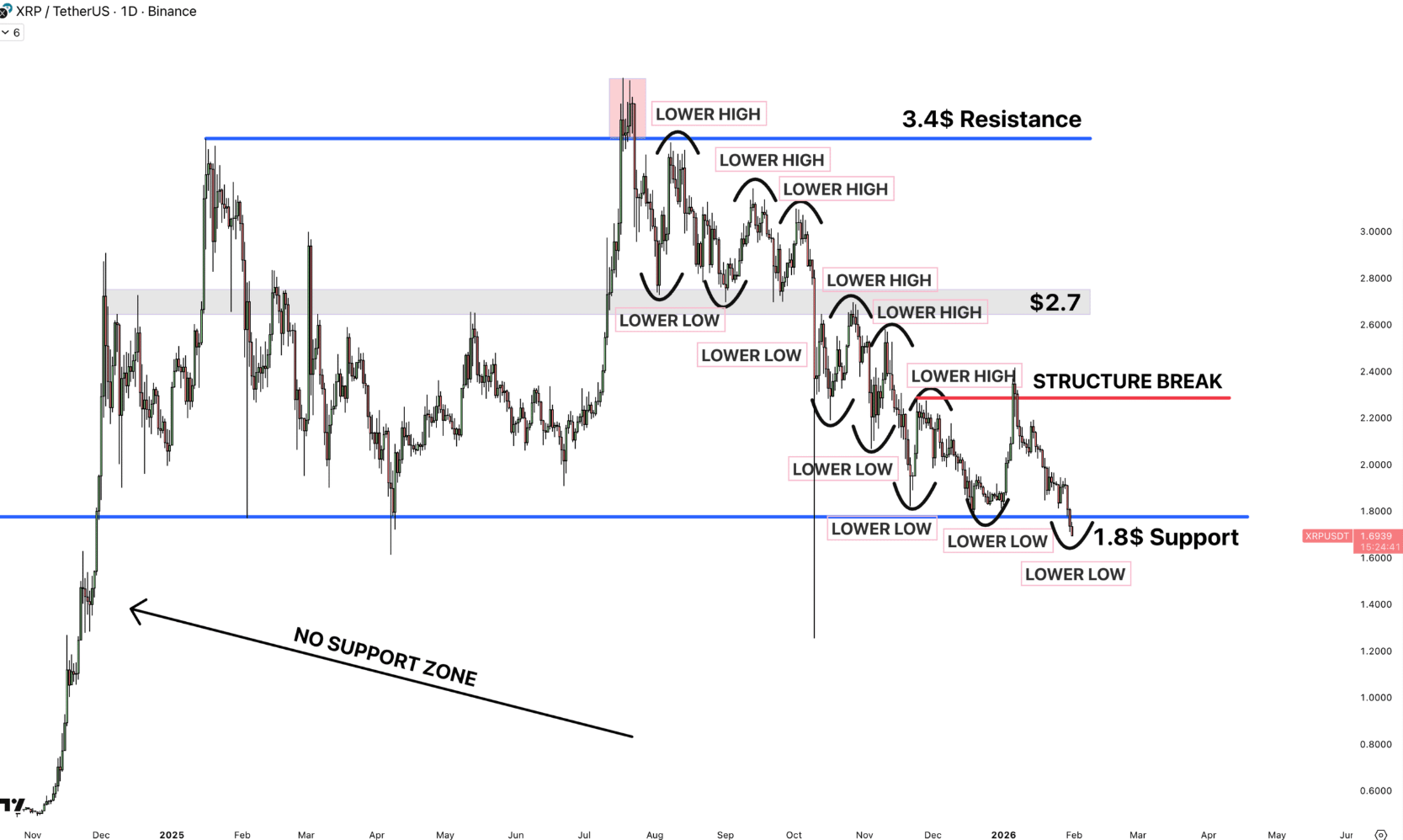

XRP’s healing to $2.40 in January ended up being a “fakeout” as the rate continued to form “rate formed a fresh lower lows,” pseudonymous expert AltCryptoGems stated in a current post on X, including:

” The sag stays undamaged and we are on the edge of a dreadful collapse in a big no-support zone.”

