Secret takeaways:

-

The variety of XRP whale addresses strikes 317,500 record highs, suggesting build-up.

-

XRP cost need to break the $2.59 resistance initially for a possibility to restore $3.

XRP (XRP) bounced from Friday’s lows of $2.18, increasing as much as 13% to an intraday high of $2.48 on Monday.

A strong technical setup and whale activity revealed that the XRP/USD set was primed for a pattern turnaround towards $3 in the coming days.

What lags XRP’s rebound?

XRP whales stay positive about the potential customers of an additional rally, utilizing the current pullback to collect more tokens.

Santiment’s whale count metric suggests that the variety of wallets holding a minimum of 10,000 XRP has actually reached an all-time high of approximately 317,500.

” XRP’s cost has actually rebounded back a modest +5.3%,” Santiment stated in an X post on Saturday.

Related: Ripple looks for to purchase $1 billion XRP tokens for brand-new treasury: Report

The marketplace intelligence company discussed that the quantity of mid to big stakeholders continues to grow is a “great long-lasting indication,” including:

” XRP now has more than 317.4 K wallets holding a minimum of 10K coins for the very first time in history.”

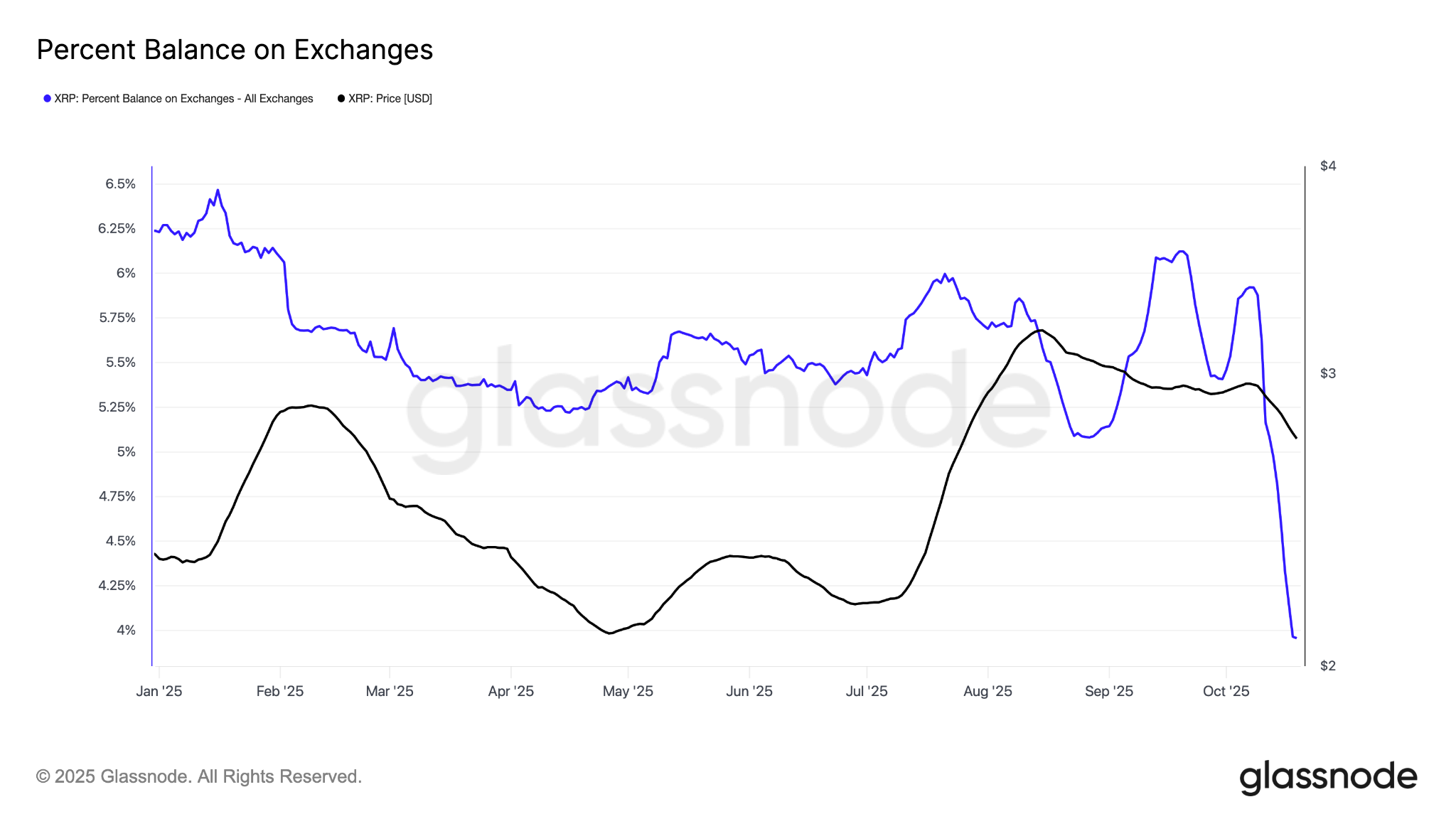

This lines up with a sharp decline in XRP supply on central exchanges in the previous one month, according to information from Glassnode.

The chart listed below programs that the portion of XRP supply on exchanges dropped to 3.9% from 6.12% in between Sept. 19 and Oct. 19.

A decreasing balance on exchanges recommends less supply that can be right away offered, enhancing the upside capacity for XRP.

” Most of XRP on exchanges is currently gone,” stated crypto financier Black Swan Capitalist in a Sunday post on X, including:

” With so little liquidity left, any considerable need will require the marketplace to soak up the staying supply immediately. Conditions are ripe for a significant pattern turnaround.”

As Cointelegraph reported, Ripple is preparing to construct a $1 billion Digital Property Treasury business.

XRP cost requires to recover the 200-day SMA

XRP’s cost action has actually been following a possible V-shaped healing chart pattern on the day-to-day amount of time because mid-September, as revealed listed below.

A V-shaped healing is a bullish pattern formed when a possession experiences a sharp cost boost after a high decrease. It is finished when the cost goes up to the resistance at the top of the V development, likewise referred to as the neck line.

XRP seems on a comparable trajectory, however bulls require to turn $2.59, where the 200-day easy moving average (SMA) sits, to verify the healing.

Another stiff barrier lies within the $2.81 and $2.95 supply zone, which is bounded by the 50-day and 100-day SMAs, respectively.

Greater than that, the next rational relocation would be the neck line at $3.40 to finish the V-shaped pattern. This would represent a 26% boost from the present cost.

XRP expert Egrag Crypto highlighted the crucial levels to enjoy, stating that a “close above $2.55 to $2.65 on the 3-day amount of time would be a strong bullish signal! “

On The Other Hand, Bollinger Band width, a technical sign utilized by traders to examine momentum and volatility within a specific variety, has actually reached its tightest point because June, signalling that a considerable cost relocation might be underway.

The last time the bands were this tight, it resulted in a 66% rebound in XRP cost from its multi-year high of $3.66 from $2.20.

As Cointelegraph reported, the 20-day EMA at $2.63 is a crucial level for the bulls to conquer, as a break above might move XRP cost towards $3.40.

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.