UK auction giant Christie’s is apparently closing its department that manages non-fungible token sales, now putting it under a wider department amidst a worldwide decrease in the art market.

The “tactical choice” will see the 256-year-old British auction home continue to offer digital art such as non-fungible tokens (NFTs), today within the bigger 20th and 21st-century art classification, according to a Monday report from Now Media, pointing out a declaration from a Christie’s representative.

At the very same time, Now Media reported the auction huge laid off 2 workers, including its vice president of digital art, however a minimum of one digital art expert will be continued personnel.

Christie’s has actually had a substantial existence in the NFT area, offering several art work, consisting of Mike “Beeple” Winkelmann’s Everydays: The Very First 5000 Days, which closed at auction in March 2021 with a quote of $69.3 million.

The auction home had actually likewise been an advocate of the Web3 area, releasing an NFT auction platform in September 2022 and a crypto-only realty group in July.

Market conditions might have stimulated shift

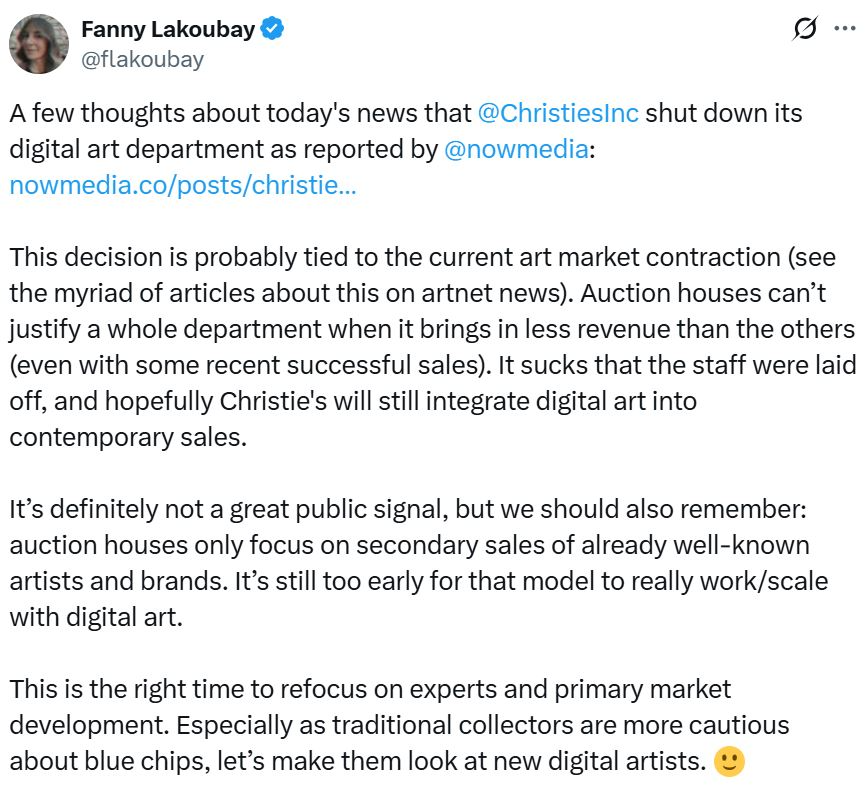

Fanny Lakoubay, a digital art consultant, manager and collector, stated in an X post on Monday that she thinks Christie’s relocation might be connected to the “present art market contraction.”

The broader art market has actually been decreasing, with worldwide sales down 12% in 2024 to $57 billion, together with combined public and personal sales by auction homes coming by 20% to $23 billion, according to the Art Basel & & UBS Art Market Report 2025 launched in April.

” Auction homes can’t validate an entire department when it generates less profits than the others, even with some current effective sales,” Lakoubay stated.

” It’s certainly not a fantastic public signal, however we ought to likewise keep in mind: auction homes just concentrate on secondary sales of currently widely known artists and brand names. It’s still prematurely for that design to truly work/scale with digital art,” she included.

Lakoubay stated it might be a great time to concentrate on main market advancement and present conventional collectors to brand-new digital artists.

