Secret takeaways:

-

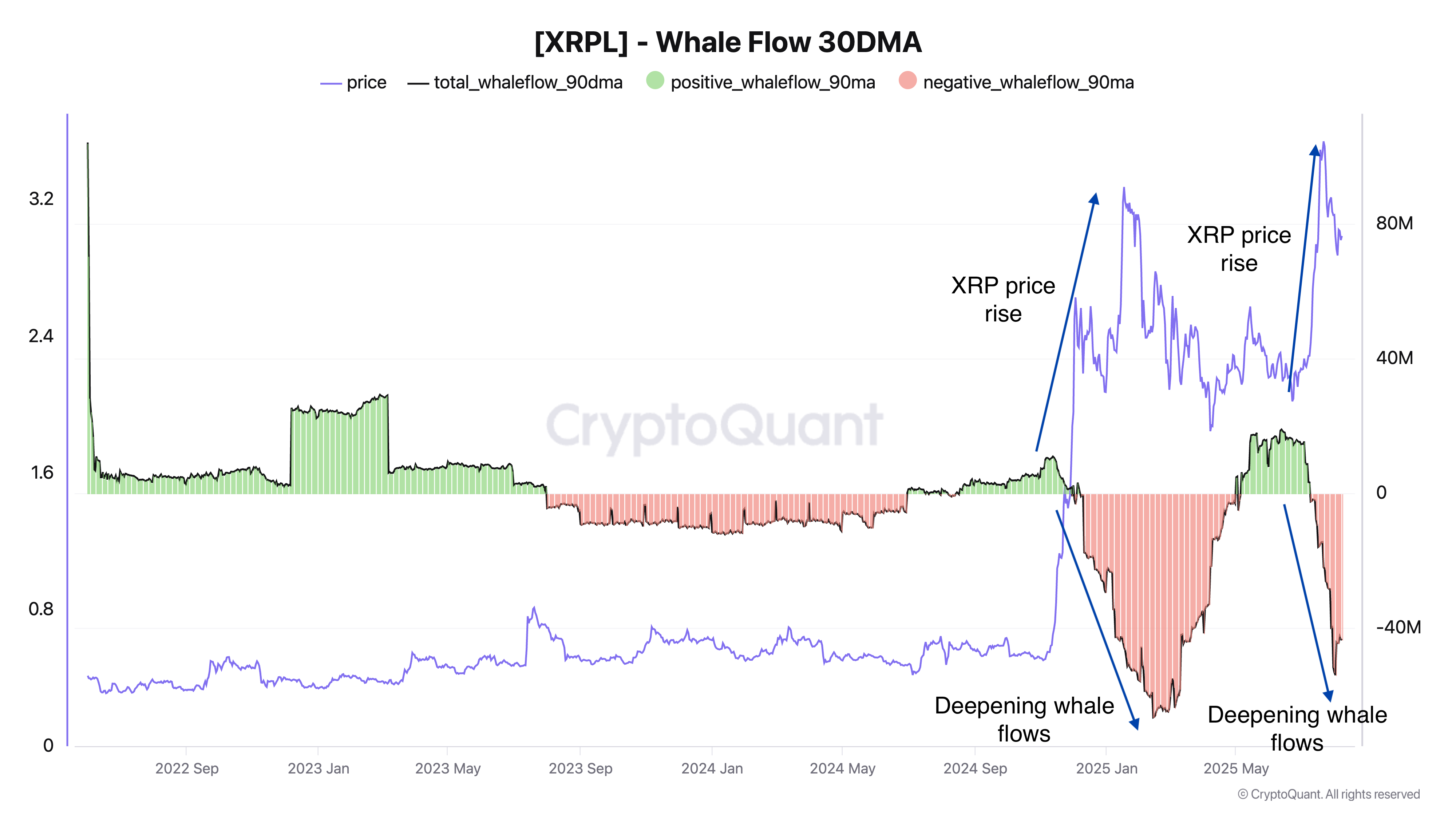

In the previous month, XRP whales have actually unloaded 640 million tokens, or $1.91 billion.

-

Bearish divergence on the chart mean deteriorating momentum.

XRP (XRP) onchain information exposes its biggest holders have actually been silently unloading their tokens for practically a month, with experts indicating dangers of a 30% crash in the coming days.

Whale wallets stop by 640 million XRP

Given That July 9, XRP whales have actually unloaded about 640 million tokens, according to onchain information resource CryptoQuant.

At present rates, the overall worth of these outflows goes beyond $1.91 billion. The majority of the circulation happened while XRP traded in between $2.28 and $3.54.

It is the 2nd time in the in 2015 that whales have actually been dispersing throughout rate rallies.

Related: $ 3 rate at threat? Why XRP was among the worst entertainers today

In Between November and January, they strongly decreased direct exposure even as XRP rose from $1.65 to $3.27, suggesting that retail need most likely soaked up much of the sell pressure.

Not all outflows always equate into real selling, nevertheless. A few of the XRP whale activity might show internal reshuffling.

