Secret takeaways:

XRP rate visited 5% over the previous 24 hr as United States GDP information revealed a diminishing economy.

Nevertheless, an enhancing market structure and financiers’ growing wish for an area XRP ETF approval in the United States recommend that the altcoin may review its April peak at $2.36 in the short-term.

Technical charts presently reveal XRP (XRP) trading within a falling wedge pattern. A “falling wedge” is a bullish turnaround chart pattern that consists of 2 assembling pattern lines that link lower lows and lower highs. This merging shows weakening down momentum.

The pattern will deal with when the rate breaks above the upper trendline at $2.40, and if this takes place, purchasers might target $3.74 next, representing a 71% boost from the existing rate.

The relative strength index (RSI) is above the midline, suggesting that the marketplace conditions still prefer the advantage.

Nevertheless, to sustain the continuous healing, XRP rate needs to very first hold the assistance at $2.20 and after that conquer the resistance in between $2.80 and $3.00.

A number of experts stay positive about the altcoin’s capability to rebound to all-time highs, with popular trader Dark Protector stating that the continuous correction becomes part of an Elliott Wave pattern that will ultimately see “XRP continue its reach the top.”

Fellow trader Allincrypto thinks XRP is “heading to $19.27” based upon a breakout from a falling wedge pattern.

” Where we are drawing back is book best, and we had actually highlighted a falling wedge that existed on XRP that eventually was simply choosing an extension to $19.27.”

Related: What are XRP futures and how to buy them?

Approval chances for an XRP ETF approval in 2025 increase

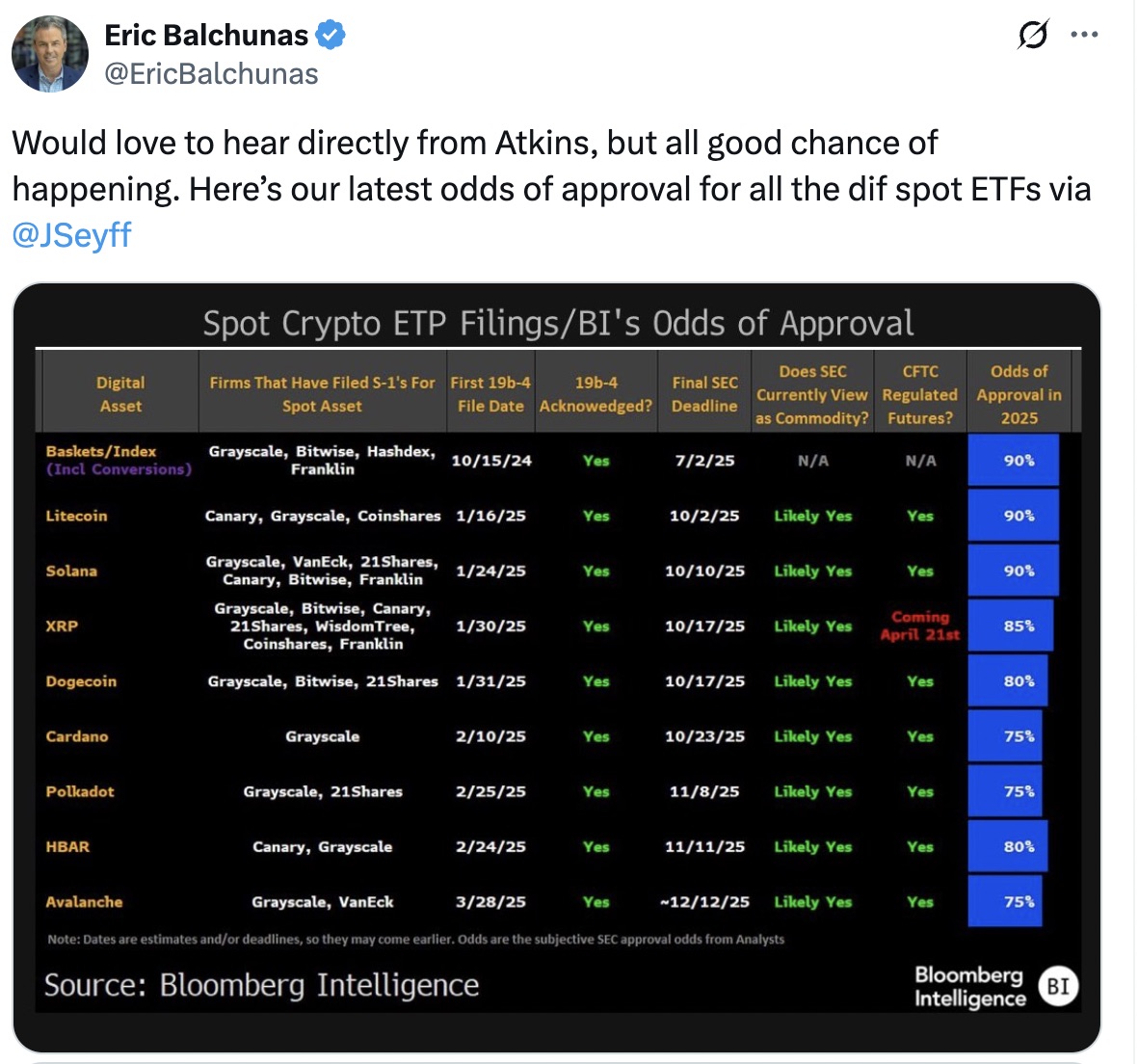

Bloomberg senior ETF experts stated that the 5 area XRP ETFs, consisting of Grayscale, 21Shares, WisdomTree, Bitwise, Canary, and Franklin Templeton, have an 85% possibility of approval after the modification in management at the United States Securities and Exchange Commission (SEC).

