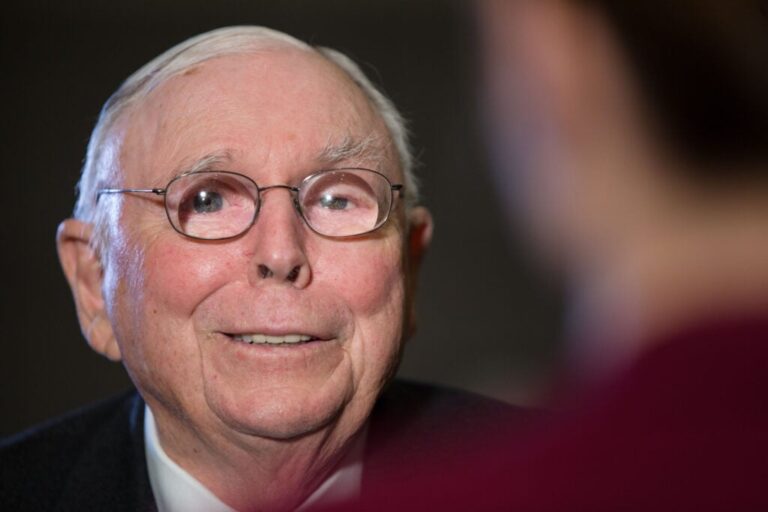

Charlie Munger, the late vice-chairman of Berkshire Hathaway, when provided some words of knowledge for financiers handling market turbulence.

What Taken Place: Munger, who was a close partner of Warren Buffett at Berkshire Hathaway, highlighted the requirement for long-lasting financiers to weather market volatility. He argued that if financiers are not able to endure significant market slumps, they are not eliminate to be regular investors.

Munger drew from his individual experience throughout the 2009 monetary disaster, when his Berkshire Hathaway shares had actually plunged by over 50%. Regardless of this obstacle, he kept his faith in the business and continued his stock exchange financial investments.

” I believe it remains in the nature of long-lasting shareholding that the regular turnarounds in markets implies that the long-lasting holder has actually the priced estimate worth of his stocks decrease by, state, 50%,” Munger informed BBC in an interview.

” If you’re not happy to keep your chin up throughout the periodic thrashing, you’re not fit to be a typical investor, and you should have the average outcome you’re going to get compared to individuals who can be more philosophical about these market variations,” he included.

Likewise Check Out: Charlie Munger’s 4 Life Lessons: ‘Take In Less Than You Accumulate, Invest Carefully, Constantly Find Out, and Promote Discipline’

Both Munger and Buffett abided by Buffett’s popular mantra: ” Be afraid when others are greedy, and be greedy when others are afraid.”

This technique assisted them to regularly get underestimated stocks, relying on the ultimate success of American companies.

Additionally, Munger counseled financiers to make use of chances to buy properties at significant markdowns throughout significant market drops, rather of claiming much better conditions.

Why It Matters: Munger’s suggestions comes at a time when market volatility is a substantial issue for lots of financiers. His words act as a tip that perseverance and long-lasting vision are essential to browsing rough markets.

His technique of taking advantage of market slumps by acquiring underestimated stocks has actually shown effective in the past, and might act as a helpful guide for financiers in the existing environment.

His belief in the ultimate success of American companies likewise uses a favorable outlook for financiers stressed over the future of the U.S. economy.

Read Next:

Charlie Munger’s 3 Financial investment Lessons: ‘Purchase Fantastic Services At Fair Rates, Huge Cash Isn’t In Purchasing Or Selling-It’s In Waiting, Great Services Are Ethical Services’

Image Via Shutterstock