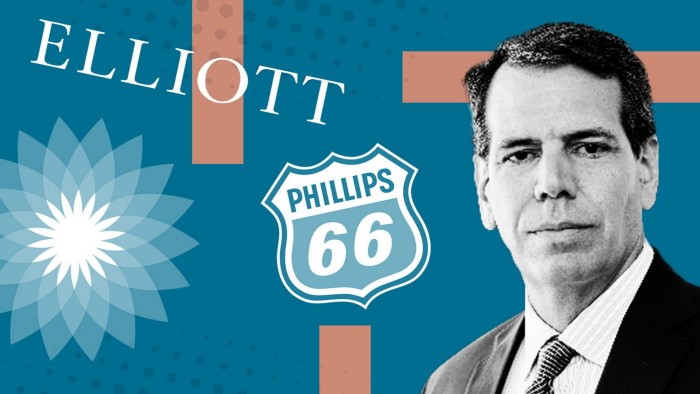

John Pike had his target in his sights. The Elliott Management partner was taking on versus the president of Phillips 66, the oil and gas giant in which he had actually developed a $2.5 bn stake, throughout a Manhattan conference room.

Throughout an hour, the Texan business and its legion of defence advisors had a last opportunity to work out a truce with the world’s most feared activist hedge fund and avoid the kind of costly proxy defend which Pike was ending up being understood. They stopped working.

Within 24 hr Elliott had actually introduced among the most aggressive activist projects the energy sector had actually seen in years with a full-blown proxy fight for 4 seats on Phillips 66’s board, choosing a slate of brand-new directors.

The battle highlights how even as competitors have actually changed to behind-the- scenes lobbying and Elliott itself has actually softened its design, Pike embodies the hedge fund’s “old aggressive design”, according to previous coworkers.

The company’s projects had actually ended up being significantly “corporatised and fully grown”, stated another individual who has actually met Elliott numerous times. However despite the fact that it stressed its collegial nature, Pike’s technique stood apart, they stated, calling him “an only wolf within Elliott who wishes to do things a various method”.

Under Pike, Elliott has actually taken a series of prominent energy positions in current months, looking for to direct the instructions of blue-chip business from BP in the UK to RWE in Germany– along with at Phillips 66 in the United States.

” If you take a look at the most intriguing projects Elliott is running today, they are all his,” stated another individual who has actually handled Pike in a variety of scenarios.

To those who have actually dealt with him, Pike is thought about among Elliott’s shrewdest financiers.

A 22-year Elliott veteran, Pike manages “international situational groups” with particular proficiency in energy– along with energies, transport, mining and insurance coverage– and ended up being an equity partner in 2022. In 2015, he rose to its effective 12-person management committee.

A college basketball gamer who matured in southern California and later on finished from Yale Law School, Pike’s manner is calm and purposeful. He keeps a low profile: the only picture of him online is from his election to the Phillips 66 board.

” It’s not tough to alter John’s mind, you simply need to be right,” stated Quentin Koffey, who dealt with Pike for 7 years before leaving Elliott and later on establishing his own activist fund, Politan Capital Management. “He reacts to well-reasoned analysis, and is neither provoked nor swayed by shallow project rhetoric or advertisement hominem attacks.”

His financial investment record indicate a more callous design.

Considering that Pike initially selected a battle with United States oil and gas group Hess in 2013, Elliott has actually invested a minimum of $21.6 bn in openly traded energy business, according to analysis by the Financial Times and information service provider Def 14 Inc.

3 of the 4 projects targeting significant United States corporations in which Elliott has actually presumed regarding mail proxy products to investors have actually been led by Pike. Considering that his fight with Hess, Pike has actually won 13 board seats throughout 5 business in the energy sector alone.

Elliott’s energy projects are connected by a typical thread: the split of big energy corporations to refocus them on their core proficiencies. It consistently requires possession divestments, as it did at Hess, Suncor Energy and Marathon Petroleum.

However another link is the company’s opposition to standard energy business owning sustainable services.

Elliott has actually run one project where it supported higher renewables implementation, at a business called Evergy in 2020. The pattern has actually remained in the other instructions, nevertheless.

At NRG Energy and BP, the activist has actually promoted the offloading of sustainable services– relocations that line up with the political leanings of Elliott’s creator, Paul Vocalist, according to individuals who understand him. Others firmly insist the projects have absolutely nothing to do with individual politics.

One previous Elliott staff member stated: “They think the energy shift. is costly and lengthy.” A current letter to financiers stated the “net absolutely no” program enforced “huge expenses” and served as a “drag on development”.

Till just recently, this view broke the dominating wind, where huge fund supervisors motivated oil majors to press even more into renewables and decrease carbon emissions.

However considering that Elliott’s big stake in BP ended up being public in February, the UK oil significant has actually currently altered course. Its chair Helge Lund has actually revealed strategies to step down, the business has actually promised to accelerate its pivot far from renewables, and it has actually fast-tracked $20bn of possession divestments. It has actually likewise assured to increase financial investment in oil and gas by 25 percent.

Elliott desires more. Previously today, the hedge fund upped its stake past 5 percent, and has actually informed the UK energy business that it desires it to improve complimentary capital to $20bn by 2027 by more strongly managing expenses and capital investment, according to individuals acquainted with conversations.

Altering the course of the approximately ₤ 57bn oil significant will be no mean accomplishment.

” In Europe, board modifications are far more hard,” stated Christopher Kuplent, an expert at Bank of America. “And if you take a look at the projects where [Elliott] have actually not had the ability to impact board modifications, they have actually stopped working.”

” BP is the lowest-quality supermajor oil business. there is no fast repair,” stated Per Lekander, handling partner at hedge fund Clean Energy Shift.

Back at Phillips 66, Elliott’s 17-month project is reaching a denouement.

Unless one side blinks, investors will next month pick in between the 4 directors proposed by Elliott and the ones installed by Phillips 66 in a full-blown proxy vote: a Rubicon that Elliott has actually never ever crossed versus a significant United States corporation. Phillips 66 today raised the stakes with a letter to investors implicating Elliott of being clashed due to its pursuit of a competitor, Citgo.

Success for Elliott increases the probability of possession sales, consisting of the business’s midstream service and its chemicals joint endeavor with Chevron, along with a shake-up of the management group.

Phillips 66 has actually been Pike’s a lot of flammable project considering that he handled Hess, his maiden project in the energy sector that settled simply hours before an investor vote.

Although Elliott went peaceful on Hess after simply a year, the financier hung on to its position there for the very best part of a years before lastly squandering.

Taking the battle to Phillips 66 and BP might need the exact same perseverance.

Abundant Kruger, who was set up as Suncor Energy’s president in 2023, a year after Elliott took a stake, stated the activist in some cases offered voice to what other financiers were believing.

Suncor’s shares got as much as 41 percent from when the activist initially revealed its needs in April 2022 and their high in November in 2015.

” I have actually had a great deal of hallelujahs from my long-lasting investors about Elliott’s method,” he stated. “Perhaps they’re a bit more patient and less aggressive than Elliott, however I believe they search for the exact same results.”

Extra reporting by Tom Wilson. Information visualisation by Louis Ashworth.