This is a substantial enhancement from their forecast over 2 months ago that set the opportunities of an XRP approval in 2025 at 65%.

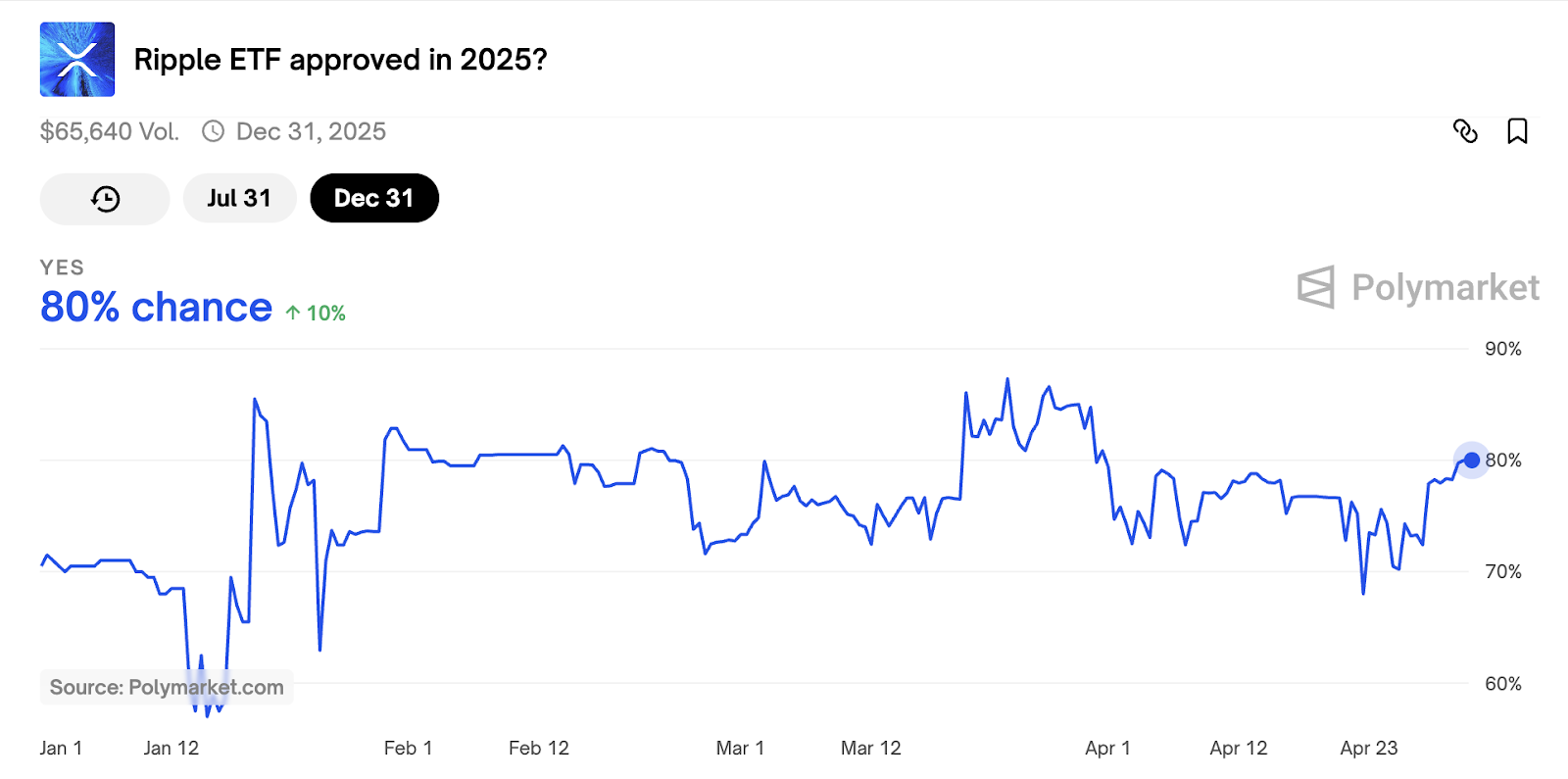

Likewise, the wagering chances for an XRP ETF approval by Dec. 31 now stand at 80% on Polymarket. Over the previous week, the possibility of approval has actually swung 17% in favor of the bullish masses, which was around 63% on April 23.

On The Other Hand, on April 29, the SEC delayed its choice on Franklin Templeton’s area XRP ETF, setting a brand-new evaluation due date on June 17.

The approval of these ETFs might open institutional capital, enhancing need for the XRP. While approval timelines stay uncertain, they would mark an action towards mainstream adoption for XRP.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.