Christie’s might be having a “Kodak minute”

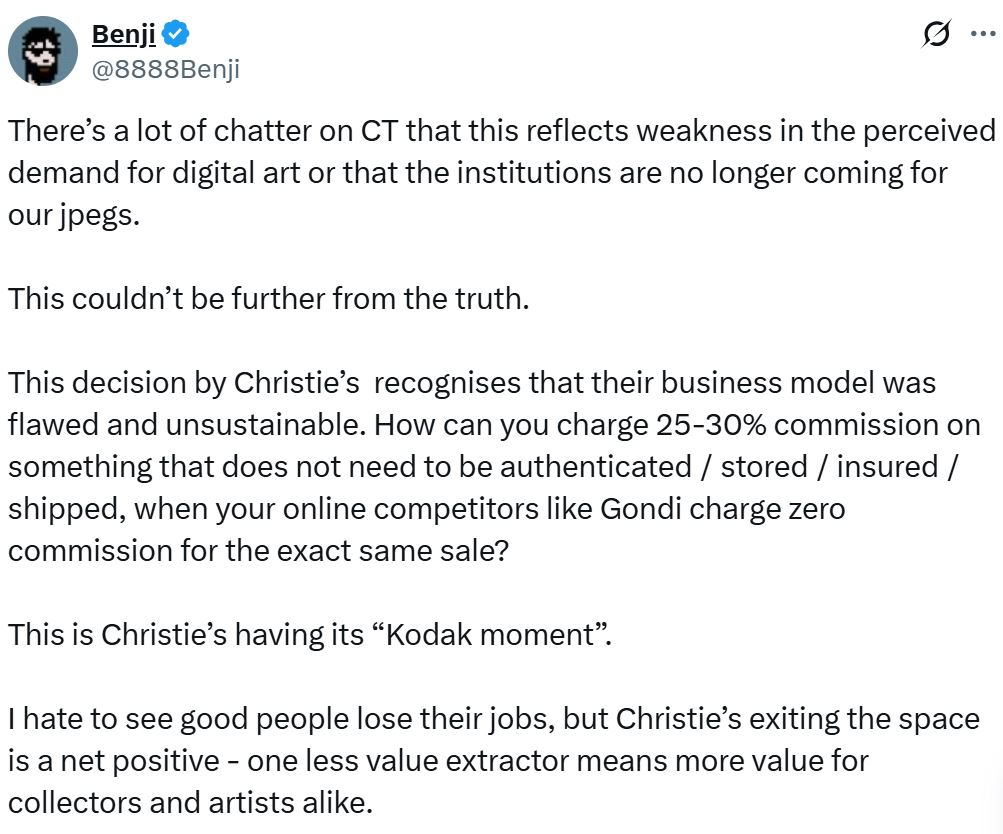

On The Other Hand, an NFT collector and member of the Doomed DOA, publishing under the manage Benji, argued Christie’s relocate to close its digital art department does not show a weak point in the need for digital art, or that “organizations are no longer coming for our jpegs.”

He hypothesizes business design is most likely to blame for the choice due to the fact that it was “flawed and unsustainable,” and this brand-new instructions might be Christie’s “Kodak minute.”

” How can you charge 25-30% commission on something that does not require to be validated/ saved/ guaranteed/ delivered, when your online rivals like Gondi charge no commission for the precise very same sale?” Benji stated.

” I dislike to see excellent individuals lose their tasks, however Christie’s leaving the area is a net favorable – one less worth extractor suggests more worth for collectors and artists alike.”

Christie’s didn’t right away react to Cointelegraph’s ask for remark.

NFT market records combined outcomes

The NFT market has actually had an unstable couple of years. In 2015 was flagged as the marketplace’s worst year for trading volume and sales because 2020, partially due to the fact that of volatility and increasing token rates.

Related: NFT market cap come by $1.2 B as Ether rally slows

It has actually been revealing indications of life in 2025. In August, the sector rose to a market capitalization of more than $9.3 billion, a 40% uptick from July, as Ethereum-based collections and Ether (ETH) increased in rate.

The marketplace has actually revealed indications of cooling in current weeks, however its present market capitalization is up 2% in the last 24 hr and sitting at $5.97 billion.

Numerous of the biggest NFT collections by market capitalization have likewise skilled gains. CryptoPunks is up 1.9% in the last 24 hr, and has a trading volume of $208,319 with 3 sales.

Yuga Labs’ Bored Ape Luxury Yacht Club is up 3.7% and has actually clocked a trading volume of more than $1.2 million and 30 sales, while Pudgy Penguins is up 2%, has $905,526 in trading volume and 20 sales.

Publication: Astrology might make you a much better crypto trader: It has actually been predicted