The crypto market’s Worry & & Greed Index turned greatly to “fear” today, being up to levels last seen in April, as a market sell-off eliminated over $230 billion in a single day.

On Friday, CoinMarketCap’s Crypto Worry & & Greed Index, which tracks volatility, market momentum, social networks patterns and supremacy metrics, was up to a low of 28, which is within the “worry” classification and is inching closer to “severe worry.”

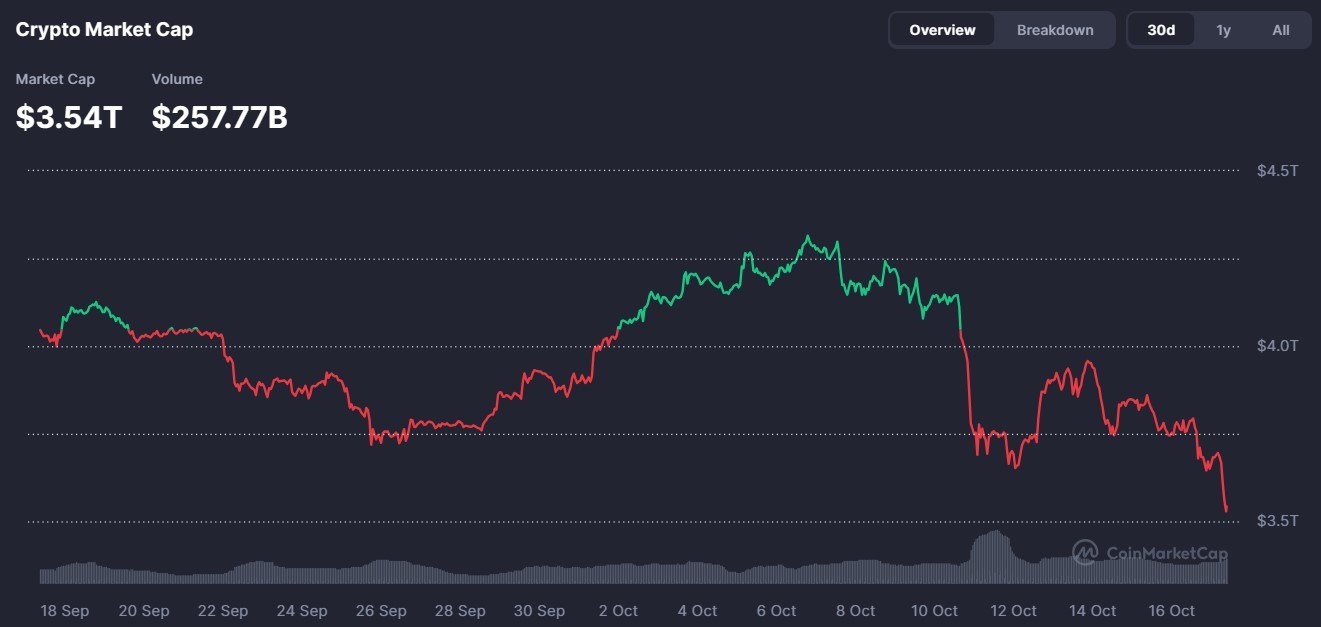

CoinMarketCap information revealed that on Friday, the overall crypto market capitalization dropped to about $3.54 trillion, a 6% drop from $3.78 trillion the previous day. This eliminated over $230 billion in worth from the sector, marking among the sharpest single-day decreases in months.

The Worry & & Greed Index for standard possessions likewise was up to 22, indicating severe worry in the market, following United States stocks closing lower on Thursday as the credit market chaos, local banks’ direct exposure to bad loans and US-China trade stress spread out jitters on Wall Street.

Leading crypto possessions continue to bleed

Information reveals that significant crypto possessions extended their decreases in the last 24 hr as the wider market correction deepened.

Bitcoin (BTC) fell almost 6% to about $105,000, while Ether (ETH) dropped practically 8% to about $3,700. Amongst large-cap altcoins, BNB (BNB) led losses with an almost 12% decrease, followed by Chainlink (LINK) with an 11% drop and Cardano (ADA), which dropped 9%.

Solana (SOL) and XRP (XRP) likewise toppled by over 7%, extending a week-long decrease that eliminated double-digit gains collected previously this month.

Usually, the biggest non-stablecoin crypto possessions decreased by about 8%– 9% over the last 24 hr.

While recently’s market crash caused almost $20 billion in liquidations, today’s decline saw considerably lower activity.

On Friday, information from CoinGlass revealed that about $556 million worth of leveraged positions were eliminated throughout exchanges, a small portion of recently’s figure.

From this quantity, about $451 million originated from long positions, while $105 million originated from brief liquidations.

Related: Gold market cap skyrockets to $30T, overshadowing Bitcoin and tech giants

NFTs, Memecoins and ETFs respond to market sell-off

Apart from leading cryptocurrencies, other possessions like memecoins, non-fungible tokens (NFTs) and exchange-traded funds (ETFs) were likewise impacted by the current crash.

Memecoins, which revealed little indications of healing today, dropped 33% in 24 hr, according to CoinMarketCap. Leading memecoin possessions experienced decreases of 9%– 11% over the last 24 hr, while trading volumes stayed fairly high, at almost $10 billion.

The NFT sector, which likewise rebounded from a $1.2 billion wipeout recently, eliminated its gains and dropped listed below a $5 billion evaluation, a level last seen in July. CoinGecko information revealed that a bulk of blue-chip collections dropped double-digit portions in the last 24 hr.

On the other hand, area Bitcoin and Ether ETFs responded to the crash. On Thursday, area Bitcoin ETFs tape-recorded outflows of over $536 million, while area Ether ETFs revealed day-to-day web outflows of more than $56 million.

Publication: Sharplink officer stunned by level of BTC and ETH ETF hodling: Joseph Chalom