Boeing Co. BACHELOR’S DEGREE broadened its order pipeline after bagging 5 significant offers over the last 10 days. While its brief and medium-term rate pattern stays strong, here’s more on the business’s technical analysis.

What Took Place: Here are the 5 orders bagged by Boeing from March 21 to March 30.

Malaysia Air Travel Group:

- Purchased 30 Boeing 737 MAX airplane (18 737-8 jets and 12 737-10 jets) with choices for 30 more. This order is to update Malaysia Airlines’ single-aisle fleet and improve guest experience in Southeast Asia.

Japan Airlines:

- Purchased 17 extra Boeing 737-8s to revitalize their domestic fleet. This order almost doubles JAL’s 737 MAX stockpile.

Korean Air:

- Settled an order for as much as 50 widebody airplane, consisting of 20 each of 777-9 jets, and 787-10 jets, and choices for 10 more 787 Dreamliners. This is Korean Air’s biggest Boeing order, supporting their post-merger change.

U.S. Army Unique Operations Air Travel Command:

- Purchased 5 extra Boeing MH-47G Block II Chinook helicopters. This agreement brings the overall MH-47G Block II airplane under agreement to 51, supporting the modernization of the Army’s fleet.

BOC Air Travel:

- Purchased 50 Boeing 737-8 jets to support worldwide airline companies. This broadens BOC Air travel’s 737 MAX portfolio and supports the growing need for narrowbody airplane.

See Likewise: Charlie Munger’s Leading Choose Costco’s Golden Touch: Gold Rates Skyrocket 58%, Exceeding SPY Considering That It Began Offering Gold 33 Months Ago

Why It Matters: Technical analysis of the easy moving averages on Benzinga Pro reveals that Boeing’s stock, which ended at $170.55 each since Monday, was listed below its 8 and 50-day moving averages. Whereas it had a near-term assistance at its 50-day moving average of $167.02 and 200-day moving average of $167.67.

The relative strength index of 48.92 indicated that the stock remained in a neutral zone, while its MACD momentum sign showed a bullish pattern. Its 12-day rapid moving average was above the 26-day EMA, hence showing a favorable momentum in the near-term.

Boeing’s stock fell dramatically in 2024 due to security issues from a 737 MAX occurrence, production stops from labor disagreements, 777X hold-ups, and defense agreement losses, all leading to shipment shortages and monetary stress.

Cost Action: Boeing fell 0.33% in premarket on Tuesday, whereas SPDR S&P 500 ETF Trust SPY, tracking the S&P 500 index, decreased 0.066% to $559.02.

BACHELOR’S DEGREE was down 0.77% on a year-to-date basis and 10.00% lower over a year.

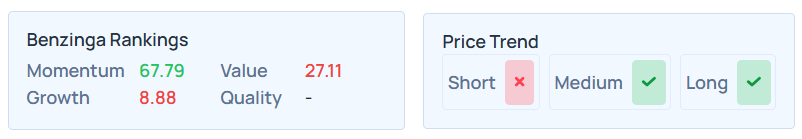

Benzinga Edge Stock Rankings show Boeing has favorable medium and long-lasting rate patterns, contrasted by a weak short-term outlook. Momentum ranking is strong at the 67.79 th percentile, however worth and development rankings are lower. Additional essential information and the worth and development rankings are readily available here.

Benzinga’s analysis of 22 experts reveals an agreement “hold” ranking for the stock, with a typical rate target of $201.63, varying from $113 to $260. Current rankings from Wells Fargo, Citigroup, and JPMorgan typical $174.33, recommending a 2.55% prospective benefit.

Read Next:

Picture courtesy: Shutterstock

Momentum–

Development 8.88

Quality–

Worth 27.11

Market News and Data gave you by Benzinga APIs