Trader and financier Alex Clay stated that after breaching the assistance line of a double bottom pattern at $1.60, the course is now cleared for a drop towards $1 or lower.

As Cointelegraph reported, XRP’s next significant assistance level is near its aggregated understood rate at $1.48. If this level is lost, it would put the typical holder undersea, a setup that carefully matches the 2022 bear stage that eventually ended in a 50% drawdown towards $0.30.

XRP purchasers go back

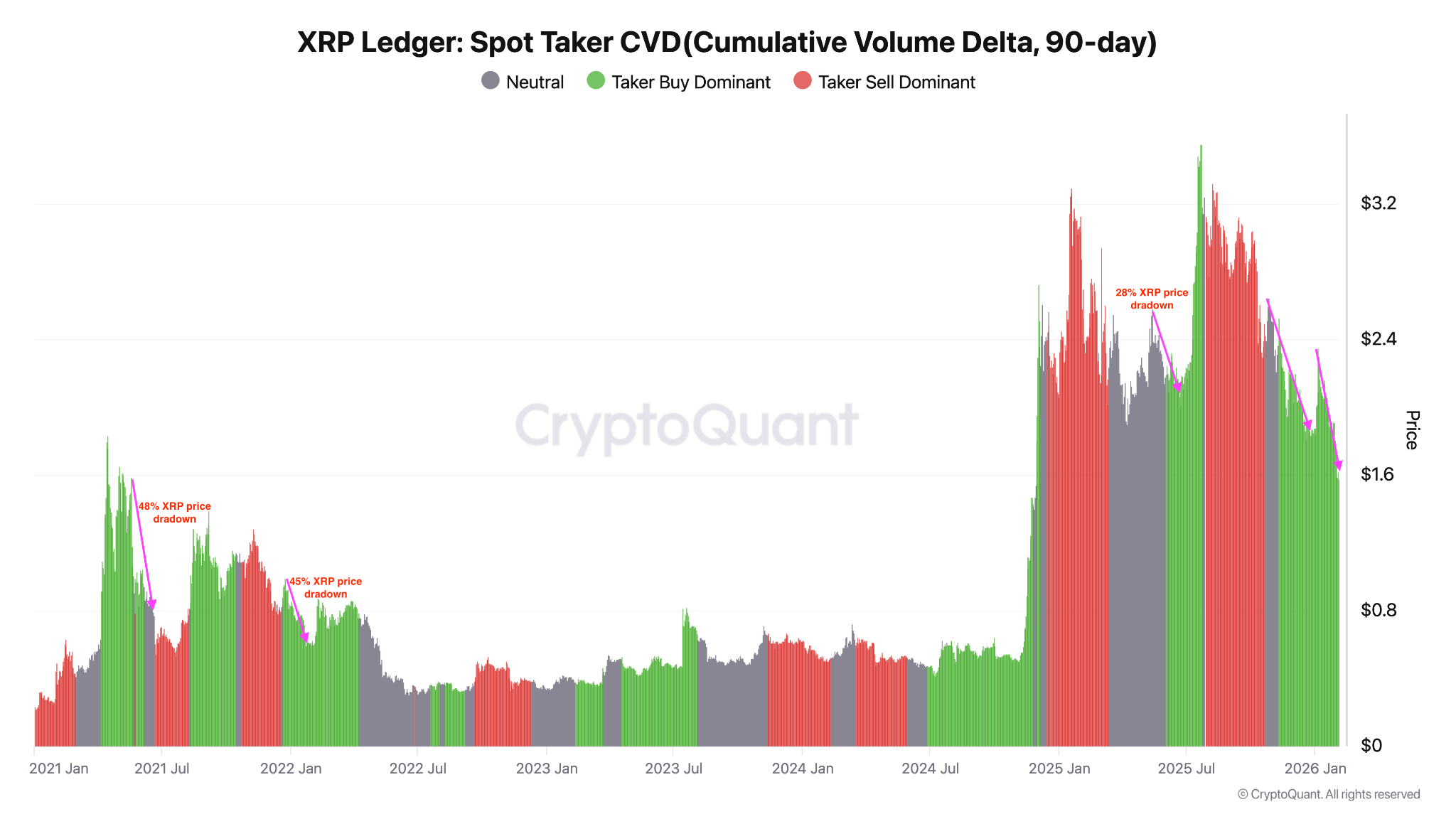

The 90-day Area Taker Cumulative Volume Delta (CVD), a metric that tracks whether market orders are driven by purchasers or sellers, exposes that buy-orders (taker purchase) have actually been decreasing dramatically given that early January.

While demand-side pressure has actually controlled the order book given that November 2025, purchase orders have actually dropped dramatically over the last 1 month, according to CryptoQuant.

