The non-fungible token (NFT) market revealed early indications of healing after a high sell-off erased about $1.2 billion in market capitalization throughout the crypto market crash on Friday.

According to CoinGecko information, the sector’s total appraisal fell from $6.2 billion on Friday to $5 billion on Saturday. This removed practically 20%, or about $1.2 billion, in market capitalization for digital antiques throughout all blockchain networks.

The sector experienced a quick healing as crypto markets rebounded. On Sunday, NFTs reached $5.5 billion, marking a 10% gain following the crash. At the time of composing, the total market cap was practically $5.4 billion.

The sell-off highlights the NFT sector’s level of sensitivity to larger crypto volatility. With the marketplace dropping greatly on Friday, NFT flooring costs did the same as liquidity dried up and speculative need decreased.

Leading NFT collections stay at a loss

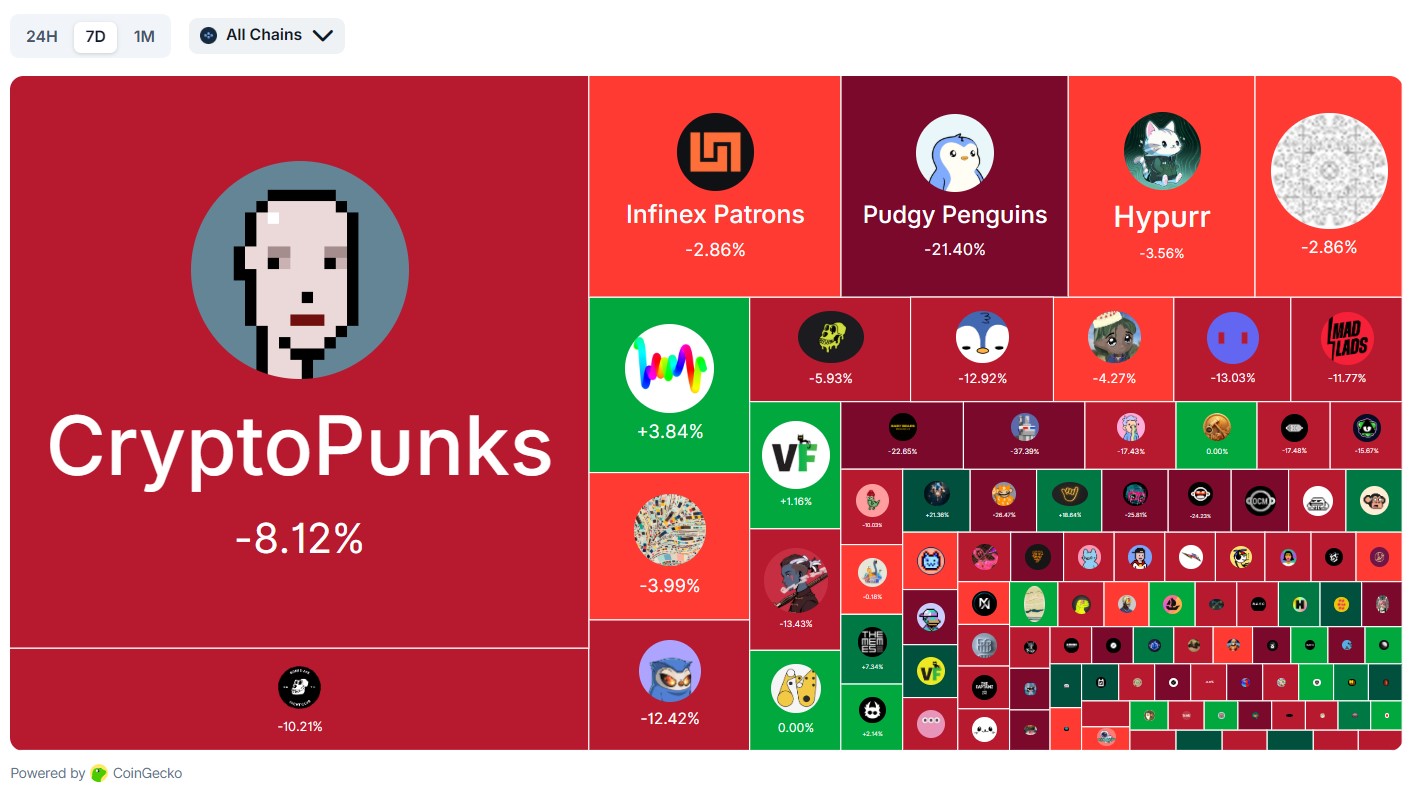

In spite of the partial healing, lots of leading NFT collections are down over 7- and 30-day durations.

Leading Ethereum-based jobs, such as the Bored Ape Luxury Yacht Club (BAYC) and Pudgy Penguins, are still down 10.2% and 21.4%, respectively, over the previous week. Collections like Infinex Patrons and Fidenza by Tyler Hobbs tape-recorded double-digit losses on the month-to-month charts.

CryptoPunks, the leading NFT collection by market capitalization, is down by 8% on the weekly charts and almost 5% on the 30-day NFT efficiency chart.

While the majority of the leading 10 NFTs are down, some collections revealed a minor healing on the 24-hour charts. This consists of Hyperliquid’s Hypurr NFTs, which published a 2.8% gain in the last 24 hr, and the Mutant Ape Luxury Yacht Club (MAYC) collection, which published a 1.5% gain.

The minor healing tips that, in spite of the crash, purchasers might be selectively going back to the marketplace.

Related: Judge tosses suit versus Yuga Labs over failure to please Howey test

Crypto items recuperate after Friday market crash

On Friday, Bitcoin plunged to $102,000 in the Binance continuous futures set as United States President Donald Trump revealed a 100% tariff on China as the nation tried to put export constraints on uncommon earth minerals.

As the marketplaces crashed, the sector saw liquidations of approximately $20 billion, outmatching previous crypto market crashes, consisting of the FTX collapse.

CoinGecko information revealed that the total crypto market capitalization dropped from $4.24 trillion on Friday to $3.78 trillion on Sunday, an almost $460 billion wipeout in 2 days.

The marketplace recuperated to an appraisal of $4 trillion on Monday. At the time of composing, crypto markets are valued at $3.94 trillion.

In spite of the marketplace crash, crypto financial investment items brought in billions in inflows.

On Monday, CoinShares reported that crypto exchange-traded items (ETPs) saw $3.17 billion in inflows recently in spite of the flash crash on Friday. This highlights the funds’ strength to market panic triggered by the liquidations and the sell-off.

Publication: Digital art will ‘age like great red wine’: Inside Flamingo DAO’s 9-figure NFT collection