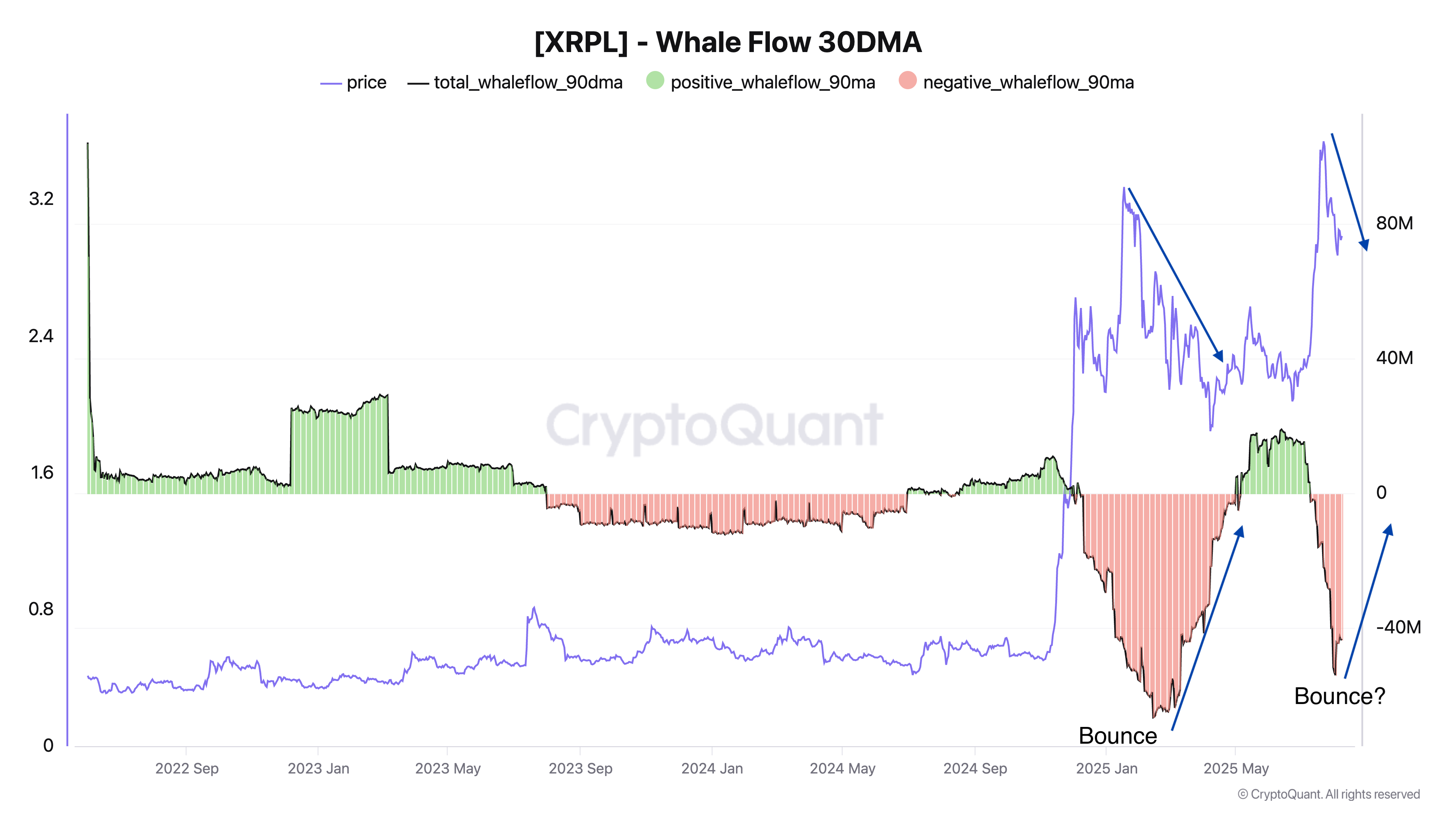

Nonetheless, there does seem an inverted pattern. For instance, the recuperating whale streams in between January and April lined up with XRP’s correction from $3.27 to as low as $1.87, hinting that huge financiers build up throughout market weak point.

Since Thursday, the whale circulation revealed indications of a modest healing.

The Enigma Trader, a CryptoQuant-associated expert, stated that XRP’s market might stay structurally weak unless whale addresses include 5 million XRP or more in the coming days, including

” At present, there is no indication of constant build-up from big holders, a crucial part for a useful pattern turnaround.”

XRP should hold above $2.65 or run the risk of 30% crash

XRP should hold above the $2.65-support location, or it might run the risk of crashing towards $2, as seen in a growing bearish divergence in between increasing rates and falling momentum on the weekly charts.

XRP rate has actually printed greater highs in current weeks, while its relative strength index (RSI) has actually made lower highs given that January.

The divergence shows deteriorating upside momentum, even as rate presses greater, comparable to what took place throughout the April 2021 market top.

Volume has actually likewise faded through the current push, strengthening the momentum fatigue signal.

XRP’s continuous correction might press the rate towards the 20-week EMA near $2.55, lining up with $2.65 assistance.

A break listed below this variety raises the threat of a much deeper drop to the 50-week EMA at $2.06, a crucial mean-reversion level after overheated rallies.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.