This shows subsiding interest or fatigue amongst XRP financiers, indicating decreased bullish momentum and increasing disadvantage threat for the rate.

Previous sharp drops in area CVD have actually been accompanied by 28% -50% rate drawdowns within weeks.

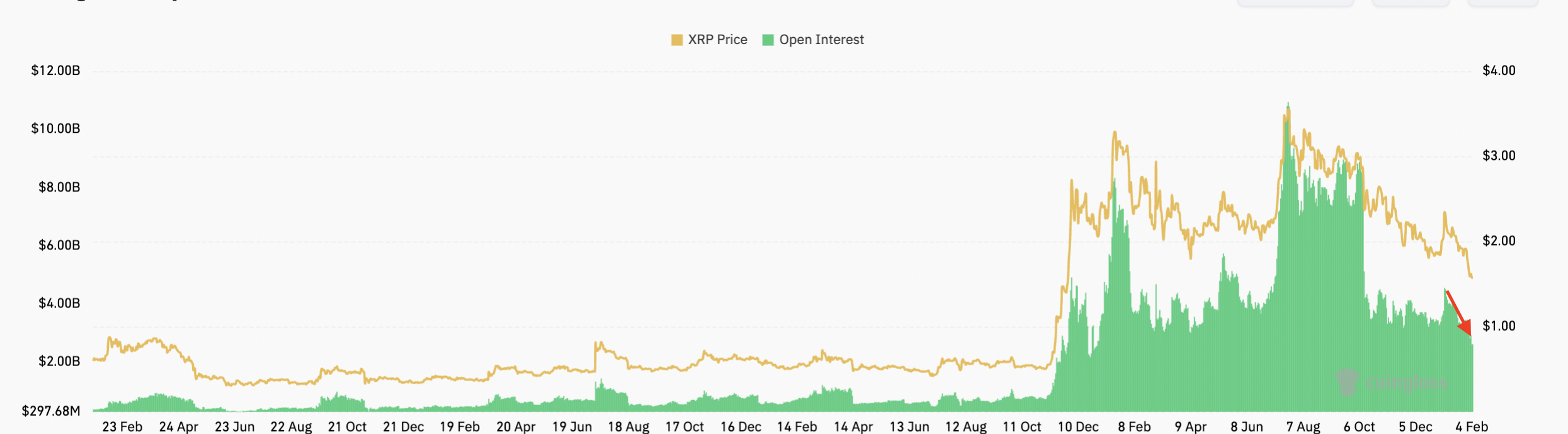

Nevertheless, in the present sag, one wish for the bulls is the decreasing XRP futures open interest (OI). It has actually dropped dramatically to $2.61 billion on Wednesday, from $4.55 billion on Jan. 6.

When OI decreases in mix with falling rates, it shows a weakening bearish pattern or a prospective pattern turnaround.

This might supply some fuel for the bulls to evaluate the essential overhead resistance at around $1.85, a level that worked as assistance throughout the majority of 2025.

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding. While we make every effort to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage developing from your dependence on this info.